You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

tradesmart

Experienced member

- Messages

- 1,286

- Likes

- 22

10360 was breached yesterday, and as predicted by many, opened the bearish floodgates; compounded by ‘Big Blues’ negative numbers after the bell, and the futs are now around 10220…….!……the cash having closed at 279......!!.......when it tanks it tanks bigtime.....!!!

The target of the 360/560 consolidation, the first major consolidation following the 520 fall from the near 11000 highs to the centre of the consolidation gives a speculative target of c.9960 imho, or at least 10160 from the 200 point consolidation height…..

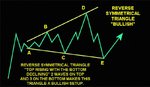

The only succour for the bulls is that there may be an expanding triangle forming (second chart) which, if validated, could produce another surge to the upside….(theoretical detail attached….)

Meanwhile, the last bull on Wall Street is led away to the asylum minus his shirt…

😉

The target of the 360/560 consolidation, the first major consolidation following the 520 fall from the near 11000 highs to the centre of the consolidation gives a speculative target of c.9960 imho, or at least 10160 from the 200 point consolidation height…..

The only succour for the bulls is that there may be an expanding triangle forming (second chart) which, if validated, could produce another surge to the upside….(theoretical detail attached….)

Meanwhile, the last bull on Wall Street is led away to the asylum minus his shirt…

😉

Attachments

Last stochastic daily chart update, plus yesterday's P&F action 😉...now targeting 9800.ChowClown said:Enroute to 10200 anyone?

GL

Attachments

............................................................................................................................................................................user said:Nice gains kriesau, well done.

I see a bounce today. Maybe the job figure will be weak which intially should prompt the market lower but then reverse higher. Either way I see a bounce. Resistance would be at 10365-400

Some of the gain was diluted by two day trade shorts yesterday which got stopped out on stop losses that were too tight.

I think you're right about the new resistance levels in the 10365 - 400 range and it will be interesting to see if these come under attack today. Even if they do I still think that we are in a bearish trend with the market heading down further next week. I concur with Tradesmart that we could be looking at a target level of just under 10,000 before this downward momentum begins to stabilize.

I'll be looking for further Dow & Nas short opportunities in an attempt to keep riding this downtrend - got to get smarter on setting stop loss levels that don't get hit on the temporary rallies. The two Dow shorts that got stopped out yesterday would have held if my SL's had just been 10 pts higher and that would have given me a terrific return if they had remained in play.

............................................................................................................................................................................tradesmart said:10360 was breached yesterday, and as predicted by many, opened the bearish floodgates; compounded by ‘Big Blues’ negative numbers after the bell, and the futs are now around 10220…….!……the cash having closed at 279......!!.......when it tanks it tanks bigtime.....!!!

The target of the 360/560 consolidation, the first major consolidation following the 520 fall from the near 11000 highs to the centre of the consolidation gives a speculative target of c.9960 imho, or at least 10160 from the 200 point consolidation height…..

The only succour for the bulls is that there may be an expanding triangle forming (second chart) which, if validated, could produce another surge to the upside….(theoretical detail attached….)

Meanwhile, the last bull on Wall Street is led away to the asylum minus his shirt…

😉

Hey TS - are you sure that the pic wasn't Greenspan in training for the next G7 summit ?

DowSyndrome

Newbie

- Messages

- 8

- Likes

- 0

My shirt is still on my back, just its very sweaty.

roguetrader

Senior member

- Messages

- 2,062

- Likes

- 49

tradesmart said:Meanwhile, the last bull on Wall Street is led away to the asylum minus his shirt…

😉

😆 TS you need help mate 😆

............................................................................................................................................................................user said:On the two positions that were stopped out, where were your entries and what prices did you get stopped out at?

My open shorts on the Dow at 10447 and the Nasdaq at 1490 have been in place since Tuesday and last week respectively. Yesterday I opened three day trade shorts on the Dow.

The first was shortly after the market opened at 10381 with a 60 pt stop. That went into negative territory for about half an hour and then the market went down. I closed this short early this morning at 10220 to take profits. The other two shorts were opened at 10340 mid morning with a 40 pt stop and we then had a brief rally and this got stopped out. I then opened a third short at 10300 at around 6.30pm with a 40 pt stop and this got stopped out fairly quickly on the best short term rally of the day. If I had kept to 60 points both my 2nd & 3rd shorts would have held up.

............................................................................................................................................................................DowSyndrome said:10400 would be nice, I went long at 10358 so am getting a kicking at the minute. Alot of my colleagues are going long now.

Which contract are you trading and how long is your stop ?

Racer

Senior member

- Messages

- 2,666

- Likes

- 30

GE Delivers Strong First Quarter 2005 Financial Results

Friday April 15, 6:30 am ET

FAIRFIELD, Conn.--(BUSINESS WIRE)--April 15, 2005--General Electric (NYSE: GE - News)

First Quarter Highlights

* Earnings grow 25% to more than $4.0 billion

* $.38 EPS, up 19%, exceeds high end of original guidance

* Nine of 11 businesses deliver at least double-digit earnings growth

* Revenues increase 19% to $39.8 billion, with 10% organic revenue growth

* Cash flow from operating activities (CFOA) up 10%, industrial CFOA up 19%

* Full-year EPS guidance now $1.78-$1.83, high end of target range

Friday April 15, 6:30 am ET

FAIRFIELD, Conn.--(BUSINESS WIRE)--April 15, 2005--General Electric (NYSE: GE - News)

First Quarter Highlights

* Earnings grow 25% to more than $4.0 billion

* $.38 EPS, up 19%, exceeds high end of original guidance

* Nine of 11 businesses deliver at least double-digit earnings growth

* Revenues increase 19% to $39.8 billion, with 10% organic revenue growth

* Cash flow from operating activities (CFOA) up 10%, industrial CFOA up 19%

* Full-year EPS guidance now $1.78-$1.83, high end of target range

DowSyndrome

Newbie

- Messages

- 8

- Likes

- 0

Trading the futures, stop is at 10190, I see that as the new support.

Racer

Senior member

- Messages

- 2,666

- Likes

- 30

I have to go out this afternoon so don't buy it too much will you 😉Originally Posted by DowSyndrome

10400 would be nice, I went long at 10358 so am getting a kicking at the minute. Alot of my colleagues are going long now.

............................................................................................................................................................................user said:If you stick with 40 point stops then you were probably right in putting your stops where you did. So I would say you were unlucky. If you had wider stops then that would have worked out well!

Well sometimes they do sometimes they don't. I've also used 20 pt stops successfully on day trades too - it's all about timing !

I use longer stops on longer term trades to give the market room to work.

Kriesau,

I had similar yesterday, went short at 360, it went to 290 and i moved up my stop to 320, and got stopped out, had to go out and so missed opportunity to get back in. If only I hadnt moved my stop!

Now long from 215 and 200 waiting for a bounce with a stop at 180.

Also short dollar index from 8505 and 8483, short oil from 5090.

Good trading

mj

I had similar yesterday, went short at 360, it went to 290 and i moved up my stop to 320, and got stopped out, had to go out and so missed opportunity to get back in. If only I hadnt moved my stop!

Now long from 215 and 200 waiting for a bounce with a stop at 180.

Also short dollar index from 8505 and 8483, short oil from 5090.

Good trading

mj

I'm interested in finding out if any fellow swing traders have conflicting or according sentiment. I believe now is a very good time to go long with time frame of a few weeks. The market is at a hinge right now. The bears have had their move and if they want to continue much more they really have to put their necks on the line (sp 1162 support) . I'm definitly not bullish, I'm what you would could call rangeish. I think we maintain the range for most of 2005. I do not think the buy side fund industry is ready to alllow a collapse just yet. Fundamentally equities are actually better off than a few weeks ago. Inflation concerns have abated this is very clear when you look at how the 10yr notes are trading. Oil has fallen quite a bit and I think it will remain in this area for the time to come. The VIX is quite high in realtion to the range its been in for the past 2 years. However, if I was a long term mutal fund holder I would get out on the next cycle of strength we are only marking time for a major bear shift, just not quite yet.

............................................................................................................................................................................Racer said:I have taken some profits but want a bit of a bounce to top up my short again

We've already seen a 20 pt rise this morning before the market opens. I'm expecting a bounce but the question is how high. Will it approacg resistance at 10360 - 400 and then fall back or will a rally break through and head up to 10500. Wherever a rally this morning might head I think that when it runs out of steam we will be testing support again at around 10200.

Similar threads

- Replies

- 1

- Views

- 3K

- Replies

- 1

- Views

- 5K