How does volatility affect Options trading and is it a good or bad thing?

A little violence is one's life can be very exciting, and profitable. No, I'm not suggesting you go rob your neighborhood liquor store. I'm talking about your trading life. The violence I'm referring to is the up and down fluctuations in the stock market. How severe these fluctuations are is measured by what is called "volatility."

Obviously, when there are dramatic spikes, the volatility can be very high. Conversely, when the stock is moving sideways, and not moving up and down, the volatility is reduced. Remember, earlier we discussed the components of an option price based on the Black Scholes pricing formula. Volatility is one of the ingredients. Basically, increased volatility means there will be a higher premium. Reduced volatility translates into lower premium.

Volatility - Good or Bad?

How do we determine if the price of an option is good or bad? Well, it depends on what we're trying to do. If we're buying a put or call option, and we're hoping for a directional move, we don't want to overpay for the option. So, we look for options that are undervalued instead of options that are overvalued. We're essentially looking for a bargain.

When we buy an option, a portion of the price is "time value." We discussed that quite thoroughly in previous columns. This time value will deteriorate during the life of the option. When picking a direction, we're hoping the underlying stock will move in the appropriate direction before all the time value disappears from the value of the option.

On the opposite side, if we are selling options, we want there to be as much premium available as possible. Why? Because it goes right into our pocket. In this case, we would WANT the option to expire worthless - because the other person owns it. When we sold them the option, we made a contract to perform. If we don't have to perform, we keep all the premium collected from the sale of the option.

How do we know if an option is a bargain? Or are we paying top dollar? There has to be a way to measure the price of an option - to determine if it is fairly priced, under priced, or over priced. In the Black-Scholes column, we looked at the "theoretical value" of an option. Those figures are available on the software of any quality broker.

Note: There are dozens of brokers out there - all claiming to be excellent option brokers. There is a huge difference between brokers - in price, efficiency, quotes, charts, etc. Be patient. Don't rush out and open a brokerage account for trading options just yet. We'll be covering the topic of brokers in a few weeks. If you open your account too soon, you may not be able to resist the temptation to trade and guess what? You're not ready to trade yet.

Two Kinds Of Volatility

Let's confuse the issue a little more. There are actually two kinds of volatility - historical and implied. In its simplest terms, "historical" volatility is a measurement that averages out the volatility figures over an extended period of time - perhaps years.

Then, "implied" volatility is a calculation based on what has been happening to the underlying asset recently, and what is projected for the near term. This is another calculation that is normally provided on the site of a good broker. See figure below (courtesy of BrokersXpress.com)

Let's look at the "official" definitions of these terms.

Historical Volatility - A statistical measure of the amount of fluctuation in a stock's price within a period of time. A stock with high volatility would have rapid up and down movements in its stock price. A stock with very little movement in its price would constitute low volatility.

Implied Volatility - The volatility of a futures contract, security, or other instrument as implied by the prices of an option on that instrument, calculated using an options pricing model.

[Image not available]

A few years back, especially during the internet bubble, volatility was ridiculously high. But, times have changed. For a long time, we have been in a low volatility environment. Options purchasers pay only a fraction for options now, a bargain compared to what they paid for a similar option back in the days of "irrational exuberance."

There is a volatility index called the VIX. It is a calculation of the implied volatility of the 100 stocks in the S&P 100 index. The symbol for that measurement is $VIX. It's a good way to, at a glance, see what the market, in general, is doing.

Volatility Skew Charts

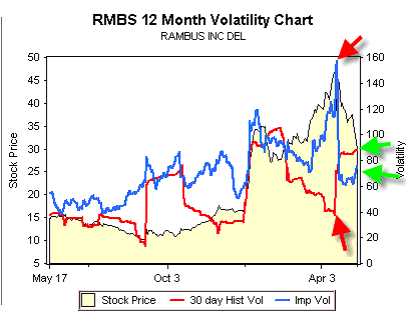

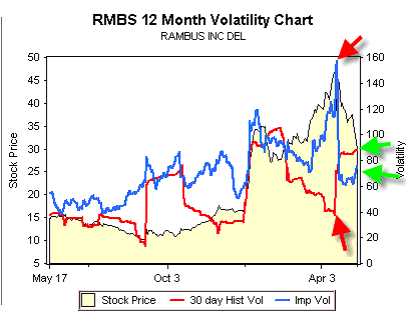

These are charts in which the chart of "historical" volatility is overlaid on the chart of "implied" volatility, enabling you to visually compare them. This is another standard feature available on good broker sites. See figure below (courtesy of BrokersXpress.com)

The chart above compares the historical volatility (red line) with the implied volatility (blue line). The historical volatility looks to be about 90 and the implied volatility is 71.92. So, currently, RMBS is tamer than it has been historically, but not by a lot. However, look at the distance between the blue and red lines after about the first week of April. They're at opposite extremes. The implied volatility was very high and the option premiums were correspondingly high - the perfect environment to sell premium. And, as is usually the case, the uncharacteristically high implied volatility returns to more normal historical levels.

If the implied volatility is currently higher than the historical volatility, the option is overpriced. If the implied volatility is currently below the historical volatility, the option may be a bargain.

This bit of violence (or non-violence) can have a significant effect on an option's price. This is an important concept, but doesn't come into play in all strategies. It's good to know, but it's only one part of many in the decision making process.

A little violence is one's life can be very exciting, and profitable. No, I'm not suggesting you go rob your neighborhood liquor store. I'm talking about your trading life. The violence I'm referring to is the up and down fluctuations in the stock market. How severe these fluctuations are is measured by what is called "volatility."

Obviously, when there are dramatic spikes, the volatility can be very high. Conversely, when the stock is moving sideways, and not moving up and down, the volatility is reduced. Remember, earlier we discussed the components of an option price based on the Black Scholes pricing formula. Volatility is one of the ingredients. Basically, increased volatility means there will be a higher premium. Reduced volatility translates into lower premium.

Volatility - Good or Bad?

How do we determine if the price of an option is good or bad? Well, it depends on what we're trying to do. If we're buying a put or call option, and we're hoping for a directional move, we don't want to overpay for the option. So, we look for options that are undervalued instead of options that are overvalued. We're essentially looking for a bargain.

When we buy an option, a portion of the price is "time value." We discussed that quite thoroughly in previous columns. This time value will deteriorate during the life of the option. When picking a direction, we're hoping the underlying stock will move in the appropriate direction before all the time value disappears from the value of the option.

Note: Over 80% of options expire worthless. That should tell you a little about your probability of success from straight option buying. We'll go into that later, in depth, and learn how to improve your chances of becoming profitable.

On the opposite side, if we are selling options, we want there to be as much premium available as possible. Why? Because it goes right into our pocket. In this case, we would WANT the option to expire worthless - because the other person owns it. When we sold them the option, we made a contract to perform. If we don't have to perform, we keep all the premium collected from the sale of the option.

How do we know if an option is a bargain? Or are we paying top dollar? There has to be a way to measure the price of an option - to determine if it is fairly priced, under priced, or over priced. In the Black-Scholes column, we looked at the "theoretical value" of an option. Those figures are available on the software of any quality broker.

Note: There are dozens of brokers out there - all claiming to be excellent option brokers. There is a huge difference between brokers - in price, efficiency, quotes, charts, etc. Be patient. Don't rush out and open a brokerage account for trading options just yet. We'll be covering the topic of brokers in a few weeks. If you open your account too soon, you may not be able to resist the temptation to trade and guess what? You're not ready to trade yet.

Two Kinds Of Volatility

Let's confuse the issue a little more. There are actually two kinds of volatility - historical and implied. In its simplest terms, "historical" volatility is a measurement that averages out the volatility figures over an extended period of time - perhaps years.

Then, "implied" volatility is a calculation based on what has been happening to the underlying asset recently, and what is projected for the near term. This is another calculation that is normally provided on the site of a good broker. See figure below (courtesy of BrokersXpress.com)

Let's look at the "official" definitions of these terms.

Historical Volatility - A statistical measure of the amount of fluctuation in a stock's price within a period of time. A stock with high volatility would have rapid up and down movements in its stock price. A stock with very little movement in its price would constitute low volatility.

Implied Volatility - The volatility of a futures contract, security, or other instrument as implied by the prices of an option on that instrument, calculated using an options pricing model.

[Image not available]

A few years back, especially during the internet bubble, volatility was ridiculously high. But, times have changed. For a long time, we have been in a low volatility environment. Options purchasers pay only a fraction for options now, a bargain compared to what they paid for a similar option back in the days of "irrational exuberance."

There is a volatility index called the VIX. It is a calculation of the implied volatility of the 100 stocks in the S&P 100 index. The symbol for that measurement is $VIX. It's a good way to, at a glance, see what the market, in general, is doing.

Volatility Skew Charts

These are charts in which the chart of "historical" volatility is overlaid on the chart of "implied" volatility, enabling you to visually compare them. This is another standard feature available on good broker sites. See figure below (courtesy of BrokersXpress.com)

The chart above compares the historical volatility (red line) with the implied volatility (blue line). The historical volatility looks to be about 90 and the implied volatility is 71.92. So, currently, RMBS is tamer than it has been historically, but not by a lot. However, look at the distance between the blue and red lines after about the first week of April. They're at opposite extremes. The implied volatility was very high and the option premiums were correspondingly high - the perfect environment to sell premium. And, as is usually the case, the uncharacteristically high implied volatility returns to more normal historical levels.

If the implied volatility is currently higher than the historical volatility, the option is overpriced. If the implied volatility is currently below the historical volatility, the option may be a bargain.

This bit of violence (or non-violence) can have a significant effect on an option's price. This is an important concept, but doesn't come into play in all strategies. It's good to know, but it's only one part of many in the decision making process.

Last edited by a moderator: