George A

Active member

- Messages

- 147

- Likes

- 11

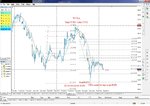

Isnt it just great when we get text book days like this ?????

The chart is self explanatory , and hope it will be understood easily .

A perfect 76.4 rally of the previous days range ,,,

A 200% repeat range of the first MAJOR range of the day , target 96.962.

A 127 ext. of the reversal range ,, todays high to yesterdays low , with a targte of 96.945 , and actual low 96.931.

People say that Fibonacci can NOT be traded as a stand alone strategy ,,, well , I CAN argue that point , and the proof of that IS ,, the REAL charts as we can all see.

Yes i am a 100% FIB trader , and as u can see there are NO indicators on my chart , reasonably NAKED chart ,, EXCEPT 2 moving averages , and i ONLY use them as momentum indicator as i have mastered the use of them and the signal i get out of them when we reach bottoms and tops , and i NEVER trade off them OR crosses of the averages , as by that time the market has put in the foundation range for the day , and i do NOT like trading the wash area ,, either TOPS or BOTTOMS ,and FIB levels in between for compounding trades .

Cheers

George 😎

The chart is self explanatory , and hope it will be understood easily .

A perfect 76.4 rally of the previous days range ,,,

A 200% repeat range of the first MAJOR range of the day , target 96.962.

A 127 ext. of the reversal range ,, todays high to yesterdays low , with a targte of 96.945 , and actual low 96.931.

People say that Fibonacci can NOT be traded as a stand alone strategy ,,, well , I CAN argue that point , and the proof of that IS ,, the REAL charts as we can all see.

Yes i am a 100% FIB trader , and as u can see there are NO indicators on my chart , reasonably NAKED chart ,, EXCEPT 2 moving averages , and i ONLY use them as momentum indicator as i have mastered the use of them and the signal i get out of them when we reach bottoms and tops , and i NEVER trade off them OR crosses of the averages , as by that time the market has put in the foundation range for the day , and i do NOT like trading the wash area ,, either TOPS or BOTTOMS ,and FIB levels in between for compounding trades .

Cheers

George 😎