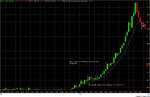

The one that got away.........

Ok, after all the decent trades shown today, here's one for you:

A couple of days after some coaching, with someone most of you know, I was paper trading and found the attached trade.

I still cocked it up, because that day I had already traded 2 losses, so when this one neared the round number I closed the position and took the (theoretical) profit of $0.83/share.

Felt very smug with myself and considered I'd ended up with a decent trading day. A CLASSIC beginner's mistake of not staying in a winning trade, I would think.

If had, I would probably have ridden it up to around the 26.50 mark, over $4/share profit. In a way, I'm almost glad it was only paper trading 🙂

The interesting thing about this one was that earnings had been announced the previous day, therefore a gap down based on that, I assume. Then they had a telephone conference call at 16:00 (times are UK) and look what happened. Whoever spoke on that call, I want their children! (And I'm not even gay....)

Rgds

DD

(1st attachment I've done, I'm sure someone will let me know if it didn't work.....)