Trading psychology is a subject most books and so-called professionals keep separate from the mechanics and strategies of trading and investing. A reality largely misunderstood is that the underlying mechanics and strategies within trading and investing are a direct function of your psychological belief system. At any given time in the stock market, there are buy and sell invitations sent out in the form of news events, technical indicators, earnings reports, company announcements, brokerage upgrades and downgrades, and much more. These invitations are then received by the belief systems of tens of millions of traders and investors worldwide. What separates the consistently profitable market player from everyone else is a psychological belief system that filters all these invitations to buy and sell through the markets ongoing supply (resistance) and demand (support) relationship. When this is done properly, you will quickly realize for example that often, a buy recommendation from a brokerage firm and/or a good earnings report from a company do not equate to market demand or higher prices for the company's stock. Conversely, negative news or a brokerage downgrade may actually be a low risk / high reward buying opportunity. Some of the most common and popular invitations to buy and sell occur with stocks. Providing awareness of the various buy and sell invitations for stocks, demonstrating how to mechanically filter these invitations through the stock market's true supply and demand equation, and providing rule-based tools for taking advantage of these frequent red flags and opportunities is the focus of this article.

A psychological belief system that enjoys consistent low risk / high reward profits is one that identifies and accepts an invitation to buy into a market when objectively, market price is at a level where demand greatly exceeds supply. A belief system that suffers consistent poor results is one that identifies and accepts an invitation to buy into a market when objectively, price is at a level where supply exceeds demand. There are two types of buy and sell invitations. The first are the market's buy and sell invitations which are based only on the irrefutable governing dynamics of supply and demand. The second includes everything from good and bad news to positive and negative earnings reports to brokerage upgrades and downgrades and many more. The first has you focus on reality while the second has you focus on everything but reality.

On April 21st, More bad banking news came out for Bank of America. We bought at demand (support) on that day even with the bad news while the sellers on the 21st sold because of the bad news. These sellers made the same two emotional mistakes every novice trader makes. They sold after a decline in price and at a price level where demand exceeds supply. Why would someone make such an obvious mistake? Simple, the belief system that drives their behavior/action is flawed. When you understand that your psychological belief system IS your trading and/or investing strategy, you will realize how important it is to align your belief system with reality. You are essentially searching for truth so beware of illusion. The addition of even the slightest amount of illusion into your belief system ensures truth will never be found.

Often, the focus of poor trading and investing results is a lack of discipline when attempting to follow the rules of a strategy. What keeps people from not following rules is not a lack of discipline, it is because their invitations to buy and sell are not in line with their psychological belief system. There is internal conflict when it is time to take action. Don't punish yourself for not acting when the market calls you to action. Instead, take a step out of the box that is your belief system and make sure it is only filled with objective information and reality.

Any and All Iinfluences on Price are Reflected in Price

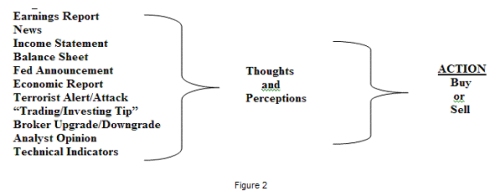

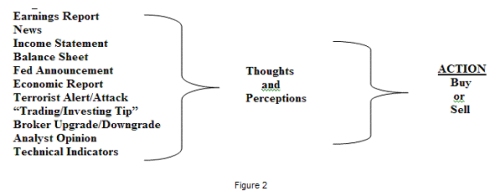

All the news and market information is filtered through your belief system. Your belief system is responsible for the thoughts and perceptions created from the news and information. Every thought and perception leads to ACTION and in trading and investing, action is either buying or selling. Therefore, all the consistently profitable trader or investor needs to focus on is price. Whatever the news and information for the stock is, your belief system MUST filter that information through a filter that quantifies the market's TRUE supply and demand relationship before a perception is created and action is taken. This will ensure you will not fall into the trap that the sellers of Bank of America did on April 21st. It will also allow you to profit from the many that consistently fall into that trap.

Once you understand that any and all influences on price are reflected in price at the level of your belief system, your next step is to know what true supply and demand look like on a price chart. If you're not careful on this step, illusion can again creep into the equation if you let it. If you think the conventional technical analysis definitions of support and resistance are the answer, think again. A cluster of trading activity above and below current price is not necessarily true supply and demand. There is a very unique and simple chart pattern that represents peak demand and peak supply. While the details of this are beyond the scope of the article, the chart examples I have provided should help guide the way. Once you are able to identify true supply and demand on a price chart, simply follow these two rules:

A negative news event or negative stock market information which brings price to a level of peak demand is typically an opportunity to buy, not sell.

A positive news event or positive stock market information which brings price to a level of peak supply is typically an opportunity to sell, not buy.

Hope this was helpful. Have a great day.

A psychological belief system that enjoys consistent low risk / high reward profits is one that identifies and accepts an invitation to buy into a market when objectively, market price is at a level where demand greatly exceeds supply. A belief system that suffers consistent poor results is one that identifies and accepts an invitation to buy into a market when objectively, price is at a level where supply exceeds demand. There are two types of buy and sell invitations. The first are the market's buy and sell invitations which are based only on the irrefutable governing dynamics of supply and demand. The second includes everything from good and bad news to positive and negative earnings reports to brokerage upgrades and downgrades and many more. The first has you focus on reality while the second has you focus on everything but reality.

April 21st - "We continue to face extremely difficult challenges, primarily from deteriorating credit quality driven by weakness in the economy and growing unemployment," Bank of America CEO Kenneth Lewis said.

On April 21st, More bad banking news came out for Bank of America. We bought at demand (support) on that day even with the bad news while the sellers on the 21st sold because of the bad news. These sellers made the same two emotional mistakes every novice trader makes. They sold after a decline in price and at a price level where demand exceeds supply. Why would someone make such an obvious mistake? Simple, the belief system that drives their behavior/action is flawed. When you understand that your psychological belief system IS your trading and/or investing strategy, you will realize how important it is to align your belief system with reality. You are essentially searching for truth so beware of illusion. The addition of even the slightest amount of illusion into your belief system ensures truth will never be found.

Often, the focus of poor trading and investing results is a lack of discipline when attempting to follow the rules of a strategy. What keeps people from not following rules is not a lack of discipline, it is because their invitations to buy and sell are not in line with their psychological belief system. There is internal conflict when it is time to take action. Don't punish yourself for not acting when the market calls you to action. Instead, take a step out of the box that is your belief system and make sure it is only filled with objective information and reality.

Any and All Iinfluences on Price are Reflected in Price

All the news and market information is filtered through your belief system. Your belief system is responsible for the thoughts and perceptions created from the news and information. Every thought and perception leads to ACTION and in trading and investing, action is either buying or selling. Therefore, all the consistently profitable trader or investor needs to focus on is price. Whatever the news and information for the stock is, your belief system MUST filter that information through a filter that quantifies the market's TRUE supply and demand relationship before a perception is created and action is taken. This will ensure you will not fall into the trap that the sellers of Bank of America did on April 21st. It will also allow you to profit from the many that consistently fall into that trap.

Once you understand that any and all influences on price are reflected in price at the level of your belief system, your next step is to know what true supply and demand look like on a price chart. If you're not careful on this step, illusion can again creep into the equation if you let it. If you think the conventional technical analysis definitions of support and resistance are the answer, think again. A cluster of trading activity above and below current price is not necessarily true supply and demand. There is a very unique and simple chart pattern that represents peak demand and peak supply. While the details of this are beyond the scope of the article, the chart examples I have provided should help guide the way. Once you are able to identify true supply and demand on a price chart, simply follow these two rules:

A negative news event or negative stock market information which brings price to a level of peak demand is typically an opportunity to buy, not sell.

A positive news event or positive stock market information which brings price to a level of peak supply is typically an opportunity to sell, not buy.

Hope this was helpful. Have a great day.

Last edited by a moderator: