To accomplish this however means suggesting ideas, concepts, and strategies that sometimes fly in the face of conventional wisdom. What I have found over the years is that simply questioning anything conventional often exposes a flaw and most importantly, opens the door of opportunity so many search for but never find.

Today, let’s question conventional wisdom when it comes to price, market timing, volume, and time itself. Specifically, I am referring to what happens to price at key market turning points. The goal of any market speculator is to identify where and when the market is going to turn, before it turns and where it is going to go, before it goes there. That is the only way to truly attain low risk, high reward, and high probability trading opportunities. To make a long story short, markets turn at price levels where supply and demand are “most” out of balance. In other words, the more out of balance supply and demand is at a price level, the stronger and more probable the turn in price. So, how do we identify these levels on a price chart? Today, let’s focus on one specific issue when it comes to identifying key supply and demand levels because as we know, this is where prices turn. Time and volume are two important issues when it comes to conventional Technical Analysis. For example, the Technical Analysis books tell us when looking for key “support” and “resistance” levels, we should look for areas on the chart that have “plenty” of trading activity, many candles on the screen, and “heavy” volume. They strongly suggest we should look for support and resistance levels that have many candles in the area and above average volume. This type of level on a chart to the eye does look good but is this the best answer when attempting to identify key market turning points, a supply and demand imbalance?

When you think the simple logic through, I think you will find that actually, conventional Technical Analysis has it wrong and the real answer is actually the opposite. We just concluded that the most significant turns in price will happen at price levels where supply and demand are most out of balance. Think about it, at price levels where supply and demand are most “out of balance,” will you see lots of trading activity or very little trading activity? If you said very little, you are correct. This is because of the big supply and demand imbalance. At that same price level, you have the potential for the most activity but the reason you don’t get much trading activity is because all that potential is on one side of the market, the buy (demand) or sell (supply) side. So, what does this picture look like on a price chart? It’s not many candles on a screen like conventional technical analysis suggests, it’s actually very few. Furthermore, this picture is not going to include above average volume, it’s going to be very low volume most of the time.

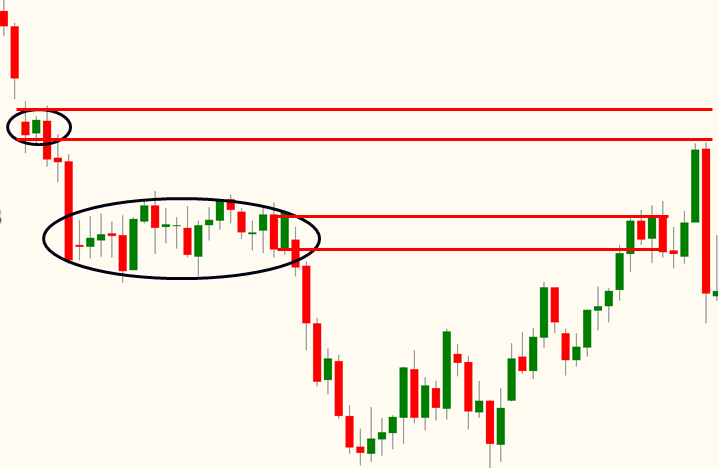

The chart below represents exactly what I am suggesting in this piece. The circled area with many candles is what conventional technical analysis would suggest is a strong “resistance” level. This is because of the high amount of trading activity, the many candles on the screen, and so on. When price does rally up to that level, it does stall and stay there for a bit because there is some supply at that level. However, with that much trading activity at that level, there CAN’T be a significant supply and demand imbalance.

Eventually price rallies up through that level and reaches an area of congestion most people would ignore. They would ignore it because they would think there is so little trading activity there, it can’t be a good level. That my friends is EXACTLY why it is a strong supply level but people don’t think that was because of conventional technical analysis. As you can hopefully now understand, that lack of activity is what makes it such a strong demand level.

Always remember, we don’t care about where price traded, which is what charts show us clearly. What we do care about is where price could NOT trade at or when it traded there, it was only for a very short period of time. In other words, we are not looking for filled orders which is what charts show us, we are looking for significant unfilled orders. This is the key to low risk, high reward, and high probability trading and investing. As I have said before, don’t be afraid to question something everyone believes to be true. If something doesn’t make logical sense, there is probably a better answer that does. By thinking the simple logic through, you will almost always arrive at truth.

Sam Seiden can be contacted on this link: Sam Seiden

Last edited by a moderator: