Chocolate

Member

- Messages

- 88

- Likes

- 1

I've only just come across this thread and I haven't examined it thoroughly, but as I understand it Alba means breakout from European session range (does this mean European morning, or the whole European session till 5pm?). Are the auxiliary tools just common sense support, resistance and basically your feel for the market? If the system was working well except in the last couple of weeks, maybe that's something to do with the current situation - Euro attempting to break out of its previously narrow range. So why might that adversely affect the system?? Any ideas?

If EUR is trending, I can see that the US would be wary of pushing EUR/USD countertrend beyond European extremes lest they receive a backlash the following morning, but I don't see any reason against them getting a headstart on an existing trend and pushing it along. But then what I've said doesn't apply just to EUR/USD, and whether there's any truth in the idea I would welcome comments, analysis or backtesting if anyone's done anything like this. The problem comes down to the definition of "trending" but I'm sure you can come up with something...

If you were more open about your system, I think we might lure some others to come post on this thread and share their thoughts.

If EUR is trending, I can see that the US would be wary of pushing EUR/USD countertrend beyond European extremes lest they receive a backlash the following morning, but I don't see any reason against them getting a headstart on an existing trend and pushing it along. But then what I've said doesn't apply just to EUR/USD, and whether there's any truth in the idea I would welcome comments, analysis or backtesting if anyone's done anything like this. The problem comes down to the definition of "trending" but I'm sure you can come up with something...

If you were more open about your system, I think we might lure some others to come post on this thread and share their thoughts.

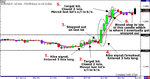

Big Pippin said:It's been a very tough 2 weeks and we're actually negative for the month at this moment. Since the Alba inception, I've never had a losing month so it will be interesting to see what will happen next week. This is one of those times when you can really see the power of good money management 🙂

4/10/06 - 4/12/06

Monday: No trades

Tuesday: No trades

Wednesday: -105

4/18/06 - 4/21/06

Tuesday: -33

Wednesday: -138

Thursday: +24

Friday: No trades

Total: -252 pips

Overall track record