You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread The 3 Duck's Trading System

- Thread starter Captain Currency

- Start date

- Watchers 259

bangkoker

Well-known member

- Messages

- 314

- Likes

- 17

Am I to take it that you cant really follow this system profitably without paying for the course and learning extra intricacies of it

No, I don't think anyone is saying that. You can follow it and make money. The one on one course helped me sort some trading things out in my mind and get to discuss them with someone who is already established.. It depends what stage you are at in your trading development. I had learnt quite a lot about trading with mixed success and the course helped me push some of my knowledge to one side (declutter and prioritise).

It has left me feeling a lot more confident in my trading and less confused but it was only part of a bigger journey that I am still on.

No, I don't think anyone is saying that. You can follow it and make money. The one on one course helped me sort some trading things out in my mind and get to discuss them with someone who is already established.. It depends what stage you are at in your trading development. I had learnt quite a lot about trading with mixed success and the course helped me push some of my knowledge to one side (declutter and prioritise).

It has left me feeling a lot more confident in my trading and less confused but it was only part of a bigger journey that I am still on.

Absolutely, spot on.

Thanks Bangkoker 👍

I agree with Bangkoker,

I did the one on one course 2 weeks ago, and am more into the set n forget approach for now (pesky 9-5 gets in the way of day trading!)

But I enjoy reading Nigel's posts, as they are always informative, and usually give me insight into currency pairs that I am not overly familiar with.

Please keep it up Nigel! :clap:

by the way, is there an easy way to get email updates as the thread is updated? I have subscribed but that gives me one update, then I have to visit the site and sign back in.

Be Lucky

Sabre

Captain Currency

Experienced member

- Messages

- 1,093

- Likes

- 681

Captain Currency's mid-week “Simple Market Scan” using The 3 Ducks Trading System

Good morning Traders,

Thought for Today;

When things line up a good system gives you entries that have a higher probability of success but more importantly lets you know when things don't line up and when to sit on your hands.

Below is my mid-week “Simple Market Scan” using The 3 Ducks Trading System and my preference for the next few days.

January 18th 2012

Eur.Usd – current spot price is 1.2831, I would still prefer to be looking for selling opportunities if/when my 3 ducks line up. A break and close below the 1.2700 area is needed first for the bears to get control back 😕

Gbp.Usd – current spot price is 1.5362, I would prefer to be looking for selling opportunities when my 3 ducks line up. A break and close below the 1.5320 area is needed for the bears😎

Eur.Gbp – current spot price is 0.8347, the Eur is slightly stronger than the Gbp at the moment and I would be sitting on my hands with this pair for the moment 👎

Usd.Chf – current spot price is 0.9426, A bit of a sell off over the last 2 day but I would still prefer to be looking for buying opportunities if/when my 3 ducks line up. A break and hold below the 0.9400 area would get me neutral on this pair 😕

Aud.Usd – current spot price is 1.0412, Same as last week, I would prefer to be looking for buying opportunities when my 3 ducks line up 🙂

Usd.Cad – current spot price is 1.0152, Another pair I would be sitting on my hands with for the moment :whistling

Usd.Jpy – current spot price is 76.76, Fairly sideways for the last few days but I would prefer to be looking for selling opportunities when my 3 ducks line up. A break and close below the 76.55 area is needed for the bears to get control back 😴

Eur.Jpy – current spot price is 98.33, I would be looking for selling opportunities when my 3 ducks line up 🙂

Hope that helps you.

Until next time Buddy, Keep it Simple

Andy

These are not trade recommendations. The 3 Ducks Trading System is best used as a set of guidelines with discretion in addition with your own market analysis and trading ideas. I do not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Good morning Traders,

Thought for Today;

When things line up a good system gives you entries that have a higher probability of success but more importantly lets you know when things don't line up and when to sit on your hands.

Below is my mid-week “Simple Market Scan” using The 3 Ducks Trading System and my preference for the next few days.

January 18th 2012

Eur.Usd – current spot price is 1.2831, I would still prefer to be looking for selling opportunities if/when my 3 ducks line up. A break and close below the 1.2700 area is needed first for the bears to get control back 😕

Gbp.Usd – current spot price is 1.5362, I would prefer to be looking for selling opportunities when my 3 ducks line up. A break and close below the 1.5320 area is needed for the bears😎

Eur.Gbp – current spot price is 0.8347, the Eur is slightly stronger than the Gbp at the moment and I would be sitting on my hands with this pair for the moment 👎

Usd.Chf – current spot price is 0.9426, A bit of a sell off over the last 2 day but I would still prefer to be looking for buying opportunities if/when my 3 ducks line up. A break and hold below the 0.9400 area would get me neutral on this pair 😕

Aud.Usd – current spot price is 1.0412, Same as last week, I would prefer to be looking for buying opportunities when my 3 ducks line up 🙂

Usd.Cad – current spot price is 1.0152, Another pair I would be sitting on my hands with for the moment :whistling

Usd.Jpy – current spot price is 76.76, Fairly sideways for the last few days but I would prefer to be looking for selling opportunities when my 3 ducks line up. A break and close below the 76.55 area is needed for the bears to get control back 😴

Eur.Jpy – current spot price is 98.33, I would be looking for selling opportunities when my 3 ducks line up 🙂

Hope that helps you.

Until next time Buddy, Keep it Simple

Andy

These are not trade recommendations. The 3 Ducks Trading System is best used as a set of guidelines with discretion in addition with your own market analysis and trading ideas. I do not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Hi, thanks for this system, looks great and made for a good read.

Just one question though. If the first 2 ducks have been lined up for a few hours, and the 3rd duck on 5min chart has already passed the previous high, would that be a missed entry or can you still enter?

Thanks!

Just one question though. If the first 2 ducks have been lined up for a few hours, and the 3rd duck on 5min chart has already passed the previous high, would that be a missed entry or can you still enter?

Thanks!

bangkoker

Well-known member

- Messages

- 314

- Likes

- 17

I would have thought that is where you have to start using discretion. I mean if it has made new highs and gone on 50,60, 70+ pips already, then that is very different if it went up past a high, ran on 20-30 pips and has retraced..

That probably doesn't help much 🙄

Last edited:

Hi, thanks for this system, looks great and made for a good read.

Just one question though. If the first 2 ducks have been lined up for a few hours, and the 3rd duck on 5min chart has already passed the previous high, would that be a missed entry or can you still enter?

Thanks!

Hi Benjam1n - Bangkoker is correct, there is a bit of discretion involved. The best way to get a good feel of what works is to practice identifying setups and seeing what works and what doesn't. I enjoy flicking back through charts looking at good setups and studying what they looked like as they were forming. There are common characteristics amongst successful trades.

If you want to post a chart here that displays your question I, and I am sure some of the other more experienced traders, would be glad to comment on it. Same goes for anyone else who has any questions.

My own three ducks trading went pretty well this week, I had a short on Aud.Nzd and a long on Aud.Usd. I pulled about 70 pips out of Aud.Nzd before it violently reversed. I took about 20 pips net on Aud.Usd today, should have been more but my entry was a bit sloppy.

I missed a great 3 ducks trade on silver which I was a bit annoyed about. You can't get them all, I know, but I had it on my list of charts to watch and for some reason I didn't check it this morning 😡 I don't know what actually caused the big jump, must be more money printing or something.

Have a good weekend.

Nigel

Attachments

Another thing Benjam1n, don't stress out too much about trade entries. If price is under/over all three moving averages when you enter, you'll never be too far off. Traders attribute a hugely disproportionate amount of concentration and effort to perfecting the entry. Forums are chock full of threads describing different ways to enter the market. They all are in danger of missing the point.

Entries are only a small part of the overall equation in trading.

You do not need to be hitting 70/80/90% success rate. Steven A Cohen has a 5% success rate and he's a billionaire. Concentrate and dwell on what it means to have your winners bigger than your losers. A good risk : reward ratio will forgive you a multitude of poor entries. When you have good risk : reward, poor entries and unprofitable trades are merely small blips on your rising equity curve.

Someone who fully appreciates the power of running winners in a trend has the potential to become a very potent trader. So don't beat yourself up if you don't pick the "correct" high or low on a 5 min chart. It is a very minor point in the grand scheme of things.

Have a good wekend.

Nigel

Entries are only a small part of the overall equation in trading.

You do not need to be hitting 70/80/90% success rate. Steven A Cohen has a 5% success rate and he's a billionaire. Concentrate and dwell on what it means to have your winners bigger than your losers. A good risk : reward ratio will forgive you a multitude of poor entries. When you have good risk : reward, poor entries and unprofitable trades are merely small blips on your rising equity curve.

Someone who fully appreciates the power of running winners in a trend has the potential to become a very potent trader. So don't beat yourself up if you don't pick the "correct" high or low on a 5 min chart. It is a very minor point in the grand scheme of things.

Have a good wekend.

Nigel

Aspen Trading Group

Well-known member

- Messages

- 427

- Likes

- 1

Another thing Benjam1n, don't stress out too much about trade entries. If price is under/over all three moving averages when you enter, you'll never be too far off. Traders attribute a hugely disproportionate amount of concentration and effort to perfecting the entry. Forums are chock full of threads describing different ways to enter the market. They all are in danger of missing the point.

Entries are only a small part of the overall equation in trading.

You do not need to be hitting 70/80/90% success rate. Steven A Cohen has a 5% success rate and he's a billionaire. Concentrate and dwell on what it means to have your winners bigger than your losers. A good risk : reward ratio will forgive you a multitude of poor entries. When you have good risk : reward, poor entries and unprofitable trades are merely small blips on your rising equity curve.

Someone who fully appreciates the power of running winners in a trend has the potential to become a very potent trader. So don't beat yourself up if you don't pick the "correct" high or low on a 5 min chart. It is a very minor point in the grand scheme of things.

Have a good wekend.

Nigel

Nigel - generally speaking I agree with you on entry stats, a lower hit ratio say 60% or even below 50% does not mean you do not have a viable trading plan/system (hate the word 'system' since no 100% mechanical system exists largely speaking).

The problem however for most traders is holding on to the winners - the temptation to ring the cash register is really high despite there likely being no technically relevant reason to do so. It goes to another point - most traders have no idea as to where they will take profits - they react versus anticipate - in order to book profits - never a good thing.

Bottom line: your trade plan should anticipate both entries and exits - if not the lower your win/loss ratio is the more you run into danger of having a mathematically losing strategy over many iterations.

bangkoker

Well-known member

- Messages

- 314

- Likes

- 17

Hi Benjam1n - Bangkoker is correct, there is a bit of discretion involved. The best way to get a good feel of what works is to practice identifying setups and seeing what works and what doesn't. I enjoy flicking back through charts looking at good setups and studying what they looked like as they were forming. There are common characteristics amongst successful trades.

If you want to post a chart here that displays your question I, and I am sure some of the other more experienced traders, would be glad to comment on it. Same goes for anyone else who has any questions.

My own three ducks trading went pretty well this week, I had a short on Aud.Nzd and a long on Aud.Usd. I pulled about 70 pips out of Aud.Nzd before it violently reversed. I took about 20 pips net on Aud.Usd today, should have been more but my entry was a bit sloppy.

I missed a great 3 ducks trade on silver which I was a bit annoyed about. You can't get them all, I know, but I had it on my list of charts to watch and for some reason I didn't check it this morning 😡 I don't know what actually caused the big jump, must be more money printing or something.

Have a good weekend.

Nigel

Nigel, looks like the Silver trade would have indeed been lovely. What would you have done for an exit target. I only ask as yesterday I did a 3 ducks style trade.. price quickly went 10 or so points in my favour (and I decided to remove risk and move stop to b/e).. it ran on to just over 20pts up.. then stalled for awhile.

I took 20pts a few minutes later, as I was happy with that..

A few minutes later it spiked up and I could have had 50 pips if had held my nerve. As it was it didn't keep going. Really my original target had been a quick 25 pips and I could have had that if I had waited, like I said I didn't mind as although I had started with a 20 pip stop loss.. within 2-3 mins of trade opening I had already moved to breakeven.

Really just a discussion point on the merits of trailing a stop, going for an arbitrary pippage or targeting a key level. Just wondered what others do.

I realise that with a trailing stop you are always going to be taken out at a lower price as it will only get hit by a retrace but it does allow for possibility of catching the occasional big move.

There is a few things I have considered. Taking some profit at an arbitrary level, say 2 x R and letting rest run with a trailing stop or even using low (for long) of previous candle as a manual stop (as Mr Charts seems to do on his trend following methods).

Clearly there is always a compromise with not wanting a winning trade turning into a loser and want to achieve the most pips in order to increase profits.

Just looking for other peoples views🙄

I was thinking about using daily pivot points as targets, what do you think?

I agree trailing stop are great... but as you say you can get stopped out a lot lower than if you wait. I think my preference would be to manually move my stop loss up once a feel momentum is slowing or if i'm quite happy with the number of pips made so far.

I agree trailing stop are great... but as you say you can get stopped out a lot lower than if you wait. I think my preference would be to manually move my stop loss up once a feel momentum is slowing or if i'm quite happy with the number of pips made so far.

bangkoker

Well-known member

- Messages

- 314

- Likes

- 17

I was thinking about using daily pivot points as targets, what do you think?

I agree trailing stop are great... but as you say you can get stopped out a lot lower than if you wait. I think my preference would be to manually move my stop loss up once a feel momentum is slowing or if i'm quite happy with the number of pips made so far.

I've never had much involvement with daily pivot points. I suppose the thing is that if you know the average daily range of a FX pair and how far it has travelled then it is possible to ascertain a reasonable target based on this.

For instance if the 'Pretend FX pair' had an average daily range of 100 pips and it had moved 20 pips so far then you potentially have 80 pips to play with (of course just because the pair usually moves an average of 100 pips it could have a much narrower range on any one given day).

If this daily pivot point is at a sensible distance though and it seems like a potential target then why not (especially if a sensible stop distance is not as far as the sensible target).

I am sure this is the hardest part. As I think AspenTrading said, entry is relatively easy (and maybe not as important) it is choosing when to get out which is the difficult bit.

You mentioned momentum tailing off, this is a danger I fall in to if daytrading a pair.. because the trade I did yesterday.. had been up over 20 pips before falling back.. as it appeared momentum had slowed down I accepted 20 pips when the chance was again offered a little later... but once a new high had been made it took off again and ran up another 30 pips very quickly before retracing.

Very difficult but with a bit of discipline using a lovely style (won't say system) like Three ducks and letting the trend be your friend then with time it should be possible to keep losses small and stretch out some of the wins. I like to move to breakeven once a bit of profit in the bag but that is not without its frustrations either.

The psychology of trading 🙄

forexkunta

Established member

- Messages

- 818

- Likes

- 24

Why not use the 60SMA on the 5M chart as a trailing stop? That way you get out of losing trades early and let good trades run a while.

Nigel, looks like the Silver trade would have indeed been lovely. What would you have done for an exit target. I only ask as yesterday I did a 3 ducks style trade.. price quickly went 10 or so points in my favour (and I decided to remove risk and move stop to b/e).. it ran on to just over 20pts up.. then stalled for awhile.

I took 20pts a few minutes later, as I was happy with that..

A few minutes later it spiked up and I could have had 50 pips if had held my nerve. As it was it didn't keep going. Really my original target had been a quick 25 pips and I could have had that if I had waited, like I said I didn't mind as although I had started with a 20 pip stop loss.. within 2-3 mins of trade opening I had already moved to breakeven.

Really just a discussion point on the merits of trailing a stop, going for an arbitrary pippage or targeting a key level. Just wondered what others do.

I realise that with a trailing stop you are always going to be taken out at a lower price as it will only get hit by a retrace but it does allow for possibility of catching the occasional big move.

There is a few things I have considered. Taking some profit at an arbitrary level, say 2 x R and letting rest run with a trailing stop or even using low (for long) of previous candle as a manual stop (as Mr Charts seems to do on his trend following methods).

Clearly there is always a compromise with not wanting a winning trade turning into a loser and want to achieve the most pips in order to increase profits.

Just looking for other peoples views🙄

bangkoker

Well-known member

- Messages

- 314

- Likes

- 17

Why not use the 60SMA on the 5M chart as a trailing stop? That way you get out of losing trades early and let good trades run a while.

Looking back at the last trade i did the 60MA was a bit faraway even on a 5 minute time frame, I do agree though that this would definitely be a time to close out.

I think any sensible plan to try and stay in the trade whilst progressively locking in profit is what it is all about though

Hi Everyone,

Great discussion on taking profits. I think any helpful conversation about taking profits has to be had in conjunction with taking losses. It's that old risk v reward ratio that I keep banging on about.

Say for instance we have two 3 Ducks traders who have both just hit a take profit target. They have both put 50 pips worth of profits into their accounts. Trader A had a stop loss (or a pre-defined level at which he was going to get out of the market) of 20 pips. Trader B had a stop loss of 100 pips. You must appreciate that these two trading approaches are completely different and merit different methods of evaluation, despite the fact that the TP was the same.

Personally I like to make my 3 Ducks entries with reference to 5 min charts so I have fairly tight stops and low risk. When a trade moves a bit in my favour I always zoom out and look at the bigger picture on the 4 hour chart. If a trade is moving with momentum in my direction and I like the look of the chart I will generally just tighten the stop to breakeven and let it ride the trend until (a) price definitively crosses back over the 4 hour MA/the MA flattens out or (b) my stop gets taken out. Sometimes I close out a portion of the position to bank some pips and let the rest run.

This means that my percentage of successful trades is quite low (19% since October) and sometimes I sustain many losing/breakeven trades in a row. But when my winners come they tend to be big (in relation to my risk), and some are absolute monsters.

If price comes up and knocks me out at breakeven or a small loss it doesn't bother me because I know if I continue to make entries in the direction of the trend it is only a matter of time before I land another monster. When you actually accept the innate logic in this precise point, you will find yourself trading with a great deal of confidence and thus, the psychology of taking losses becomes far less of a challenge. This is why I always repeat that a thorough understanding of risk v reward is fundamental to good profitable trading.

Now I know other people's style will differ from me, so I am not saying you should trade like I do. Plenty of people will take profits in a different fashion to me; different strokes for different folks. The main point to take away is that if you are trading the 3 Ducks method you should always be aiming to bank more than you risk.

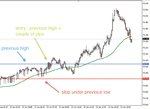

This is the trade I took this morning which I think I will let run to see what happens. My entry was 76.07 and my mental stop was 15 pips, at 75.93 (below last low). I now have a hard stop at breakeven. It got as far as 76.61 today but is retracing a bit now. Will see what happens - if it gets stopped out I've lost nothing, if it really stretches its legs, well, great.

There are, as always, exceptions to this general rule - sometimes if I am going to be away from the computer or it is getting close to weekend and the trade is just not moving away from my entry with some momentum, I just close it out and forget about it. With practice you tend to get a feeling for these type of things.

I hope this is of some use.

Good trading.

Nigel

Great discussion on taking profits. I think any helpful conversation about taking profits has to be had in conjunction with taking losses. It's that old risk v reward ratio that I keep banging on about.

Say for instance we have two 3 Ducks traders who have both just hit a take profit target. They have both put 50 pips worth of profits into their accounts. Trader A had a stop loss (or a pre-defined level at which he was going to get out of the market) of 20 pips. Trader B had a stop loss of 100 pips. You must appreciate that these two trading approaches are completely different and merit different methods of evaluation, despite the fact that the TP was the same.

Personally I like to make my 3 Ducks entries with reference to 5 min charts so I have fairly tight stops and low risk. When a trade moves a bit in my favour I always zoom out and look at the bigger picture on the 4 hour chart. If a trade is moving with momentum in my direction and I like the look of the chart I will generally just tighten the stop to breakeven and let it ride the trend until (a) price definitively crosses back over the 4 hour MA/the MA flattens out or (b) my stop gets taken out. Sometimes I close out a portion of the position to bank some pips and let the rest run.

This means that my percentage of successful trades is quite low (19% since October) and sometimes I sustain many losing/breakeven trades in a row. But when my winners come they tend to be big (in relation to my risk), and some are absolute monsters.

If price comes up and knocks me out at breakeven or a small loss it doesn't bother me because I know if I continue to make entries in the direction of the trend it is only a matter of time before I land another monster. When you actually accept the innate logic in this precise point, you will find yourself trading with a great deal of confidence and thus, the psychology of taking losses becomes far less of a challenge. This is why I always repeat that a thorough understanding of risk v reward is fundamental to good profitable trading.

Now I know other people's style will differ from me, so I am not saying you should trade like I do. Plenty of people will take profits in a different fashion to me; different strokes for different folks. The main point to take away is that if you are trading the 3 Ducks method you should always be aiming to bank more than you risk.

This is the trade I took this morning which I think I will let run to see what happens. My entry was 76.07 and my mental stop was 15 pips, at 75.93 (below last low). I now have a hard stop at breakeven. It got as far as 76.61 today but is retracing a bit now. Will see what happens - if it gets stopped out I've lost nothing, if it really stretches its legs, well, great.

There are, as always, exceptions to this general rule - sometimes if I am going to be away from the computer or it is getting close to weekend and the trade is just not moving away from my entry with some momentum, I just close it out and forget about it. With practice you tend to get a feeling for these type of things.

I hope this is of some use.

Good trading.

Nigel

Attachments

Last edited:

Why not use the 60SMA on the 5M chart as a trailing stop? That way you get out of losing trades early and let good trades run a while.

Yes, forexkunta, I think that is certainly a good way to approach short term trading with the 3 Ducks method. If you didn't fancy keeping trading trades open overnight for instance, that would definitely work well.

Nigel

The problem however for most traders is holding on to the winners - the temptation to ring the cash register is really high despite there likely being no technically relevant reason to do so. It goes to another point - most traders have no idea as to where they will take profits - they react versus anticipate - in order to book profits - never a good thing.

I agree 100%. This is a hurdle that must be overcome.

Similar threads

- Replies

- 11

- Views

- 4K