Part of the learning process is for you to understand the different types of traders. In essence there are two, and these are a fundamental trader or a technical trader. For you to succeed as an online trader you must understand the differences. Both have very different views in the techniques they use to assess market conditions and the direction an instrument may take.

Whilst there is some overlap, these are two very distinct methodologies, and you need to be comfortable with one or the other. You will come across this terminology all the time. Whilst there are huge differences in the approach, it is safe to say that most large financial institutions now employ both methods as both have their strengths and weaknesses. Fundamental also applies to the broad economy such as GDP, exports, imports etc. As a forex trader I use both in my trading, but with an emphasis on technical trading.

Technical or Fundamental: The Trading Approach

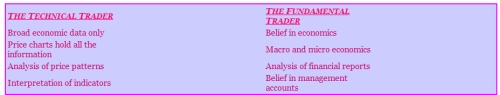

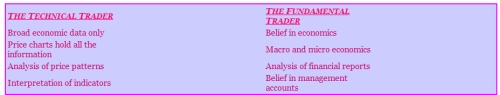

As we have seen, the two schools are called FUNDAMENTAL and TECHNICAL and for the record I am primarily a technical trader. In a nutshell, the fundamental trader believes that a share's performance is based on the fundamentals of the company ( hence the name ) such as PE ratio, profit/loss, balance sheets, management, ratios, business forecasts - the sort of information that is contained in a small forest of paper provided to shareholders. The technical trader however believes that the future performance is based purely on one simple piece of information, namely the price chart for the instrument. They believe that all the information about a company's performance is encapsulated in this simple chart. This is not an unreasonable assumption since the price reflects past performance, and is dictated by market conditions throughout the trading day. ( You may also hear the term chartist - this is the same thing ) In essence it is the ability to analyse a price chart in order to predict future price movements. The basic concepts are as shown below :

One of the key things you must understand, is that even though as a technical trader you will principally be studying charts, fundamental data does play a part, but only on a large scale. You use fundamental analysis to determine what part of the business cycle the economy is in and therefore which industries offer the best growth potential. Then you would use that information to identify groups of target stocks, and finally use technical analysis of the price charts to follow trends and select prospects. Let's look at one or two charts. Technical analysis is much more of an art form than a science and you will need to practice constantly and study charts until it becomes second nature!

Technical or Fundamental: Technical Analysis of Charts

Technical online trading, is all about the study and analysis of charts, and throughout the rest of the site you will find various examples of charts highlighting different aspects of this trading style. All of these charts are from the Sharescope package from Ionic, and excellent charting product that I use for end of day data for UK and US shares.

If this is the first chart you have ever looked at- well done CONGRATULATIONS - it will be the first of many. Have a look at the chart by clicking on the image, and after you have looked at the chart, I would like to ask you the following questions. Firstly, given that the chart shows the shares price over the last few months Before I explain the various components of the chart I would like to ask you two simple questions as follows - given that the chart is showing the shares price over the last few months, would you buy or sell this share at the moment, yes or no, and if so why?

Technical or Fundamental: Chart Components

Before I give you the answers, let me just explain briefly the various components of the chart. This is a daily chart for a share called Chloride Group PLC. The left and right hand side show the price of the share in pence. On June 12th 2006 the share price was 90.25 pence.( see right hand side ). Along the bottom is the timescale. In this case the chart goes from 25th Jan.2006 to the 12th June 2006 ( approx. 6 months ). The chart itself has two coloured bars, yellow and red. These are called candlesticks which you will come to know and love! Each bar represents the daily movement of the price of the share, and shows its opening and closing price on the day. The yellow ones are where the price closed up on the day( i.e. higher ), and the red ones where the share price closed down on the day( i.e. lower ). ( the little blue ones are where the price opened and closed at the same point )

At the bottom of the chart is one of the most important pieces of information that you will use in your analysis, and this is volume. The numbers up the left and right hand side ( 2 and 4 ) are the scale in millions, and indicate the number of shares traded on the market during the day. As you can see they are displayed as bars so that they are easy to read. You can instantly see where the volume is high, low or just average. Look at May 1st for example where the volume for the day was approximately 4million, and yet the day before was tiny ( perhaps 200-300,000). You will learn how to interpret this information to help you forecast future prices.

Finally, the last piece of information is the CHLD displayed behind the chart. In the UK this is called an EPIC symbol, and in the US is called a ticker. It is a unique code allocated to the company by the exchange on which its stock is listed. Usually the code is an abbreviation of the company's name e.g.: VOD = Vodafone, MCD= McDonalds, and as in our chart above CHLD = Chloride. These codes are not hard to find, and all charting packages will include them, as will the online broker that you use. They will also appear on statements and contract notes etc. You will pick then up very quickly and even remember which is which (just like me !) - how sad I must have become. They are also important when you start in derivatives ( options etc ). One other piece of information I have just noticed is the ORD - this just means that the shares are 'Ordinary' shares ( not preferential etc ). Right, back to the original question, and the answers are as follows :

Would you buy this share at the moment - yes or no? The answer is probably not!

Why? - because the share price is in a downtrend at the moment

This simple conclusion is your first piece of technical analysis. It has been based on a simple price vs. time chart. It has not involved hours or days studying management accounts, directors reports, financial statements. It does not require you to be a graduate of a business school ( though you may be one anyway ), or to understand PE ratios or any other ratio for that matter. You probably have little or no idea what the company does, who the management are, how many divisions there are, or where it is based. You have arrived at this simple conclusion based on what you see graphically represented before your very eyes.

Now, there is great deal more to it than that, but this is the basis of all technical analysis. The study of a chart to forecast future price movements. And finally the most wonderful part of all, is that this can be applied to ANY financial instrument in any market anywhere in the world. So it is possible to trade any instrument anywhere in the world, because all financial instruments will have a chart. Once you have learnt the basics of understanding and interpreting charts ( practice, practice and more practice ) you just need to understand the nuances of the particular market you wish to trade. Right - time for one more test!! - just to make sure you understand - would you buy or sell the following share in the chart shown below.

As you can see, the share price is showing an upwards trend, so on this occasion we would buy. One of the odd things that many traders suffer from is the fear of buying something that is trending up. The 'logic' if you can call it that, is simply that you subconscious is telling you that the prices are bound to fall soon. Perhaps this has something to do with our understanding of gravity, and that it is easier for things to fall than rise. This also becomes an issue when prices break into new high ground ( a price for the instrument that has never been achieved before ) Again the fear is that ' it can't go any higher'. I guarantee that you will suffer this yourself. It is the reason that people buy things like penny shares or try to buy when prices are falling fast ( known as trying to catch a falling knife!!) Please, don't ever be frightened about buying when prices are rising strongly - you have a much better chance of making money, than trying to predict the bottom when prices are falling - believe me!!

In a odd way, this really should be the first page of the site, as in order to start trading you need to decide whether you are going to be a fundamental or technical trader, which will then dictate your online trading and trading style. Only you can make this decision - no-one else. Hopefully this site will help a little!

Whilst there is some overlap, these are two very distinct methodologies, and you need to be comfortable with one or the other. You will come across this terminology all the time. Whilst there are huge differences in the approach, it is safe to say that most large financial institutions now employ both methods as both have their strengths and weaknesses. Fundamental also applies to the broad economy such as GDP, exports, imports etc. As a forex trader I use both in my trading, but with an emphasis on technical trading.

Technical or Fundamental: The Trading Approach

As we have seen, the two schools are called FUNDAMENTAL and TECHNICAL and for the record I am primarily a technical trader. In a nutshell, the fundamental trader believes that a share's performance is based on the fundamentals of the company ( hence the name ) such as PE ratio, profit/loss, balance sheets, management, ratios, business forecasts - the sort of information that is contained in a small forest of paper provided to shareholders. The technical trader however believes that the future performance is based purely on one simple piece of information, namely the price chart for the instrument. They believe that all the information about a company's performance is encapsulated in this simple chart. This is not an unreasonable assumption since the price reflects past performance, and is dictated by market conditions throughout the trading day. ( You may also hear the term chartist - this is the same thing ) In essence it is the ability to analyse a price chart in order to predict future price movements. The basic concepts are as shown below :

One of the key things you must understand, is that even though as a technical trader you will principally be studying charts, fundamental data does play a part, but only on a large scale. You use fundamental analysis to determine what part of the business cycle the economy is in and therefore which industries offer the best growth potential. Then you would use that information to identify groups of target stocks, and finally use technical analysis of the price charts to follow trends and select prospects. Let's look at one or two charts. Technical analysis is much more of an art form than a science and you will need to practice constantly and study charts until it becomes second nature!

Technical or Fundamental: Technical Analysis of Charts

Technical online trading, is all about the study and analysis of charts, and throughout the rest of the site you will find various examples of charts highlighting different aspects of this trading style. All of these charts are from the Sharescope package from Ionic, and excellent charting product that I use for end of day data for UK and US shares.

If this is the first chart you have ever looked at- well done CONGRATULATIONS - it will be the first of many. Have a look at the chart by clicking on the image, and after you have looked at the chart, I would like to ask you the following questions. Firstly, given that the chart shows the shares price over the last few months Before I explain the various components of the chart I would like to ask you two simple questions as follows - given that the chart is showing the shares price over the last few months, would you buy or sell this share at the moment, yes or no, and if so why?

Technical or Fundamental: Chart Components

Before I give you the answers, let me just explain briefly the various components of the chart. This is a daily chart for a share called Chloride Group PLC. The left and right hand side show the price of the share in pence. On June 12th 2006 the share price was 90.25 pence.( see right hand side ). Along the bottom is the timescale. In this case the chart goes from 25th Jan.2006 to the 12th June 2006 ( approx. 6 months ). The chart itself has two coloured bars, yellow and red. These are called candlesticks which you will come to know and love! Each bar represents the daily movement of the price of the share, and shows its opening and closing price on the day. The yellow ones are where the price closed up on the day( i.e. higher ), and the red ones where the share price closed down on the day( i.e. lower ). ( the little blue ones are where the price opened and closed at the same point )

At the bottom of the chart is one of the most important pieces of information that you will use in your analysis, and this is volume. The numbers up the left and right hand side ( 2 and 4 ) are the scale in millions, and indicate the number of shares traded on the market during the day. As you can see they are displayed as bars so that they are easy to read. You can instantly see where the volume is high, low or just average. Look at May 1st for example where the volume for the day was approximately 4million, and yet the day before was tiny ( perhaps 200-300,000). You will learn how to interpret this information to help you forecast future prices.

Finally, the last piece of information is the CHLD displayed behind the chart. In the UK this is called an EPIC symbol, and in the US is called a ticker. It is a unique code allocated to the company by the exchange on which its stock is listed. Usually the code is an abbreviation of the company's name e.g.: VOD = Vodafone, MCD= McDonalds, and as in our chart above CHLD = Chloride. These codes are not hard to find, and all charting packages will include them, as will the online broker that you use. They will also appear on statements and contract notes etc. You will pick then up very quickly and even remember which is which (just like me !) - how sad I must have become. They are also important when you start in derivatives ( options etc ). One other piece of information I have just noticed is the ORD - this just means that the shares are 'Ordinary' shares ( not preferential etc ). Right, back to the original question, and the answers are as follows :

Would you buy this share at the moment - yes or no? The answer is probably not!

Why? - because the share price is in a downtrend at the moment

This simple conclusion is your first piece of technical analysis. It has been based on a simple price vs. time chart. It has not involved hours or days studying management accounts, directors reports, financial statements. It does not require you to be a graduate of a business school ( though you may be one anyway ), or to understand PE ratios or any other ratio for that matter. You probably have little or no idea what the company does, who the management are, how many divisions there are, or where it is based. You have arrived at this simple conclusion based on what you see graphically represented before your very eyes.

Now, there is great deal more to it than that, but this is the basis of all technical analysis. The study of a chart to forecast future price movements. And finally the most wonderful part of all, is that this can be applied to ANY financial instrument in any market anywhere in the world. So it is possible to trade any instrument anywhere in the world, because all financial instruments will have a chart. Once you have learnt the basics of understanding and interpreting charts ( practice, practice and more practice ) you just need to understand the nuances of the particular market you wish to trade. Right - time for one more test!! - just to make sure you understand - would you buy or sell the following share in the chart shown below.

As you can see, the share price is showing an upwards trend, so on this occasion we would buy. One of the odd things that many traders suffer from is the fear of buying something that is trending up. The 'logic' if you can call it that, is simply that you subconscious is telling you that the prices are bound to fall soon. Perhaps this has something to do with our understanding of gravity, and that it is easier for things to fall than rise. This also becomes an issue when prices break into new high ground ( a price for the instrument that has never been achieved before ) Again the fear is that ' it can't go any higher'. I guarantee that you will suffer this yourself. It is the reason that people buy things like penny shares or try to buy when prices are falling fast ( known as trying to catch a falling knife!!) Please, don't ever be frightened about buying when prices are rising strongly - you have a much better chance of making money, than trying to predict the bottom when prices are falling - believe me!!

In a odd way, this really should be the first page of the site, as in order to start trading you need to decide whether you are going to be a fundamental or technical trader, which will then dictate your online trading and trading style. Only you can make this decision - no-one else. Hopefully this site will help a little!

Last edited by a moderator: