Dollar Holds Steady as Markets Await US Inflation Data, Euro Under Pressure

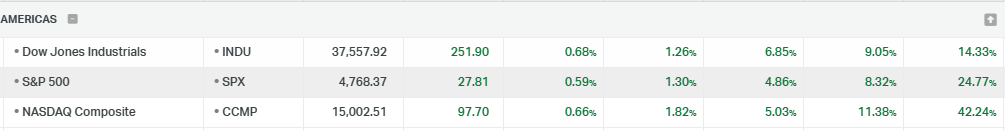

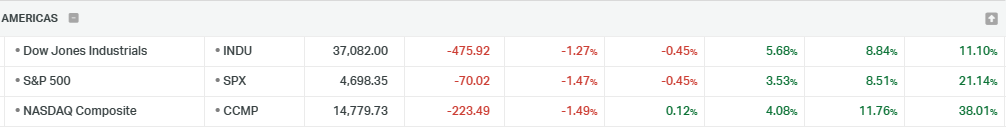

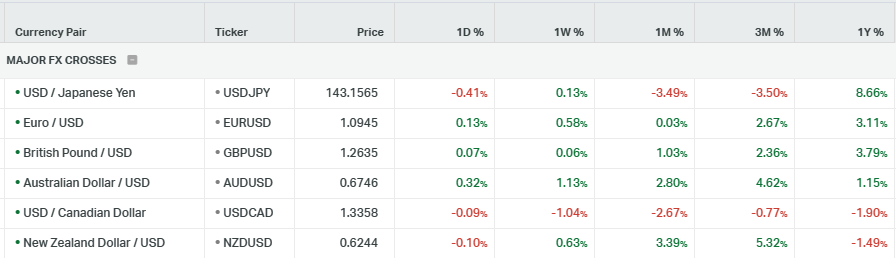

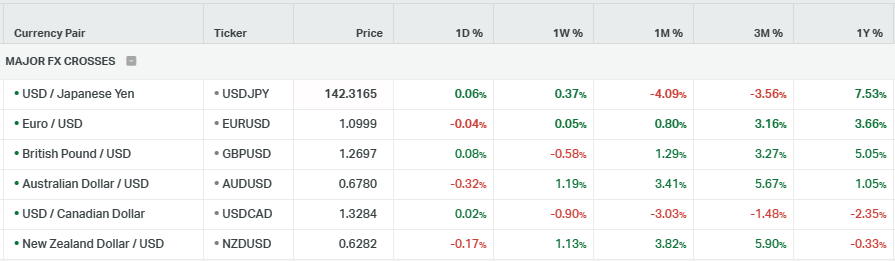

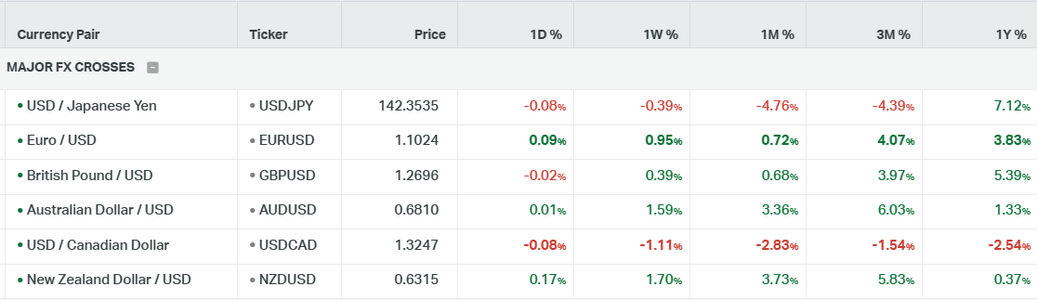

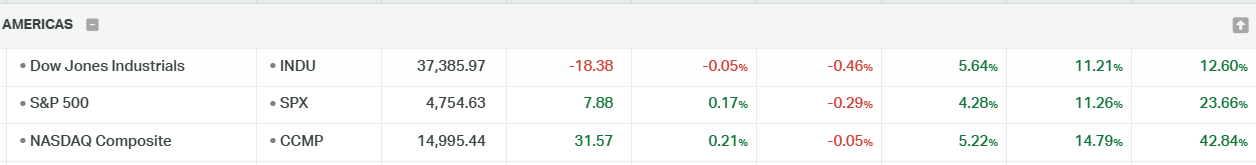

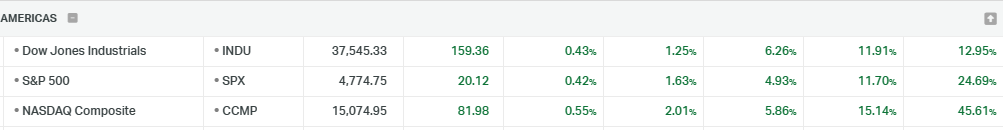

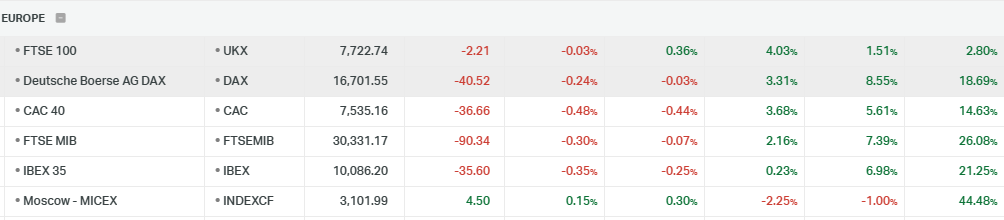

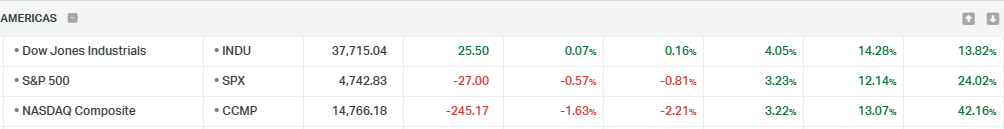

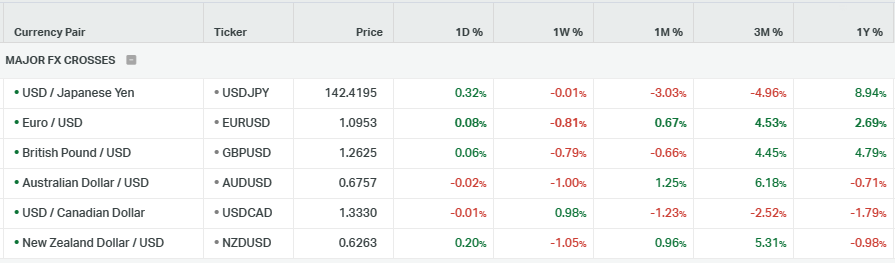

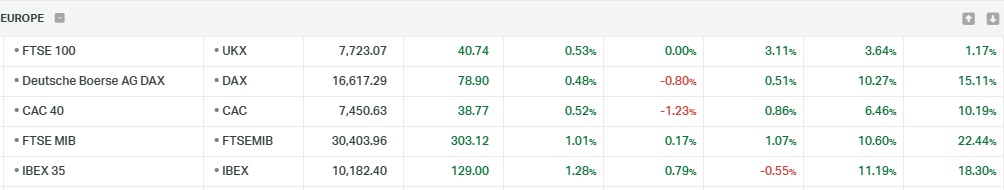

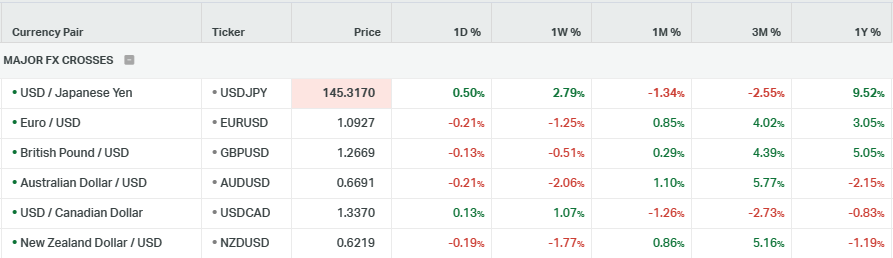

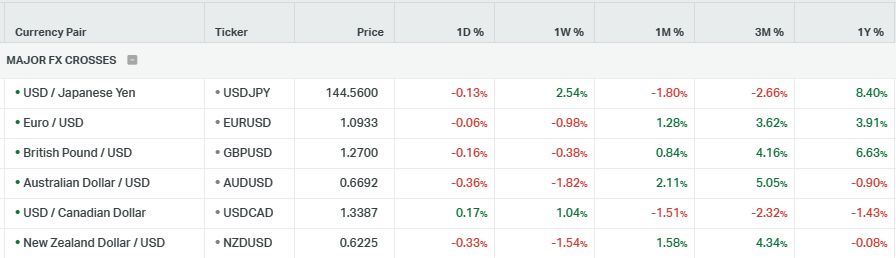

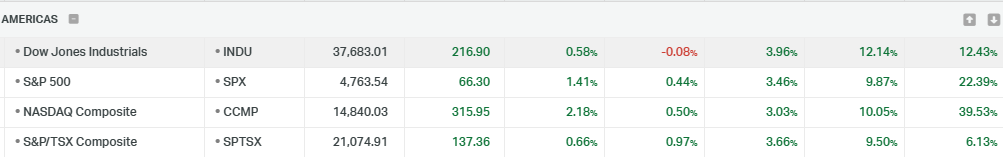

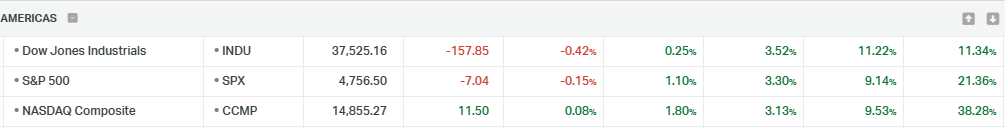

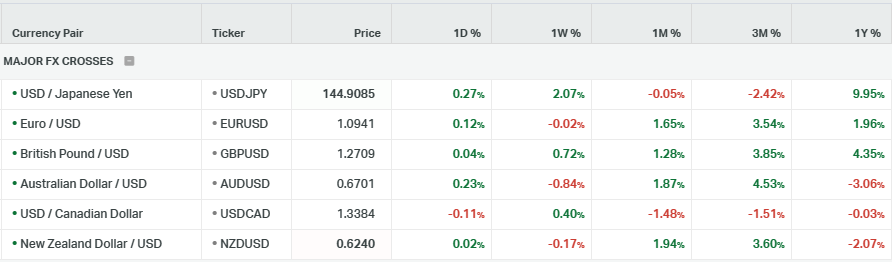

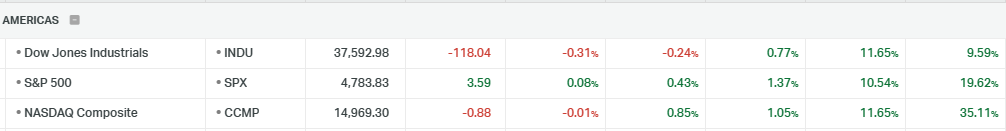

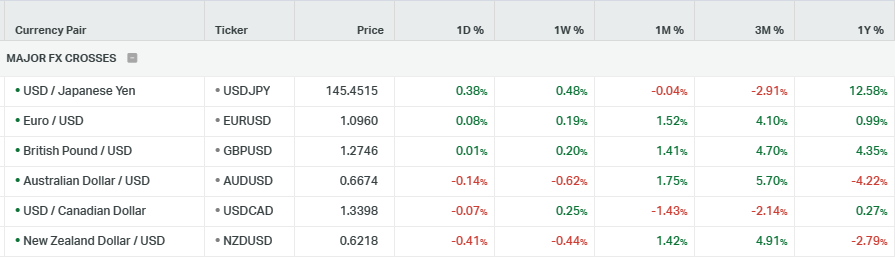

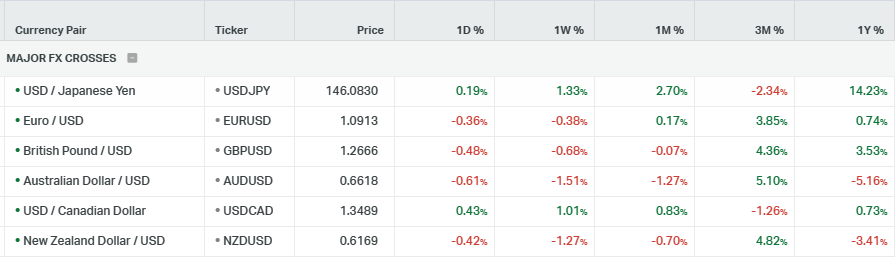

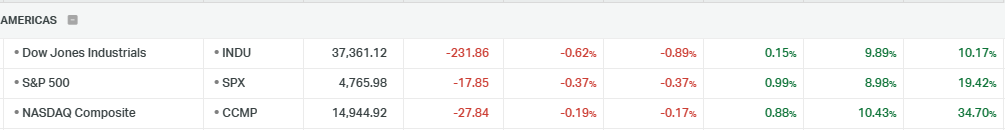

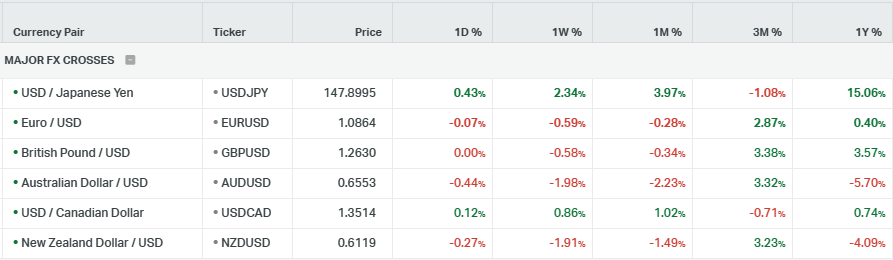

On Wednesday, the dollar remained stable in cautious trading, with markets awaiting the US inflation data due later this week. This key report could significantly influence the Federal Reserve's policy decisions. Meanwhile, Bitcoin experienced volatility following a fake social media post that disrupted the markets. The upcoming US Consumer Price Index report, expected on Thursday, is anticipated to show a 0.2% monthly increase in headline inflation and a 3.2% annual rise, which could sway opinions regarding a potential March rate cut.

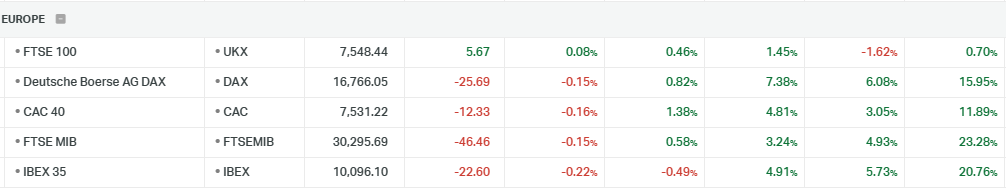

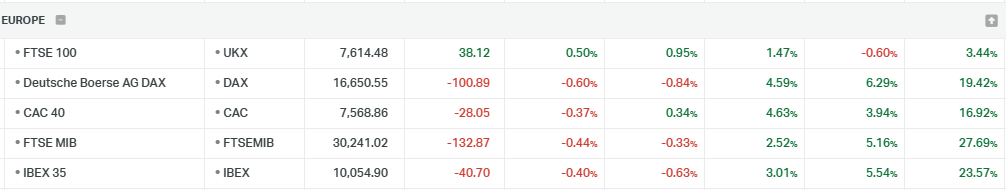

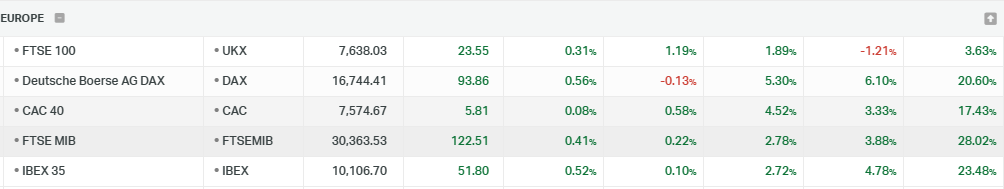

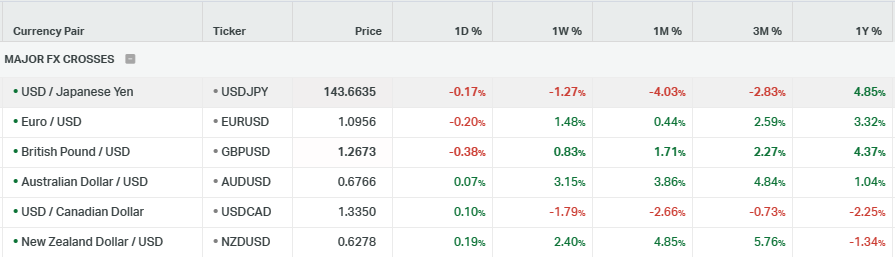

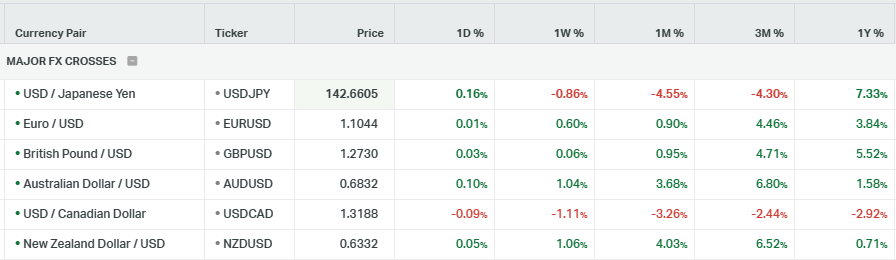

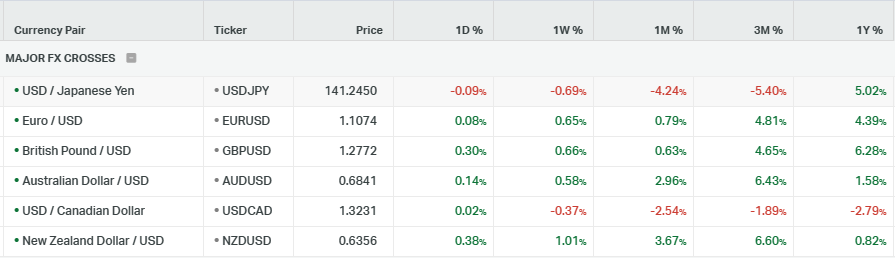

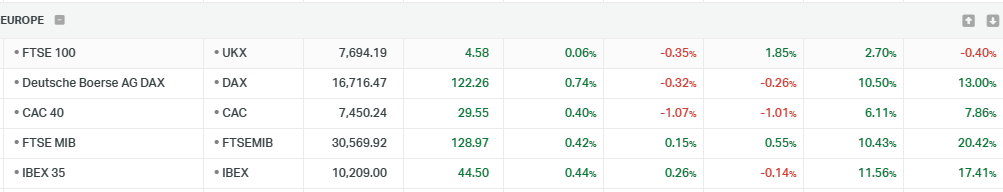

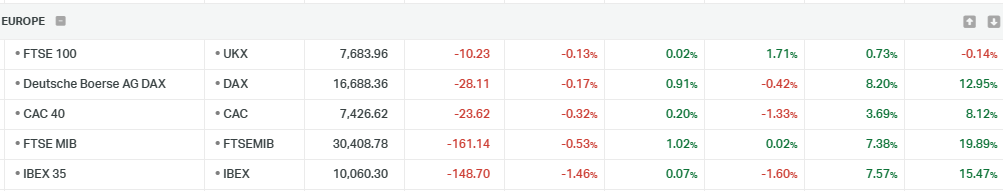

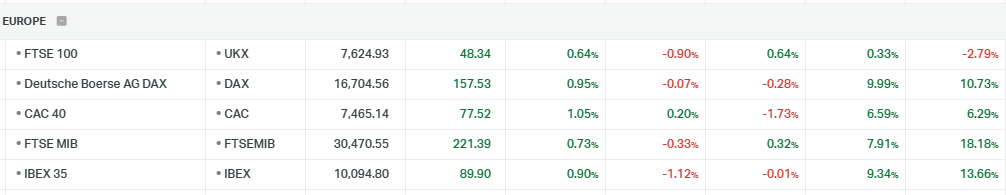

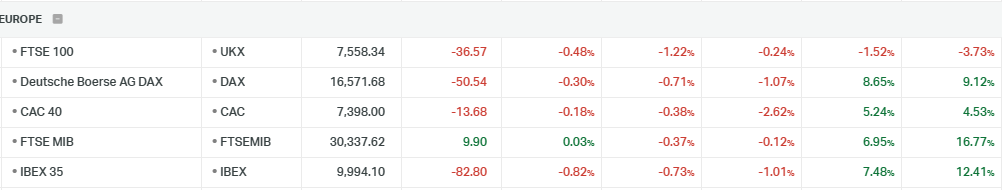

In Europe, the euro is under pressure following dismal German industrial production data released on Tuesday, which indicated a 0.7% drop in November, contrary to the expected 0.3% rise. This downturn raises concerns about a potential recession in Europe's largest economy and increases expectations for a rate cut by the European Central Bank in April. However, a recent surge in Eurozone inflation might prompt the ECB to maintain high interest rates. In the absence of significant US data on Wednesday, traders are now focusing on French industrial production and Italian retail sales figures for further direction.

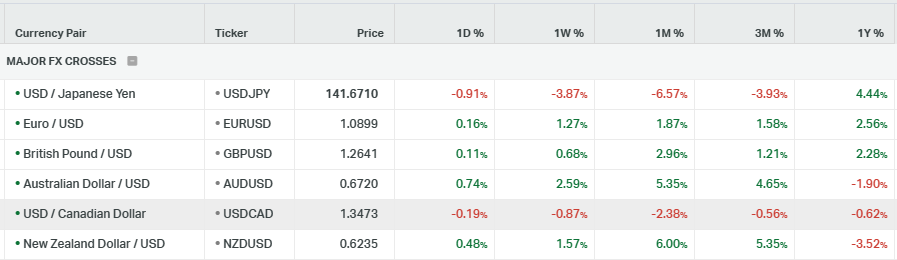

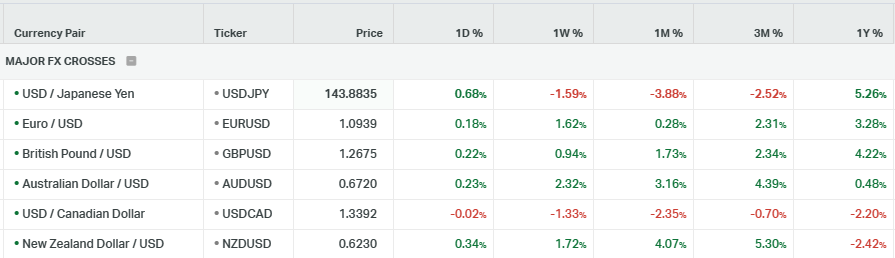

The Pound Sterling is facing a sharp sell-off due to ongoing uncertainties about the Bank of England’s tight monetary policy and the increasing risk of a technical recession in the UK. The pound's direction will likely be influenced by an upcoming speech from Bank of England Governor Andrew Bailey, expected to address interest rates and inflation. Investors are also anticipating Friday's UK factory data, hoping for a recovery in industrial and manufacturing production.

The Japanese Yen continues its depreciation following a report from the Labour Ministry that real wages in Japan have shrunk for the 20th consecutive month as of November. Coupled with falling inflation rates in Tokyo, this reinforces the expectation that the Bank of Japan will maintain negative interest rates. The yen's weakness is further exacerbated by a lack of haven flows amid the cautious mood in equity markets.

Gold prices were subdued, influenced by a firmer US dollar and higher treasury yields. The market is closely watching the US inflation report, which could clarify the Federal Reserve's stance on rate cuts. The combination of a stable US dollar and bond yields is curbing the rise in gold prices, contrasting with the trends seen at the end of 2023.

Oil prices gained about 2% in the previous session due to supply concerns following a Libyan supply outage and ongoing regional tensions from the Israel-Gaza conflict. However, the week started with a more than 3% decline in trading on Monday. Supporting oil prices are renewed attacks on shipping in the Red Sea by Yemen's Houthi militia, which threaten oil tanker flows, and a larger-than-expected drawdown in US crude inventories, supporting demand sentiment.

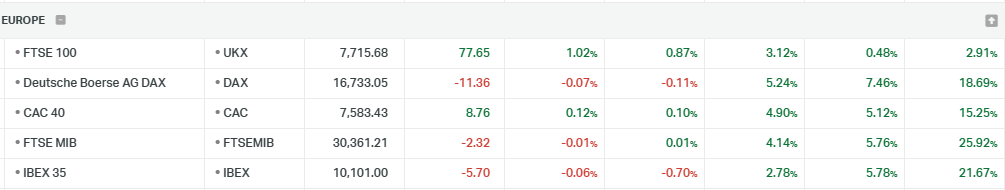

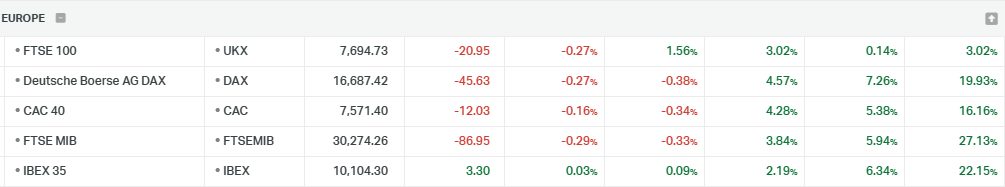

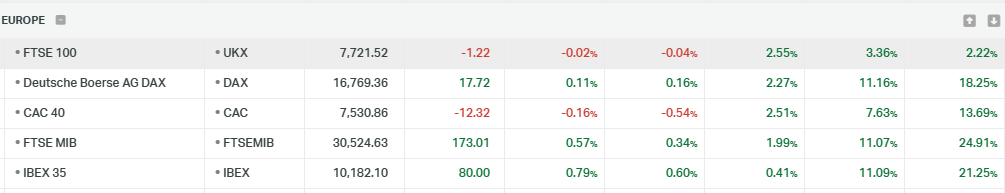

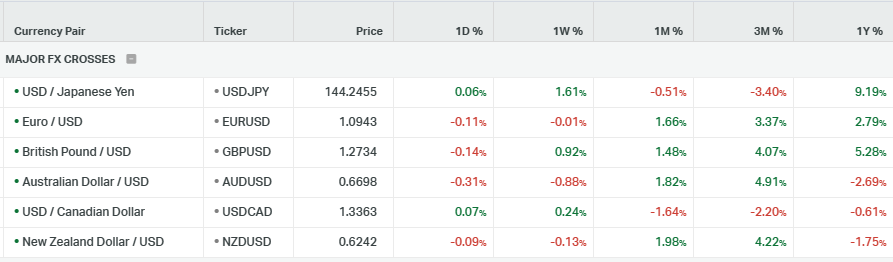

EUR/USD Stalls in Non-Directional Movement Near 1.0950

The EUR/USD has been moving in a non-directional way for the past six days, hovering around the area close to 1.0950 which is near the median line. There has been no significant movement or change from yesterday. The next resistance level is at 1.1000, while the support level is close to 1.0850.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.1200 | 1.1100 | 1.1000 | 1.0900 | 1.0850 | 1.0750 |

GBP/USD's Long Bullish Trend Faces Resistance with Channel Support

The GBP/USD is currently in the price accumulation phase where the pair is correcting for the second day. The long bullish trend faces a challenge from the resistance level at 1.2800. The down parallel of the channel is acting as support.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.2930 | 1.2800 | 1.2700 | 1.2630 | 1.2500 | 1.2400 |

USD/JPY Tests 145.00 for Breakout, Eyes Next Resistance at 148.30

The USD/JPY is testing the 145.00 level again for a breakout. The next resistance level is at 148.30, while the next support level is at 144.80.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 152.00 | 148.30 | 145.00 | 144.80 | 140.00 | 138.00 |

Gold Outlook Shifts to Neutral with Resistance at 2050

Gold prices have been attempting to recover for the second day following a short-term bearish trend. However, the current outlook is somewhat neutral. In case the rebound persists, the next resistance level will be at 2050. Conversely, if the prices keep declining, the next support level is at 2006.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 2140 | 2090 | 2050 | 2032 | 2006 | 1979 |

WTI Crude Oil Price Displays Unpredictable Unidirectional Swings

WTI crude oil price continues its volatile unidirectional movements, as the market is still divided on the direction oil prices will take next impacted by geopolitics tensions and slowing demand. The overall outlook remains uncertain due to unclear market fundamentals. The resistance area is currently between 74 and 76, while support can be found at 68. The trend is currently bearish.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 81 | 78 | 74 | 70 | 68 | 64.9 |