My personal trading style is based on a method described in the 1950s by a veteran floor trader named George Douglass Taylor. The "Taylor Trading Technique" is a short-term method for trading daily price movements that relies entirely on odds and percentages. It is a method as opposed to a system. Very few people can blindly follow a system, though many find it easier to be discretionary in a systematic way.

Because this short-term swing technique generates frequent trades, it is important to know the correct plays, when to lock in profits, and when to seek the true trend. Taking a loss is merely playing for better position. One trades strictly for probable future results, not for what the market might do.

To know the correct play is to know whether to buy or sell first, to exit or hold. Trades are based on objective points, which are simply the previous day's highs and lows. Movement between these two points determines the true trend.

When swing trading, adjust your expectations. The more conservative your expectations, the happier you will be and, ironically, the more money you will probably make. Entries are actually the easy part of the method. What is more difficult is having the confidence in your ability to get out of bad situations and bad trades early, and knowing when to use tighter stops for trading swings and wider stops when trading trends.

The Taylor method teaches you to anticipate. Never react! Know what you are going to do before the market opens. Always have a plan, but be flexible. See your stop (support or resistance) before initiating a trade. Again, knowing how to trade out of trouble situations and how to get off the hook with the smallest possible loss is part of the skill.

Never trade in narrow, dead markets; the swings are too small. And never chase a market. Rather than worry that you've missed a move, consider yourself fortunate that oscillations and volatility have come back into the market.

Because of the short-term nature of this technique, swing traders must adhere to some very basic rules, including:

What is the basis of the Taylor Technique, and how does one begin to anticipate an entry? Here are some basic guidelines.

The Count

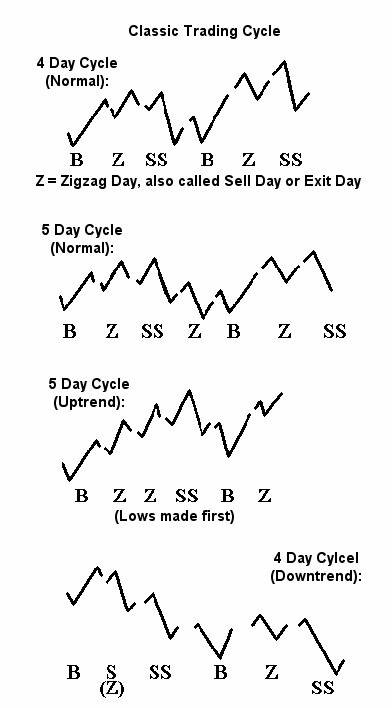

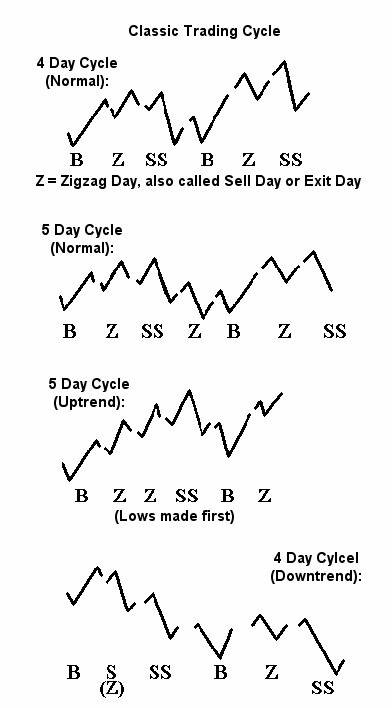

Start searching for a buying day two days after the market makes a swing high. Conversely, search for a shorting day two days after a swing low. Ideally, the market will move in complete five-day cycles. In stronger trends, the market will move four days in the primary direction and only 1 in reaction, allowing you to seek entry 1 day earlier.

?Check Mark? on the Test

Entries are sought opposite, or contrary to, the previous day's close. For example, if looking to buy, one first wants the market to "test" the previous day's low, preferably early in the day, and then form a trading pattern that looks like a "check mark" or a small "W" (see examples).

This pattern sets up and establishes a "double stop point" or strong support. If entering a market with only a "single stop point" - e.g., support formed by the current day's low only without a test, then exit on the same day. These trades are usually against the trend.

Close vs. Open

The close should indicate the following day's opening direction. When a market opens opposite what is expected or indicated by the trend, you can first look to "fade" it (i.e., trade in the opposite direction) but take profits quickly. Then look to reverse!

Support & Resistance

The key question when swing trading with the Taylor method is: is today's support (or resistance) higher or lower than yesterday's corresponding support (or resistance)?

Swing Measurements

Where is the current market relative to the last swing high or low? Always look for swings - both up and down - of equal length, and for retracements of equal percentage.

No matter what time frame you trade - intraday, daily, weekly, etc. - always look for indications of supply near potential selling points, and signs of demand near potential buying points. Supply and demand shows itself following a successful test in the form of rapid directional movement in the direction of the trade. Conversely, a lack of supply or demand at a previous low or high, results in a penetration. Valid penetrations are accompanied by an increase in volume and greater trading activity.

On average, expect trends (both up and down) to last between 2 to 3 weeks. The following conditions are fairly reliable indicators for the start of a trend. Personally, I skip the first buy or sell swing when one of these indications occurs, because the ensuing move is often quite strong.

Because a certain amount of confidence is required to trade any technique consistently, paper trading helps cultivate the faith necessary to recognize and trade the Taylor pattern. Although the temptation to try too many different styles and patterns always exists, one must strive ultimately to trade in just one consistent manner.

Certain points about trading short-term swing trading deserve note. Understanding the nature of the method and its return characteristics will help you recognize and deal with the psychological aspects of trading this method.

When consistently following a short-term system, you should expect a high win to loss ratio. Though the objectives with this style trading are conservative, you will almost always incur "positive slippage." For example, buying into a test of the previous day's low, or selling into a test of the previous day's high gives you an edge in the slippage department that trend followers do not often enjoy.

In all systems, winners are skewed. Though swing trading is designed to make small but steady profits, 3-4 really big trades may actually make your month. Thus it is vitally important to "lock in" your winning trades. Simply put, do not give back open profits when short-term trading. You may be surprised at just how large some winners are from catching the swings just right.

It is important to remember that every time you make a trade, you are making a decision. The more decisions you make, the more you increase your self-confidence.

You grow with each decision, yet each decision has a price. For example, you must discard a choice, and you must commit.

Remember that conditions are never perfect. You must allow yourself to fail. Allow for human limitations and wrong choices. Reserve compassion for yourself and your limitations.

There is almost too much instantaneous information available to traders today. It is really OK to use intuition and to respect the voice inside your head, "Does the trade feel right"? If not, get out. Learn to respect your intuition.

Finally, I want to leave you with what I believe are two Golden Rules, applicable to all traders but, of essential importance to short-term swing traders:

Because this short-term swing technique generates frequent trades, it is important to know the correct plays, when to lock in profits, and when to seek the true trend. Taking a loss is merely playing for better position. One trades strictly for probable future results, not for what the market might do.

To know the correct play is to know whether to buy or sell first, to exit or hold. Trades are based on objective points, which are simply the previous day's highs and lows. Movement between these two points determines the true trend.

When swing trading, adjust your expectations. The more conservative your expectations, the happier you will be and, ironically, the more money you will probably make. Entries are actually the easy part of the method. What is more difficult is having the confidence in your ability to get out of bad situations and bad trades early, and knowing when to use tighter stops for trading swings and wider stops when trading trends.

The Taylor method teaches you to anticipate. Never react! Know what you are going to do before the market opens. Always have a plan, but be flexible. See your stop (support or resistance) before initiating a trade. Again, knowing how to trade out of trouble situations and how to get off the hook with the smallest possible loss is part of the skill.

Never trade in narrow, dead markets; the swings are too small. And never chase a market. Rather than worry that you've missed a move, consider yourself fortunate that oscillations and volatility have come back into the market.

Basic Rules for Swing Traders

Because of the short-term nature of this technique, swing traders must adhere to some very basic rules, including:

- If the trade moves in your favor, carry it home overnight. The odds favor follow-through. Expect to exit the next day near the objective point (explained later). An overnight gap presents an excellent opportunity to take profits. The exception is when the market offers you windfall profits; take these to the bank on the close. Do not get cute.

- Concentrating on only one entry or one exit per day relieves some of the mental pressure.

- If your entry is correct, the market should move in your favor almost immediately. It may come back to test your entry point a little, but that's OK.

- Do not carry a losing position overnight. Exit and play for better position the next day.

- A strong close usually indicates a strong opening the following day.

- If the market doesn't perform as expected, exit on the first reaction.

- If you are long and the market closes flat, indicating a lower opening the following day, scratch or exit the trade. Play for better position the next day. It is always OK to scratch a trade!

- Use tight stops when swing trading and wider stops when trading trends.

- The goal always is to minimize risk and create "freebies," i.e, trades that move in your favor quickly, where the stop can be moved to break even.

- Training yourself how to think and act under pressure is a major part of the battle. Therefore, when in doubt, get out! You have lost your road map and your game plan. It's an old cliché, but when dealing with real money, it's one cliché you want to respect.

- Place your orders at the market. Do not get cute trying to price your trades with limit orders.

- When a trade isn't working, exit on the first reaction.

- Always anticipate. Do not get caught up in reacting to market moves.

"Trading the Swing"

What is the basis of the Taylor Technique, and how does one begin to anticipate an entry? Here are some basic guidelines.

The Count

Start searching for a buying day two days after the market makes a swing high. Conversely, search for a shorting day two days after a swing low. Ideally, the market will move in complete five-day cycles. In stronger trends, the market will move four days in the primary direction and only 1 in reaction, allowing you to seek entry 1 day earlier.

?Check Mark? on the Test

Entries are sought opposite, or contrary to, the previous day's close. For example, if looking to buy, one first wants the market to "test" the previous day's low, preferably early in the day, and then form a trading pattern that looks like a "check mark" or a small "W" (see examples).

This pattern sets up and establishes a "double stop point" or strong support. If entering a market with only a "single stop point" - e.g., support formed by the current day's low only without a test, then exit on the same day. These trades are usually against the trend.

Close vs. Open

The close should indicate the following day's opening direction. When a market opens opposite what is expected or indicated by the trend, you can first look to "fade" it (i.e., trade in the opposite direction) but take profits quickly. Then look to reverse!

Support & Resistance

The key question when swing trading with the Taylor method is: is today's support (or resistance) higher or lower than yesterday's corresponding support (or resistance)?

Swing Measurements

Where is the current market relative to the last swing high or low? Always look for swings - both up and down - of equal length, and for retracements of equal percentage.

Additional Considerations

No matter what time frame you trade - intraday, daily, weekly, etc. - always look for indications of supply near potential selling points, and signs of demand near potential buying points. Supply and demand shows itself following a successful test in the form of rapid directional movement in the direction of the trade. Conversely, a lack of supply or demand at a previous low or high, results in a penetration. Valid penetrations are accompanied by an increase in volume and greater trading activity.

On average, expect trends (both up and down) to last between 2 to 3 weeks. The following conditions are fairly reliable indicators for the start of a trend. Personally, I skip the first buy or sell swing when one of these indications occurs, because the ensuing move is often quite strong.

- The narrowest daily high to low range in the last 7 days

- 3 consecutive days with small range

- The point of a "wedge" pattern

- A breakaway gap from a chart pattern such as triangle.

- A rising ADX (14-period) above 32

Practice

Because a certain amount of confidence is required to trade any technique consistently, paper trading helps cultivate the faith necessary to recognize and trade the Taylor pattern. Although the temptation to try too many different styles and patterns always exists, one must strive ultimately to trade in just one consistent manner.

Method Characteristics

Certain points about trading short-term swing trading deserve note. Understanding the nature of the method and its return characteristics will help you recognize and deal with the psychological aspects of trading this method.

When consistently following a short-term system, you should expect a high win to loss ratio. Though the objectives with this style trading are conservative, you will almost always incur "positive slippage." For example, buying into a test of the previous day's low, or selling into a test of the previous day's high gives you an edge in the slippage department that trend followers do not often enjoy.

In all systems, winners are skewed. Though swing trading is designed to make small but steady profits, 3-4 really big trades may actually make your month. Thus it is vitally important to "lock in" your winning trades. Simply put, do not give back open profits when short-term trading. You may be surprised at just how large some winners are from catching the swings just right.

Decision-Making

It is important to remember that every time you make a trade, you are making a decision. The more decisions you make, the more you increase your self-confidence.

You grow with each decision, yet each decision has a price. For example, you must discard a choice, and you must commit.

Remember that conditions are never perfect. You must allow yourself to fail. Allow for human limitations and wrong choices. Reserve compassion for yourself and your limitations.

There is almost too much instantaneous information available to traders today. It is really OK to use intuition and to respect the voice inside your head, "Does the trade feel right"? If not, get out. Learn to respect your intuition.

Golden Rules

Finally, I want to leave you with what I believe are two Golden Rules, applicable to all traders but, of essential importance to short-term swing traders:

- Never, ever, average a loss. Exit if you think you are wrong. Re-enter the trade when you believe you are right or the picture become clear again.

- Never listen to anyone else's opinion. Only you know when your trade isn't working.

Last edited by a moderator: