Keith123321

Newbie

- Messages

- 1

- Likes

- 0

Hi all,

New member, first post.

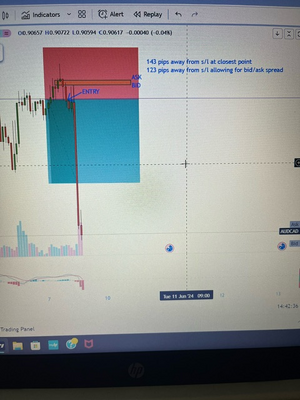

I took a trade today on AUD/CAD to short 0.6 lots. Entry after allowing for Tickmill spread was 0.91168, s/l 0.91362, t/p 0.90848.

It never got closer than 143 pips from my stop loss, never got closer than 123 pips allowing for bid/ask spread (I appreciate this can expand during certain times/events but surely not by the 600% it would have needed to be to hit my s/l). My position was closed at a £70 loss instead of a £120 gain when it supposedly hit my stop loss. Tickmill claim it reached 0.91398 according to my MT5 app. How can Trading View not show this spike? I've checked 12 different brokers charts on Trading View, none of them show it.

This all happened within high liquidity hours in the UK session, trade did not run overnight and wasn't taken during Asian session. The Tickmill spread is 1.3, even if they raised it by 500% during high volatility it would still be comfortably within my stop loss. I have a £3,000 live account, so surely this is an ample account balance to stop a margin call?

Why on earth would they have closed my position and how do we ever have any chance of successfully trading Forex if this is going on? Are 500+ pip stop losses required thus risking huge amounts for less than 1:1 risk reward? Needless to say I've lodged my dispute with them and am now waiting a response.

New member, first post.

I took a trade today on AUD/CAD to short 0.6 lots. Entry after allowing for Tickmill spread was 0.91168, s/l 0.91362, t/p 0.90848.

It never got closer than 143 pips from my stop loss, never got closer than 123 pips allowing for bid/ask spread (I appreciate this can expand during certain times/events but surely not by the 600% it would have needed to be to hit my s/l). My position was closed at a £70 loss instead of a £120 gain when it supposedly hit my stop loss. Tickmill claim it reached 0.91398 according to my MT5 app. How can Trading View not show this spike? I've checked 12 different brokers charts on Trading View, none of them show it.

This all happened within high liquidity hours in the UK session, trade did not run overnight and wasn't taken during Asian session. The Tickmill spread is 1.3, even if they raised it by 500% during high volatility it would still be comfortably within my stop loss. I have a £3,000 live account, so surely this is an ample account balance to stop a margin call?

Why on earth would they have closed my position and how do we ever have any chance of successfully trading Forex if this is going on? Are 500+ pip stop losses required thus risking huge amounts for less than 1:1 risk reward? Needless to say I've lodged my dispute with them and am now waiting a response.