SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

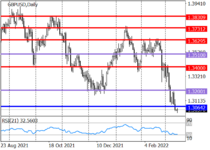

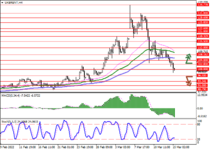

EURUSD

market is waiting for the ECB meeting

market is waiting for the ECB meeting

The day before, EURUSD corrected upwards against the current medium-term downtrend and reached 1.1094. Investor demand for risky assets is fixed against the backdrop of reports of a possible serious increase in oil production by Iraq and the United Arab Emirates, which could stop the rapid rise in commodity prices and reduce inflation. The rate of currencies alternative to the US dollar is also supported by reports about the start of negotiations between the foreign ministers of the Russian Federation and Ukraine in Turkey, which give the market hope for a resolution of the military conflict through diplomacy.

The downtrend in the asset may resume in case of a negative reaction of traders to the results of the next meeting of the European Central Bank (ECB). In the face of geopolitical uncertainty, the regulator is expected to be cautious and possibly hint at maintaining the current monetary policy, trying to prevent stagflation, in which prices in the eurozone continue to rise and business activity begins to decline. In addition, investors' attention today will be drawn to the February data on inflation in the US. It is predicted that the Consumer Price Index will increase from 0.6% to 0.8% in monthly terms and from 7.5% to 7.9% in annual terms. An increase in price pressure may push the US Fed to more actively tighten monetary policy.

Resistance levels: 1.1108, 1.123, 1.1352.

Support levels: 1.0986, 1.0864, 1.0742.