stoploss please

Established member

- Messages

- 780

- Likes

- 10

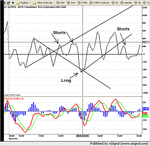

Simple posting of the Tick indicator and how it can help you stay on the right side of a move.

I have used breaks of tick trend line to help me time my moves.

What I have discovered is more rewarding is how the tick reacts after a trend line break.

What I look for is a bounce or failed break ema break as this signals that sentiment has changed and we are now moving in a new direction.

For the ease of reading, the attached chart of the tick just shows the tick average and entry points.

I have used breaks of tick trend line to help me time my moves.

What I have discovered is more rewarding is how the tick reacts after a trend line break.

What I look for is a bounce or failed break ema break as this signals that sentiment has changed and we are now moving in a new direction.

For the ease of reading, the attached chart of the tick just shows the tick average and entry points.