You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

Sorry, 1320 god damn beetle juice.

2 weeks late tsk, tsk. Included again but can you have a crack at posting up your entry before open dude?

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

W/E 18th May - Predictions

Up: 8

Down: 8

Average: 1360.5

Wt Average 1350.5

Highest: 1380

Lowest: 1303

Good luck folks :clover:

Link to predictions

Up: 8

Down: 8

Average: 1360.5

Wt Average 1350.5

Highest: 1380

Lowest: 1303

Good luck folks :clover:

Link to predictions

2 weeks late tsk, tsk. Included again but can you have a crack at posting up your entry before open dude?

Sorry, I ll have a laptop at home to post up before open.

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

Atilla

Legendary member

- Messages

- 21,036

- Likes

- 4,208

Congratulations to theMilton

Beginner's luck ? I don't think so ! 2 podiums in a row.

Interested to see this week's forecast. Can you make it 3 podiums ?

:clap:

I don't believe in luck either. Good call Milton well done. If you are a beginner then keep doing what ever it is you are doing. 🙂

themilton

Junior member

- Messages

- 33

- Likes

- 5

Is there a way for you to post this to the forum? I can't see it. Sorry I'm at work.

Congratulations to theMilton

Beginner's luck ? I don't think so ! 2 podiums in a row.

Interested to see this week's forecast. Can you make it 3 podiums ?

:clap:

Thanks. If it's not beginner's luck then I don't know what it is. lol

I don't believe in luck either. Good call Milton well done. If you are a beginner then keep doing what ever it is you are doing. 🙂

:clap: Thank You. I can't believe I got that close twice in a row. I'm pretty sure that's about all the luck I'm going to get.

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

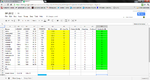

W/E 18th May - Results

So folks, no doubt that the S&P spent all last week just grinding down making lower highs and lower lows to end the week at 1295.22 and breaking the psych 1300 level. So much for all those that thought a bottom had been put in (like me) 😆

That means that this weeks Three Amigos are:

1) themilton - 1303 (7.78)

2) dpinpon - 1320 (24.78)

3) Atilla - 1332 (36.78)

Congratulations to themilton on his first win and dpinpon and Atilla for clocking up more points :clap::clap:😎

The leaderboard. It appears that Atilla put enough distance in between himself and everybody else that he is still able to hold his lead and put his cuckoo clock days behind him. Nevertheless, all that needs to happen is a purple patch for him and a bit of good fortune for others and the whole shebang could change.

On another more administrative note due to me having to be a taxi service for my daughter on Friday nights, the best I can do is get the results done and then do the narrative at some point over the weekends. Hope this is fine for folks.

Additionally, I created a thread in The Foyer to discuss a new scoring system. Unless the debate moves on from a couple of weeks and ago and people collectively agree a new scoring system, I will continue to use this one. The onus of responsibility is for you to make and agree the changes. 🙂😛

Link to thread to discuss new scoring

Finally, I am now formally imposing the 1 grace late entry per quarter on participants. All predictions need to be in before RTH Open on Monday.

@themilton - why can't you link to google docs??? Are you on a military network or something?

Link to results

So folks, no doubt that the S&P spent all last week just grinding down making lower highs and lower lows to end the week at 1295.22 and breaking the psych 1300 level. So much for all those that thought a bottom had been put in (like me) 😆

That means that this weeks Three Amigos are:

1) themilton - 1303 (7.78)

2) dpinpon - 1320 (24.78)

3) Atilla - 1332 (36.78)

Congratulations to themilton on his first win and dpinpon and Atilla for clocking up more points :clap::clap:😎

The leaderboard. It appears that Atilla put enough distance in between himself and everybody else that he is still able to hold his lead and put his cuckoo clock days behind him. Nevertheless, all that needs to happen is a purple patch for him and a bit of good fortune for others and the whole shebang could change.

On another more administrative note due to me having to be a taxi service for my daughter on Friday nights, the best I can do is get the results done and then do the narrative at some point over the weekends. Hope this is fine for folks.

Additionally, I created a thread in The Foyer to discuss a new scoring system. Unless the debate moves on from a couple of weeks and ago and people collectively agree a new scoring system, I will continue to use this one. The onus of responsibility is for you to make and agree the changes. 🙂😛

Link to thread to discuss new scoring

Finally, I am now formally imposing the 1 grace late entry per quarter on participants. All predictions need to be in before RTH Open on Monday.

@themilton - why can't you link to google docs??? Are you on a military network or something?

Link to results

Attachments

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

..

NEW YORK (Frankfurt: A0DKRK - news) , May 18 (Reuters) - Normally a big decline would set up Wall Street for a technical rebound. But that may not be the case next week, even after the market posted its worst weekly loss for the year and the S&P fell for six straight sessions.

With the corporate earnings season drawing to an end and recent U.S. economic data raising doubts about the pace of growth, the S&P 500 (SNP: ^GSPC - news) , which is down 7.3 percent so far in May, could decline further next week as concerns about the financial health of Europe (Chicago Options: ^REURUSD - news) persist.

"What has changed in the world since April? We went from hearing a constant refrain that the world is awash in money and markets must go higher to hearing nobody wants to take any risk. ... All in a week," said Peter Cecchini, global head of institutional equity derivatives at Cantor Fitzgerald & Co in New York.

The S&P 500 fell 4.3 percent for the week, its steepest weekly decline this year, and closed below 1,300 for the first time in four months.

The hotly awaited market debut of Facebook on Friday was marred by technology glitches on the Nasdaq (Nasdaq: ^NDX - news) in sending messages back to the brokerages that handled orders of Facebook Inc for individual, or "retail," investors. Those problems rekindled fears about the market's electronic trading system and caused some investors to stay away from equities.

Weighing on sentiment is a growing sense among investors that the euro zone debt crisis is nearing new heights, fueled by fears of the potential for a Greek euro exit and the deteriorating health of the Spanish banking system

Solid corporate earnings and upbeat U.S. economic indicators had fueled the rally in U.S. stocks, offsetting jitters over Europe. But with earnings almost out of the way and data starting to disappoint, investors have shifted their focus back to headlines out of Europe.

Leaders of the Group of 8 major industrial economies meet this weekend to try to tackle the financial crisis in Europe. U.S. President Barack Obama, the G8 host, has urged European leaders repeatedly to do more to stimulate growth, fearing contagion from the euro crisis that could hurt the U.S. economy and his chances of re-election in November (Stuttgart: A0Z24E - news) .

"The market is extremely oversold. Nonetheless, all major indicators remain on sell signals," said Larry McMillan, president of options research firm McMillan Analysis Corp, in a report on Friday.

"We expect a powerful but short-lived rally should be coming soon. But at this point, barring some major shifts in our indicators, it may only be a rally in a larger down-trending market," McMillian said.

THE FACEBOOK EFFECT

Facebook, the No. 1 online social network, disappointed investors with a tepid market debut on Friday. Shares rose a scant 0.6 percent - nowhere near expectations for double-digit gains on the first trading day - and the day was marred by technical problems due to huge order volume. The stock closed at $38.23 after falling as low as $38, its initial offer price.

The disappointing debut curbed investors' appetite for other social media stocks. Hardest hit was Zynga Inc, which closed down 13.4 percent to $7.16 after falling as low as $6.40. The stock was temporarily halted twice due to sudden declines.

LinkedIn shares fell 5.7 percent to $99.02, and Groupon fell 6.7 percent to $11.58. Zynga and Groupon, both of which went public late last year, are also trading below their IPO prices.

Despite the disappointing market debut and the weak performance of social media stocks, market participants are still optimistic about Facebook going forward.

"In any brand new area, social media in this case, most are going to be losers and only some are going to be winners. Yes, the IPO was disappointing, but Facebook is clearly the winner here and others aren't," said Randy Warren, chief investment strategist at Warren Financial Service.

Next (Xetra: 779551 - news) week's economic data includes April's existing home sales on Tuesday at 10 a.m. Existing home sales are forecast at a 4.60 million-unit annual, up from 4.48 million in March.

New homes sales figures are due on Wednesday at 10 a.m. April's new home sales are also expected to post an increase, gaining about 7,000 units over a 328,000-unit annual rate in March.

Initial jobless claims and durable goods orders will be published on Thursday at 8:30 a.m. Consumer sentiment is due at 9:55 a.m. on Friday.

For the week, the Dow (NYSE: DPD - news) is off 3.5 percent and the Nasdaq is down 5.3 percent. (Additional reporting by Doris Frankel in Chicago; Editing by Leslie Adler)

..

NEW YORK (Frankfurt: A0DKRK - news) , May 18 (Reuters) - Normally a big decline would set up Wall Street for a technical rebound. But that may not be the case next week, even after the market posted its worst weekly loss for the year and the S&P fell for six straight sessions.

With the corporate earnings season drawing to an end and recent U.S. economic data raising doubts about the pace of growth, the S&P 500 (SNP: ^GSPC - news) , which is down 7.3 percent so far in May, could decline further next week as concerns about the financial health of Europe (Chicago Options: ^REURUSD - news) persist.

"What has changed in the world since April? We went from hearing a constant refrain that the world is awash in money and markets must go higher to hearing nobody wants to take any risk. ... All in a week," said Peter Cecchini, global head of institutional equity derivatives at Cantor Fitzgerald & Co in New York.

The S&P 500 fell 4.3 percent for the week, its steepest weekly decline this year, and closed below 1,300 for the first time in four months.

The hotly awaited market debut of Facebook on Friday was marred by technology glitches on the Nasdaq (Nasdaq: ^NDX - news) in sending messages back to the brokerages that handled orders of Facebook Inc for individual, or "retail," investors. Those problems rekindled fears about the market's electronic trading system and caused some investors to stay away from equities.

Weighing on sentiment is a growing sense among investors that the euro zone debt crisis is nearing new heights, fueled by fears of the potential for a Greek euro exit and the deteriorating health of the Spanish banking system

Solid corporate earnings and upbeat U.S. economic indicators had fueled the rally in U.S. stocks, offsetting jitters over Europe. But with earnings almost out of the way and data starting to disappoint, investors have shifted their focus back to headlines out of Europe.

Leaders of the Group of 8 major industrial economies meet this weekend to try to tackle the financial crisis in Europe. U.S. President Barack Obama, the G8 host, has urged European leaders repeatedly to do more to stimulate growth, fearing contagion from the euro crisis that could hurt the U.S. economy and his chances of re-election in November (Stuttgart: A0Z24E - news) .

"The market is extremely oversold. Nonetheless, all major indicators remain on sell signals," said Larry McMillan, president of options research firm McMillan Analysis Corp, in a report on Friday.

"We expect a powerful but short-lived rally should be coming soon. But at this point, barring some major shifts in our indicators, it may only be a rally in a larger down-trending market," McMillian said.

THE FACEBOOK EFFECT

Facebook, the No. 1 online social network, disappointed investors with a tepid market debut on Friday. Shares rose a scant 0.6 percent - nowhere near expectations for double-digit gains on the first trading day - and the day was marred by technical problems due to huge order volume. The stock closed at $38.23 after falling as low as $38, its initial offer price.

The disappointing debut curbed investors' appetite for other social media stocks. Hardest hit was Zynga Inc, which closed down 13.4 percent to $7.16 after falling as low as $6.40. The stock was temporarily halted twice due to sudden declines.

LinkedIn shares fell 5.7 percent to $99.02, and Groupon fell 6.7 percent to $11.58. Zynga and Groupon, both of which went public late last year, are also trading below their IPO prices.

Despite the disappointing market debut and the weak performance of social media stocks, market participants are still optimistic about Facebook going forward.

"In any brand new area, social media in this case, most are going to be losers and only some are going to be winners. Yes, the IPO was disappointing, but Facebook is clearly the winner here and others aren't," said Randy Warren, chief investment strategist at Warren Financial Service.

Next (Xetra: 779551 - news) week's economic data includes April's existing home sales on Tuesday at 10 a.m. Existing home sales are forecast at a 4.60 million-unit annual, up from 4.48 million in March.

New homes sales figures are due on Wednesday at 10 a.m. April's new home sales are also expected to post an increase, gaining about 7,000 units over a 328,000-unit annual rate in March.

Initial jobless claims and durable goods orders will be published on Thursday at 8:30 a.m. Consumer sentiment is due at 9:55 a.m. on Friday.

For the week, the Dow (NYSE: DPD - news) is off 3.5 percent and the Nasdaq is down 5.3 percent. (Additional reporting by Doris Frankel in Chicago; Editing by Leslie Adler)

..

hwsteele

Experienced member

- Messages

- 1,227

- Likes

- 182

I think I will go with 1327 for this Friday.

The market couldn't possibly go down any more!:cheesy:

Weeeeeeeell maybe a little more. I guess it could go to 0 but that is unlikely.

Any way, that's my guess for this week.

Congrats to the winners!

The market couldn't possibly go down any more!:cheesy:

Weeeeeeeell maybe a little more. I guess it could go to 0 but that is unlikely.

Any way, that's my guess for this week.

Congrats to the winners!

robster970

Guest Author

- Messages

- 4,567

- Likes

- 1,390

1335 for me this week.

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

1271

Similar threads

- Replies

- 1K

- Views

- 158K

- Replies

- 1K

- Views

- 184K

- Replies

- 908

- Views

- 133K

- Replies

- 989

- Views

- 133K