Mike Kshemaraja

Established member

- Messages

- 852

- Likes

- 63

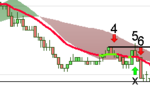

Here is the one and only trade I took Friday after the Non-Farm payrolls numbers were released. The chart is a 70 tick chart along with the 20 ema. Also the chart shows the 20 and 50 sma set up to show crossing information which I tend to ignore except to clarify a long sustained trend.

The block break (BB) trade, entered just below the red line at 7 in the chart, was scratched for a loss at 10. On review the trade mostly looked fine. It looked like a topping pattern had formed, 3-4 and a downward trend was in (3-6) and price action hit the 20 ema twice shortly before 7. On the other hand the ellipse at 1 shows some previous highs that, due to several hours of sideways trading, may have formed some support. Also I should have moved the stop down to the highs of 9, which would have lessend the loss. The 10 pip target was missed by about 2 pips.

The question I have is should the trade have been skipped for any reason? Also were the BB at 5 and the double doji (DD) 6 better trades?

Thanks,

Chart

I think it was a valid trade and yes the Sl should had been moved just above 9 (reversal bar at the end of the 8 pips run and 2 higher bottom formed), also seems that it reversed just at the ellipse (1).

Yes, the trade at 4 and 5 is also valid (double top at (3),big drop after that, (bears in control) lower top at (4) and (5), but support at the swing low before (4), which it bounced from to form a possible DD at 6, which I would not be taken (personally) because the way it retraced forming a higher bottom..

Hey, but is all easy in hindsight.

I like they way you detailed the market, it will help you to be engaged in it without a trade.(essential)

Keep in my mind that you need to monitor yourself, what are your emotions, are you getting anxious? impatient? revenge? They need not to be there. How are we going to get reed of them? Just be aware of them and they will dissolve, it may feel uncomfortable at the beginning but after a while they will lose their power because they are not real, but exist only in our little head.

As in meditation to get reed of all the cluttered thoughts we just monitor them.

If you do that (monitoring yourself) it will be easier to get into the flow, so you became the market and viceversa.

Last edited: