You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Potential setups

- Thread starter trader_dante

- Start date

- Watchers 274

- Status

- Not open for further replies.

grimweasel

Well-known member

- Messages

- 488

- Likes

- 108

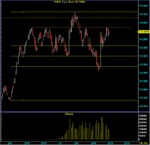

Dow Mar Futures- Wkly pin on retracement - me thinks the down move will continue - after all, from a funnymentals side - who'd want shares at the moment with limited growth and dividends being cut?

There is some light though. Check ot JD Wetherspoons, BioTech Inv Trust and Goldshield Grp to name a few - all strong risers thru this bear market, indicating that there is money to be made other than selling the rallies!!

Have a good week y'all!

Grim

There is some light though. Check ot JD Wetherspoons, BioTech Inv Trust and Goldshield Grp to name a few - all strong risers thru this bear market, indicating that there is money to be made other than selling the rallies!!

Have a good week y'all!

Grim

Breakout maybe?

if u noticed its a 4H inverted H&S. im waiting for a pullback to go long

rags2riches

Well-known member

- Messages

- 399

- Likes

- 135

from J16

from j16 thread

I don't understand the term "pin". Please be so kind as to excuse my ignorance and give me the description of a pin? Thank You

from j16 thread

Attachments

artful_dodger

Active member

- Messages

- 217

- Likes

- 5

Morning everyone.

AUD/USD hitting an important level at 7000. Looking for a failed retest although I feel that the currency goes hand in hand with gold?

Richard

AUD/USD hitting an important level at 7000. Looking for a failed retest although I feel that the currency goes hand in hand with gold?

Richard

Bloodhound

Senior member

- Messages

- 3,467

- Likes

- 1,320

rawrschach

Experienced member

- Messages

- 1,223

- Likes

- 277

That's not the best DBHLC to trade imo, the one at the top of the swing high is much better - price had more space to move.

The reason is that the one you have marked is going straight into support, evident from the bar lows to the left. It seems to be forming a descending triangle, personally I'd wait for a breakout and a pullback before getting in.

The reason is that the one you have marked is going straight into support, evident from the bar lows to the left. It seems to be forming a descending triangle, personally I'd wait for a breakout and a pullback before getting in.

trader_dante

Veteren member

- Messages

- 4,535

- Likes

- 1,704

That's not the best DBHLC to trade imo, the one at the top of the swing high is much better - price had more space to move.

The reason is that the one you have marked is going straight into support, evident from the bar lows to the left. It seems to be forming a descending triangle, personally I'd wait for a breakout and a pullback before getting in.

What he said...

ES June 08

A few things going on here:

(1) A pullback and rotation around the mean

(2) H4 pin, with the tail piercing that mean.

(3) The next H4 candle will open offside of the short-term support line.

(4) A break of the pin will also signify a movement away from value

A few things going on here:

(1) A pullback and rotation around the mean

(2) H4 pin, with the tail piercing that mean.

(3) The next H4 candle will open offside of the short-term support line.

(4) A break of the pin will also signify a movement away from value

Attachments

artful_dodger

Active member

- Messages

- 217

- Likes

- 5

What is ES?

thanx

thank you for that advise.

although it worked out for some pips, it wasnt an A+ trade.

Another querry could have one entered on the DBHLC 1 or 2.

On the descending triangle will you use the 4hr TF to confirm the test of the breakout or you move to a lower TF like the 1 hr.

as i am writing there could be a PB forming on the 1 hr TF on the EURGBP, and i dont know how i could play it if it is a PB at the close of the hour.

Thank you.

What he said...

thank you for that advise.

although it worked out for some pips, it wasnt an A+ trade.

Another querry could have one entered on the DBHLC 1 or 2.

On the descending triangle will you use the 4hr TF to confirm the test of the breakout or you move to a lower TF like the 1 hr.

as i am writing there could be a PB forming on the 1 hr TF on the EURGBP, and i dont know how i could play it if it is a PB at the close of the hour.

Thank you.

Attachments

trader_dante

Veteren member

- Messages

- 4,535

- Likes

- 1,704

can the last 8 hr candle qualify to be a PB bar.

If so is it tradeable.

Thank you.

This thread would probably be better for you to visit: http://www.trade2win.com/boards/first-steps/56178-spanish-disguise.html

supremegizmo

Active member

- Messages

- 219

- Likes

- 86

eur/usd setup

hello traders ,

let me introduce myself as a student of gr8 dante-trader . i am currently sitting just opposite to him cracking a lot of forex trades. so i thought to register and post some of the trades i done today ..😎

eur/usd

entry criteria - triple top rejection at 1.3735 along with shooting star kinda candle .

overnight low- 1.3620

o/n high - 1.3683

over night consolidation taken out london session euro goes and test 1.3735 and after rejection cracks down to 1.3623

entry criteria - pull a fib from swing high 1.3735 to low 1.3620 . our objective is to establish short on 1.3670-75 area .

1.3670-75 area ona 5 min chart has a neckline of broken H&S pattern which on break wasnt tested. Also 1.3670-75 is just 5-6 pips shy of 50% of H-L london open

2 lots short in with first lot covered at 1.3635 and next one at 1.3558 .

also noticable criteria supporting such trade .

DX was in recovery phase making H-H and H-low formation at bottom of 1 hr range.

swissy making a tripple bottom and last bottom significant with a hammer on 1hr .

Also short term correction was expected because euro was approaching 55 ema on weekly chart, swissy finding support on 55 weekly ema, usd/jpy finding support at 20 ma weekly..

cheers market players

hello traders ,

let me introduce myself as a student of gr8 dante-trader . i am currently sitting just opposite to him cracking a lot of forex trades. so i thought to register and post some of the trades i done today ..😎

eur/usd

entry criteria - triple top rejection at 1.3735 along with shooting star kinda candle .

overnight low- 1.3620

o/n high - 1.3683

over night consolidation taken out london session euro goes and test 1.3735 and after rejection cracks down to 1.3623

entry criteria - pull a fib from swing high 1.3735 to low 1.3620 . our objective is to establish short on 1.3670-75 area .

1.3670-75 area ona 5 min chart has a neckline of broken H&S pattern which on break wasnt tested. Also 1.3670-75 is just 5-6 pips shy of 50% of H-L london open

2 lots short in with first lot covered at 1.3635 and next one at 1.3558 .

also noticable criteria supporting such trade .

DX was in recovery phase making H-H and H-low formation at bottom of 1 hr range.

swissy making a tripple bottom and last bottom significant with a hammer on 1hr .

Also short term correction was expected because euro was approaching 55 ema on weekly chart, swissy finding support on 55 weekly ema, usd/jpy finding support at 20 ma weekly..

cheers market players

Attachments

Last edited:

supremegizmo

Active member

- Messages

- 219

- Likes

- 86

traders who have missed out this opportunity can get in on retracement on 1 hr chart.. 1.3610-20 looks like a good opportunity ... previous london lunch - us open downside breakout ( support turn resistance) and 50% fib .. watch for smaller time frames for clues stop aggressive above 1.3670 ..

conservative traders cant put a stop above 61.8% fib which stands at 1.3640-55 area where you should be having 1hr 20 ma as support turn ressistant aswell .. best of luck

me going home now , done for the day. also i can see dante's left his desk after his mocha hahhaa

conservative traders cant put a stop above 61.8% fib which stands at 1.3640-55 area where you should be having 1hr 20 ma as support turn ressistant aswell .. best of luck

me going home now , done for the day. also i can see dante's left his desk after his mocha hahhaa

- Status

- Not open for further replies.

Similar threads

- Replies

- 2

- Views

- 8K