Well, first of all, here's the web site:

https://www.interactivebrokers.com/en/main.php

Consider that IB has a lot of customers, and this has many advantages (better programs, better fees, more security they'll stay around, if you have a problem everyone will be having it so you don't need to call up and say there's a problem...). If you go to elitetrader.com practically the whole forum has an account with IB, so you can ask them, if the IB forum is not helping you out. Another advantage is low costs and high quality of everything. Another one is their API: it gives you capability of entirely automating your strategies, which is the most important thing for your future developments (so you don't have to stay in front of the screen all day long, which I do anyway, out of boredom). Oh, and a great advantage is the paper trading platform, which is exactly the same TWS platform, except that you are paper trading: awesome and very useful.

On the ZN I have one contract (I can only afford one with overnight margin). The information about margin is all here:

https://www.interactivebrokers.com/en/p.php?f=margin

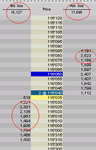

My stoploss is now only 5 ticks away from my entry. Each tick is about 15 dollars, so 75 dollars is what this lottery ticket is costing me (if I don't win: if I win, it gets refunded).

Regarding IB and futures, this is how they work. You need a margin to open your "bet" (bet on the future price, i guess). Margin required gets cut by half at different times for different futures, but it generally is close to New York open and close (15.30 CET and 22.00 CET). For most CME futures, the good ones with volume, overnight margin ranges from 2000 to 5000 (intraday margin is half).

Each tick you make gives you about 5 to 12.5 dollars on average, to give you a rough idea. And it's also good for me to sum it up, to give myself an overview.

Each futures trade costs you about 2 to 5 dollars in commissions, depending on how big the contract is. For OIL (CL) it's 5 dollars. Multiply by two if you want to close your position.

The best contract by the way is by far OIL, in the sense that if you are doing things correctly, you can make 2000 dollars (10 dollars per tick, and average daily ranges of 100s of ticks) in one day with just an intraday margin of 3000 dollars.

So, if you are doing things right, you wouldn't be missing binary options, because you can make 100% a day here as well.

Of course that also explains why my biggest losses were on OIL, since I did not do things right. The last one was 3000 dollars a week ago.

And of course, there's no volatility or time decay... you just have to pick the right direction and not worry about anything else. If price doesn't move for one month, you don't lose everything like it could happen with options.

One problem for many starting traders could be the high minimum required deposit (to open the account) which used to be 5000 dollars but now is 10 thousand dollars.

That really sucks. Because if you're a beginner and a reckless beginner like me you open your account and you lose that 10k immediately. On the other hand, if you trade futures, you will only have yourself to blame, not the commissions, not the spread, not the execution speed, not the software, not the connection. And that's why it's so good.

But even the 10k deposit is not a dangerous thing if you are not reckless, because you could paper trade, and even paper trade your automated systems, until you're positive that you are profitable. Of course, if you're a compulsive gambler (like I've been), there's no safety with this broker or any other broker. But with this broker you will definitely find out that you're a compulsive gambler, whereas with another broker you may never know if you're losing because you're doing something wrong or because you're getting screwed by the broker or spreadbetting company.

I mean, in 1997 i started by trading options that had a spread of 30%. That meant that I bought something at 60and I could only sell it back at 40. So that option would have to rise by about 30% just to cover spread costs. Now my spread is 1 tick on the EUR, which means 0.0001/1.5 = 0.01%, if I am not wrong, because it seems too little. Of course the EUR won't double in value, so maybe it's not a good comparison.

Well, let's say that if I was right that option would go from 40 to 100 in a week. I'd have lost 20 points to spread, 20/60=0.33, so 33% of my gain. Today the equivalent would be to make 4000 dollars on the EUR in one week, and the 12.5 dollars one-tick spread on the EUR is only 12.5/4000=0.003, that is 0.3% of my profit being eroded. So back then I lost 100% times as much to spread costs. This in time has improved constantly, spread by changing instruments and commissions have improved by changing brokers.... other things improved simply because of technology.

I sent my orders via fax to the broker, hoping he wouldn't be on a coffee break.. now my order gets executed in less than a second. The software to see charts and prices was telekurs if I recall correctly, and it cost my bank more than 10k per year, now that information and much more is practically free on TWS and even free on the internet. Many things improved because of technology but other things because I chose the right instruments and broker. Back in 2003 I was doing futures with an Italian broker and what now costs me 2 dollars in commissions, cost me 20 dollars back in 2003.

It is important to gradually solve all these problems: brokers, instruments, software, knowledge of the markets... until you're left with just having to deal with yourself. I kept improving everything and solving all those technical problems until I was left with just this question: do i want to make money or what? And I am still dealing with this question. I still don't know the answer.