You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

My trading: quantity versus quality, fishing net versus rifle

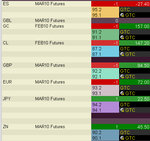

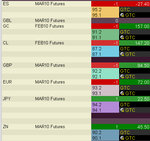

With all these positions open at once (see picture below), I feel like I am fishing with a net. Or like I am growing plants. You do your thing, and then come back later and find what you wanted: fish or tomatoes or something like that. I feel this type of trading is much better for me.

Much less stress than the sniper method, where you are required to be extremely focused not to miss and to time correctly your entry. This method opposes quantity to quality, and it's much better for me, because either because i am bad or because it's the way it is, it seems to me that trading is very approximate. If i expect prices to turn exactly where there's support or resistance, I will go crazy. Best to make small bets on a bunch of securities, come back a few hours later and see what happened. At least I know that with this method I am getting more trades right, I am making more money from each trade, and I have no stress at all. Actually the best guess on the future direction are immediate. I just look at the chart, and I guess the future direction within the first second or two.

The big changes I've made to my trading (if I'll use this approach) are:

1) timeframe: from 1 minute candles to 15 minute candles

2) quantity of securities traded: rather than focusing on 1 a lot, looking rapidly at 8 securities

3) larger stoploss/takeprofit: as I increase quantity and timeframe, I also increase the stoploss and takeprofit: less stress and more money

4) less stress and research: not necessary, as the 2 days 15 minute chart tells you everything (no need for drawing lines or looking at moving averages)

The problem for now is the same problem that I had with automated trading (which has the same exact approach, except that your assessments are automated), I have with this method: no money to buy a net. No money to invest on all 8 futures at once, and this allows me to only make small bets on the eur and gbp. Maybe just gbp. I'll see if I can increase my capital with those.

We'll see. So far total disaster, financial and emotional. The 1 minute candle up and down already drives me crazy to look at it. If you attach to each candle your financial balance, you're going to be quite upset after a few hours of it. 2 days charts with 15 minute candles. That's the way to go for me. One way or another I'll make this work. I certainly do not have the qualities required to trade 1 minute candles.

With all these positions open at once (see picture below), I feel like I am fishing with a net. Or like I am growing plants. You do your thing, and then come back later and find what you wanted: fish or tomatoes or something like that. I feel this type of trading is much better for me.

Much less stress than the sniper method, where you are required to be extremely focused not to miss and to time correctly your entry. This method opposes quantity to quality, and it's much better for me, because either because i am bad or because it's the way it is, it seems to me that trading is very approximate. If i expect prices to turn exactly where there's support or resistance, I will go crazy. Best to make small bets on a bunch of securities, come back a few hours later and see what happened. At least I know that with this method I am getting more trades right, I am making more money from each trade, and I have no stress at all. Actually the best guess on the future direction are immediate. I just look at the chart, and I guess the future direction within the first second or two.

The big changes I've made to my trading (if I'll use this approach) are:

1) timeframe: from 1 minute candles to 15 minute candles

2) quantity of securities traded: rather than focusing on 1 a lot, looking rapidly at 8 securities

3) larger stoploss/takeprofit: as I increase quantity and timeframe, I also increase the stoploss and takeprofit: less stress and more money

4) less stress and research: not necessary, as the 2 days 15 minute chart tells you everything (no need for drawing lines or looking at moving averages)

The problem for now is the same problem that I had with automated trading (which has the same exact approach, except that your assessments are automated), I have with this method: no money to buy a net. No money to invest on all 8 futures at once, and this allows me to only make small bets on the eur and gbp. Maybe just gbp. I'll see if I can increase my capital with those.

We'll see. So far total disaster, financial and emotional. The 1 minute candle up and down already drives me crazy to look at it. If you attach to each candle your financial balance, you're going to be quite upset after a few hours of it. 2 days charts with 15 minute candles. That's the way to go for me. One way or another I'll make this work. I certainly do not have the qualities required to trade 1 minute candles.

Last edited:

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Ok, that last trade on the CL ended with a 700 dollars loss, or more. Somehow, I don't remember how, today I lost 3000 on the CL in just a few hours. And for once it wasn't all my fault either. Oh, well. This is how the markets work, including manipulation, false breakouts and so on, so it was all my fault obviously. What I'm saying is that the first trade had nothing to do with overtrading or a trading addiction. The other two did.

I am done for the day. I brought my capital from a bit less than 6000 to a bit less than 3000. Never done worse in just one day: -50%

I haven't wired any money for months, but things might be different soon, since the minimum balance requirement is 2000.

I am done for the day. I brought my capital from a bit less than 6000 to a bit less than 3000. Never done worse in just one day: -50%

I haven't wired any money for months, but things might be different soon, since the minimum balance requirement is 2000.

Ok, that last trade on the CL ended with a 700 dollars loss, or more. Somehow, I don't remember how, today I lost 3000 on the CL in just a few hours. And for once it wasn't all my fault either. Oh, well. This is how the markets work, including manipulation, false breakouts and so on, so it was all my fault obviously. What I'm saying is that the first trade had nothing to do with overtrading or a trading addiction. The other two did.

I am done for the day. I brought my capital from a bit less than 6000 to a bit less than 3000. Never done worse in just one day: -50%

I haven't wired any money for months, but things might be different soon, since the minimum balance requirement is 2000.

Hey - really sorry to hear that. From your journal I can see big progress happening of late. Both emotionally and analytically. Its making more sense. I like the time frame shift to longer...

Somehow you need to convince your subconscious of this... or why else would you break your risk limits?

dog4

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

It's really hard but I am learning. I am constantly learning and I am not planning on giving up. From the outside it might look like I've been screwing around for months, but it's not the case. Even though my balance actually got worse. All progress will show at once. One day I'll be profitable and I won't go back to unprofitability. Maybe it's a problem of having such a small balance, and that is why I can't diversify enough. But I've got to be able to increase my account whether it's low or big to begin with. Besides, it's important that while I'm still learning (despite the fact that I've been doing it for 12 long years), I keep a small account in case I blow it out for one reason or the other. Also, I must pay for my mistakes. Being able to wire money as I wish is not a good thing either. I'll keep my balance as it is.

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

I don't have the capital to use that awesome strategy that has been working in demo trading. Yeah, it works because one way or another I've become capable of predicting the direction of price, in the long term. Certainly though I am not good yet with the lower timeframes. Certainly I will not become good unless I practice it just like you practice shooting with a rifle. Seiden's videos were a great way to start analyzing support and resistance. Now I've got to do some work on my own. Obsessive focusing on the GBP would do it, and this is also the only way I can bring my account back from 3000 to 9000, enough to trade my automated systems and enough to diversify as I was saying earlier (on the 2 days 15 minutes chart). "Poverty" might force me to focus obsessively on the GBP (I hope so) and this might be the only way to really understand support and resistance. I need to focus right now. I should also post a little bit less. I really don't deserve to speak so much after thinking so little. I've been writing too much and thinking too little lately. It's as if whatever good concept I write about gets out of my head, and just stays on the journal. Since I was concerned about being sincere, it's ok. But now I have written about everything pretty much, so I can start acting on my ideas and stop writing about them (since they are all here anyway).

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Right now the ideal for me would be if I could disable all symbols but the GBP, all timeframes, just keep the 4 hour chart with 1 minute candles. Best if I could do this just with the paper trading account. It's extremely boring but it's the only thing that can teach me really well how support and resistance work and how price moves. I'd need to be forced to stare at this GBP chart and paper trade it. It's not going to be easy to make myself do it. But now I see that this is clearly what I have to do. Yes, the automated systems are profitable, the diversified 2 days discretionary method would also work, but I don't have the money for either. It's one great opportunity to practice the 1 minute candles on just the GBP: will I do it? I think if I can just focus on that for 1 month, I might be able to learn to make money every day. Maybe not after 100 of these little trades (profit target of 10 ticks), but maybe after 1000. Practice helps. If it's possible, I can learn it through practice. Another thing would be automating this, but that's another problem. Lines and trendlines are complicated to automate.

To make money every week (which is what I want) you need either great diversification on big trades, that have a large drawdown, but low fixed costs, or great precision on small trades, that have a small drawdown, but huge fixed costs (spread and commissions). I can do the former but don't have the capital (nor the psychological requirements, because seeing a loss of 500 makes me lose control), and I cannot do the latter, but it the only one I could afford to do right now. Yes, I could also do two highly probable trades per week from my automated systems, but that would be unbearable for me, psychologically. That's how I got from 20k to 3k: I wanted action. I need some action. I can't just sit all day and make 2 trades per week.

Another thing I am wondering is: can you become profitable while leading a very unhealthy life like mine? I think it'd be best if I turned profitable while leading an unhealthy life, because otherwise my profitability might not last through hard times. I want to stay unhealthy and become profitable while being unhealthy. By unhealthy I mean that I didn't get out of my house for the past 2 weeks, and didn't even care to. I mean that people bother me, and that i turned down every invitation to do something. Basically it's called "being antisocial". It's not my problem, I don't see it as a problem. I am surrounded by dislikable people. I'd rather be alone than having to hang out with them.

To make money every week (which is what I want) you need either great diversification on big trades, that have a large drawdown, but low fixed costs, or great precision on small trades, that have a small drawdown, but huge fixed costs (spread and commissions). I can do the former but don't have the capital (nor the psychological requirements, because seeing a loss of 500 makes me lose control), and I cannot do the latter, but it the only one I could afford to do right now. Yes, I could also do two highly probable trades per week from my automated systems, but that would be unbearable for me, psychologically. That's how I got from 20k to 3k: I wanted action. I need some action. I can't just sit all day and make 2 trades per week.

Another thing I am wondering is: can you become profitable while leading a very unhealthy life like mine? I think it'd be best if I turned profitable while leading an unhealthy life, because otherwise my profitability might not last through hard times. I want to stay unhealthy and become profitable while being unhealthy. By unhealthy I mean that I didn't get out of my house for the past 2 weeks, and didn't even care to. I mean that people bother me, and that i turned down every invitation to do something. Basically it's called "being antisocial". It's not my problem, I don't see it as a problem. I am surrounded by dislikable people. I'd rather be alone than having to hang out with them.

Last edited:

Maybe it's a problem of having such a small balance, and that is why I can't diversify enough. But I've got to be able to increase my account whether it's low or big to begin with. Besides, it's important that while I'm still learning (despite the fact that I've been doing it for 12 long years), I keep a small account in case I blow it out for one reason or the other.

I totally agree.

To take your lessons on board, maybe you need a mantra? Sometimes if one promises to others (e.g. via a blog) it isn't the same as saying it to yourself and keeping it to yourself (at least i find that). E.g. a mantra: "I can always win tomorrow / don't risk all today / reinforce my method / keep learning / consistency allows scaling up etc etc)

dog4

Hi Travis,

guess I'm not the best person to give advice after my poor trading today, but I found one thing useful.

If I am not comfortable with a trade, I usually trade smallest possible amount.

It would be ideal not to trade in that case, but I guess need much more work on my discipline (and maybe trading addiction I'm not aware of).

guess I'm not the best person to give advice after my poor trading today, but I found one thing useful.

If I am not comfortable with a trade, I usually trade smallest possible amount.

It would be ideal not to trade in that case, but I guess need much more work on my discipline (and maybe trading addiction I'm not aware of).

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

You also have to consider that I am in a particular situation: I know enough about the markets to create profitable automated systems, but I don't know enough about myself to trade profitably. It's a nice sentence. What I mean is that I am not a typical "newbie", I am not a newbie at all, but I am still unprofitable when it comes to discretionary trading. Yet I don't have the capital to do automated trading, and when I did, I threw it away via my discretionary trading, which is what I said on this journal from post number 1 until now. The journal has helped me a lot and so have the readers. Thanks for following, and for your feedback (I don't like the concept of having a mantra). For one thing I have learned that I don't like to be told I am wrong neither by the readers nor by the market: that's why I've had so many problems until now, because I couldn't let go of my losing trades, and it will be one big step ahead if I'll learn to use the stoploss, always. In case like today (false breakout), I'll have to place it a bit lower, to avoid it going off along with everyone else's stoploss, and having my trade executed 40 ticks higher (it doesn't cost me anything to stay out of the market either).

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Hi Travis,

guess I'm not the best person to give advice after my poor trading today, but I found one thing useful.

If I am not comfortable with a trade, I usually trade smallest possible amount.

It would be ideal not to trade in that case, but I guess need much more work on my discipline (and maybe trading addiction I'm not aware of).

What a coincidence, I wrote that last sentence "it would not be bad to stay out of the market", and then i read your post, which was posted at the same minute as mine. Yeah, I agree.

As far as discipline, I don't know what it is. Maybe no one has a problem of discipline not even in life. Not discipline, but knowing the consequences. Does it take discipline to brush your teeth? No, it just takes knowing the consequences. So I think that once I know what works and what doesn't, I'll just do it. I've always been skeptical of the discipline talk, that abunds on trading forums.

I am unprofitable and I don't know how to be profitable, otherwise I'd do it. I don't think I am unprofitable because I lack in discipline.

The thing is this: I realize support and resistance exist and even work, at least on a 4 hour 1 minute candle level. Ignoring them means getting screwed. On the other hand, if I go any further than the 4 hour 1 minute candle chart, I'm going to have problems managing all the lines that could be drawn on a chart...

What I do: I use daily candles (tops and bottoms) to identify important levels surrounding the current price action, and sometimes then 3/4h and only very occassionally 1h candles as well if that seems relevant. Confluence is useful here (e.g. where a level is indicated by the daily candles and then you see the same level or a closeby level is also indicated by recent price action, then that strengthens that level's significance.)

Last edited:

Re: what trading suits me...

Mirrors my preferences for longer timeframes. The one trader I'm currently studying/learning from is a scalper and he uses 4 timeframes tother, namely 1 min, 5min, 15min and 1h. He also made a comment to the effect that the 15min is his "captain", which has to be followed. I'm not really keen on scalping (though I'm giving it a chance/investigating it at the minute.)

Anyway, longer time frames are IMHO preferable. Less stress, less bother, less work I think. 👍

Tell you what. The 1 minute candles chart is not for me.

I've been making lots of money in the past two days on the demo account on the 2 days chart, 15 minutes candles. Take profit of about 0.6% and stoploss of about 0.3%.

Mirrors my preferences for longer timeframes. The one trader I'm currently studying/learning from is a scalper and he uses 4 timeframes tother, namely 1 min, 5min, 15min and 1h. He also made a comment to the effect that the 15min is his "captain", which has to be followed. I'm not really keen on scalping (though I'm giving it a chance/investigating it at the minute.)

Anyway, longer time frames are IMHO preferable. Less stress, less bother, less work I think. 👍

I thought this was a very good post on Brett's blog today: http://traderfeed.blogspot.com/2009/02/learning-from-good-losing-trades.html

(I submit your fake-out losing trade was a good losing trade that you learnt from!)

(I submit your fake-out losing trade was a good losing trade that you learnt from!)

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

various ways to trade the same chart

Moving average crossover (plus other filters)

This is the first way I've used. It works with pivots and correlations and all that, but it produces just one trade per day, so I am leaving it aside because it's too boring and too stressful. I think it works because when I used it I got an 80% accuracy. All documented on this journal. Of course the picture below is simplified. The problem with this approach is that, unless you use it with a lot of other filters, it doesn't protect you from ranges, where you'll lose money. If you use it with other filters, it gets very complicated and it only gives you one or two trades per day:

Diagonal trendlines

I don't know much about this approach but the immediate problem I see is that this trendline works only at the end, and you know it was an uptrend only at the end. Also, the trendline can be drawn so neatly only at the end. You won't know during the move that price is touching the trendline or not. By the time you can draw a pretty neat trendline, price will have broken those lines.

Support and Resistance trading

This would seem like the messiest approach, and that is why I always discarded it, because I like simple things. On the other hand, it provides many more trading opportunities than the first one (if you do the first one right, avoiding false signals), provided that you've got a great speed of execution, straight from the chart (the 1 minute chart, for all images, even though I used the line for simplicity in the moving average example). It provides perfect timing, as long as you see the levels, which are not so easy to see, I never noticed them until recently. They are like little steps. You can divide every move in little steps, whether we're in a range or in a trend. I suspect that those who make money (because I don't) with this, do not trade the up move like in this example, but they divide it into 2 parts: the range part, from support to resistance, and the breakout part, from beyond resistance to the next resistance (if there is one, or else when price turns around). An advantage of this method seems to be that you don't lose money because of a range, and that you can lose very little when you're wrong. This method, unlike the others, totally relies on being able to identify support and resistance at every moment.

Another thing to remember is that these steps are about 10 ticks wide. I still have to see if I can make it work in a profitable way (which is what matters to me). Much of this depends on how well i can configure the chart trader function in TWS. Another thing is that if i don't spend at least 1 month on these charts trying this method there's no way i'll get it work, just like it took me one month to learn to fly and shoot airplanes down in the flight simulator. Except that trading the GBP does not feel like flying, not right now. But at least there's always someone to play with. If i could just figure out how this chart trader video game works...

Moving average crossover (plus other filters)

This is the first way I've used. It works with pivots and correlations and all that, but it produces just one trade per day, so I am leaving it aside because it's too boring and too stressful. I think it works because when I used it I got an 80% accuracy. All documented on this journal. Of course the picture below is simplified. The problem with this approach is that, unless you use it with a lot of other filters, it doesn't protect you from ranges, where you'll lose money. If you use it with other filters, it gets very complicated and it only gives you one or two trades per day:

Diagonal trendlines

I don't know much about this approach but the immediate problem I see is that this trendline works only at the end, and you know it was an uptrend only at the end. Also, the trendline can be drawn so neatly only at the end. You won't know during the move that price is touching the trendline or not. By the time you can draw a pretty neat trendline, price will have broken those lines.

Support and Resistance trading

This would seem like the messiest approach, and that is why I always discarded it, because I like simple things. On the other hand, it provides many more trading opportunities than the first one (if you do the first one right, avoiding false signals), provided that you've got a great speed of execution, straight from the chart (the 1 minute chart, for all images, even though I used the line for simplicity in the moving average example). It provides perfect timing, as long as you see the levels, which are not so easy to see, I never noticed them until recently. They are like little steps. You can divide every move in little steps, whether we're in a range or in a trend. I suspect that those who make money (because I don't) with this, do not trade the up move like in this example, but they divide it into 2 parts: the range part, from support to resistance, and the breakout part, from beyond resistance to the next resistance (if there is one, or else when price turns around). An advantage of this method seems to be that you don't lose money because of a range, and that you can lose very little when you're wrong. This method, unlike the others, totally relies on being able to identify support and resistance at every moment.

Another thing to remember is that these steps are about 10 ticks wide. I still have to see if I can make it work in a profitable way (which is what matters to me). Much of this depends on how well i can configure the chart trader function in TWS. Another thing is that if i don't spend at least 1 month on these charts trying this method there's no way i'll get it work, just like it took me one month to learn to fly and shoot airplanes down in the flight simulator. Except that trading the GBP does not feel like flying, not right now. But at least there's always someone to play with. If i could just figure out how this chart trader video game works...

Last edited:

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Ok, I think I've got it, talking about tws chart trader. You've got to reduce all the crap that appears on bottom. Then you've got to click on the chart each time, or else it won't execute your order.

Ok, it works perfectly. All I have to do, right from the chart itself, is press "B" or "S", and it automatically enters a MKT BUY or a MKT SELL and an attached bracket order for 10 ticks takeprofit and 5 ticks stoploss.

If this works, I'll be able to use it on any market. Now all I need is to practice this for a whole month. I am using of course the third approach, described above: the S/R approach.

Ok, it works perfectly. All I have to do, right from the chart itself, is press "B" or "S", and it automatically enters a MKT BUY or a MKT SELL and an attached bracket order for 10 ticks takeprofit and 5 ticks stoploss.

If this works, I'll be able to use it on any market. Now all I need is to practice this for a whole month. I am using of course the third approach, described above: the S/R approach.

Last edited:

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

best trades in a trend

http://en.wikipedia.org/wiki/Support_and_resistance

This is important and I think I understood correctly those videos if I say that the best part of the move according to seiden are those circled in red (for short trades) and blue (for long trades) in my drawing below:

In other words, he doesn't play the breakout part of the trade (i remember him saying something like that), or at least he doesn't consider it the highest probability trade.

With this method, if the trend turns into a range, you won't lose anything. And range happens so often. Yet of course the real charts don't look as regular as that picture. It looks like this (my takeprofit just went off):

For a range, both directions are good, but I suppose one should only make the trades in the most likely upcoming direction. So, if you're next to support or heavily oversold, you should only take the long trades.

No matter what systems you play, if you use S/R, the stoplosses will be very cheap, and the trades will have a good risk/reward ratio. So if you become (I am talking to myself) really good at identifying S/R levels, it might be good to play all of them and not just the ones in the first picture above. For example, now I have tried making a trade that is betting on the fact that trend will stop (I am experimenting, with the demo).

It's a great step ahead that I am using the demo account. I always found a reason not to use it, which means i was after the excitement of betting real money, rather than after making money.

http://en.wikipedia.org/wiki/Support_and_resistance

Support

A support level is a price level where the price tends to find support as it is going down. This means the price is more likely to "bounce" off this level rather than break through it. However, once the price has passed this level, by an amount exceeding some noise, it is likely to continue dropping until it finds another support level.

Resistance

A resistance level is the opposite of a support level. It is where the price tends to find resistance as it is going up. This means the price is more likely to "bounce" off this level rather than break through it. However, once the price has passed this level, by an amount exceeding some noise, it is likely that it will continue rising until it finds another resistance level.

This is important and I think I understood correctly those videos if I say that the best part of the move according to seiden are those circled in red (for short trades) and blue (for long trades) in my drawing below:

In other words, he doesn't play the breakout part of the trade (i remember him saying something like that), or at least he doesn't consider it the highest probability trade.

With this method, if the trend turns into a range, you won't lose anything. And range happens so often. Yet of course the real charts don't look as regular as that picture. It looks like this (my takeprofit just went off):

For a range, both directions are good, but I suppose one should only make the trades in the most likely upcoming direction. So, if you're next to support or heavily oversold, you should only take the long trades.

No matter what systems you play, if you use S/R, the stoplosses will be very cheap, and the trades will have a good risk/reward ratio. So if you become (I am talking to myself) really good at identifying S/R levels, it might be good to play all of them and not just the ones in the first picture above. For example, now I have tried making a trade that is betting on the fact that trend will stop (I am experimenting, with the demo).

It's a great step ahead that I am using the demo account. I always found a reason not to use it, which means i was after the excitement of betting real money, rather than after making money.

Last edited:

- Status

- Not open for further replies.

Similar threads

- Replies

- 113

- Views

- 24K

- Poll

- Replies

- 16

- Views

- 9K

- Replies

- 89

- Views

- 16K