GU

Sun's comment from approx 6 hrs ago

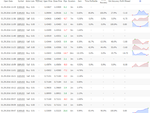

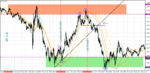

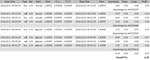

We needed under 4339 to b/o of BTTZ zone after a false try up - and she got that right

Trouble is - she never left a sell on - and the stop she needed was just 3 or 5 pips

Now down over 175 pips from there

Another Lesson learnt on the journey - all part of trading - the good and the bad times - but as long as you learn from it - then its all going to be worth it in the future

Hi Sun

Don't want to rub it in - because you have had a frustrating week

BUT

PLease - Please - Please learn from all these little mistakes

This is what you will be working for - to be able to leave part stake trades on - with stops even in profit and leave alone with no stress

We need you to be an accurate scalper and get the best entries possible - so even when you are wrong - you still might get out with plus 1 or 2 pips

We dont need you to take 20 or 40 scalps a session - yes whilst learning the skill - but then 5 to 15 a session is enough if they are good and end up with just a few with partials on - and there's your money making machine etc etc

Main things from this week

1. You need to improve your scalp entry timings to catch near interim tops and bottoms - its all possible - you dont need swing confirmations - get in asap when all lines up

2, Recognize BTTZ tease zones and dont trade them - wait for the b/o or next 30 or 60 mins

3. LiTs area - know them on every pair throughout the session

4. Levels to scalp sell and buy and jot them down so you are aware to use them

You could set up pending orders ( its know as "wrapping" a tight range ) but maybe better to enter on pullbacks a lot of the time - you need accuracy

5. The main session is over 12 hr long. ok you might only be available for 3 to 5 hrs - but spend it wisely working out bias and key levels to act on

6. Discipline a few time you have been up and then lose all your winnings - never let it happen whilst you are trying to bulid up your confidence. Ok you need to be at least 15 + pips up - but I know you knwo what I mean

7. Take control of your emotions etc and say you can do it - you did it on demo and know you know more

👍

New week - new month - you will change this month - because you are now ready to improve and we know all your silly mistakes etc and so focus on not let them keep happening etc

Have a nice weekend

Regards

F