You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Adamus

Experienced member

- Messages

- 1,898

- Likes

- 97

Yeah. I am still reading the article above. Yeah, too bad the thread on elitetrader.com got removed. Inflector is still a member and still writes... no, wait, got it!

Here's what he writes in 2006:

http://www.elitetrader.com/vb/showthread.php?s=&postid=1036275&highlight=turtle

Is this what was removed?

http://web.archive.org/web/20071013160554/http://elitetrader.com/vb/showthread.php?threadid=92696

Annoyingly I can't get any more than the first page of the thread.

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

how to convert xpo to ascii for tradestation 2000i

I just taught myself to export the goddamn .xpo file into ascii, without having to buy any expensive software such as this one:

First you create the symbol, then you import the xpo data, then open the symbol and load the data:

Then you print to file (it will go in the same directory as the xpo):

This stuff is stuff that drives you crazy when you are trying to use tradestation. The rest is all easy. This is the hardest part of back-testing systems.

It does take a few minutes to export the file, if it's a big one.

There's also this other way, which is better in that it gets rid of the data i don't need, but first I have to be able to load it onto Prosuite 2000i:

http://www.finanzaonline.com/forum/trading-line/835547-xpo-ascii.html

Nope. Wrong. My method did not work, so the only good method is finanzaonline's.

Here's what I got with my method:

And it is not ascii. Ascii looks like poetry compared to this crap.

So now I'll have to stay up until I solve this goddamn thing.

MOTHER ****ER!!!! ALL i had to do was restart it. It was a goddamn bug.

If you reboot pc and restart it all over again all you have to do is start global server, choose FILE - IMPORT DATA - GLOBALSERVER FORMAT (use exchange traded time when asked) maybe via the edit symbol first (import data into symbol) and then you just start the gbl.orw file and it works.

But this time I will save to txt once and for all. It is a ****ing nightmare and i don't want to experience it again.

I have done it finally. One day I will have a celebration and party and invite all the people who wrote posts that helped me on the internet, such as this precious post here:

http://www.finanzaonline.com/forum/trading-line/835547-xpo-ascii.html

Now I have the GBL data in ascii format instead of .xpo and all it took me was a few seconds. Thanks, nait, for your 12 thousand useful messages.

OK, done, no more problem with GBL.xpo.

Now I could go back to sleep but I want to tell you a little story, without telling you everything. Besides, I am just talking to myself here, most of the time.

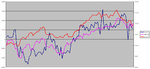

Anyway, the breakout system works and guess what? It works, with the same settings, on all futures: currencies, stock indexes, gold, oil, natural gas, bonds. It doesn't work THAT well, but it works well enough to be traded along with all my other systems (except on stock indexes). It doesn't trade THAT often, but it doesn't matter if you trade it with a bunch of systems. It doesn't have SUCH a regular equity curve, but it's ok, too, because if you put them all together they do have a straight equity curve. I think we're going to hit 70 systems soon. Yeah, cause it was at 63 right now, so we're adding 4 currencies, 2 bonds, gold, no wait: it fails on gold as well. Well, it succeeds, with the same code, on 8 out of 13 futures (on 3 it breaks even, on 2 it loses), so that is good enough for me. I still have not checked the out of samples, but will be good for sure in their majority.

I just taught myself to export the goddamn .xpo file into ascii, without having to buy any expensive software such as this one:

First you create the symbol, then you import the xpo data, then open the symbol and load the data:

Then you print to file (it will go in the same directory as the xpo):

This stuff is stuff that drives you crazy when you are trying to use tradestation. The rest is all easy. This is the hardest part of back-testing systems.

It does take a few minutes to export the file, if it's a big one.

There's also this other way, which is better in that it gets rid of the data i don't need, but first I have to be able to load it onto Prosuite 2000i:

http://www.finanzaonline.com/forum/trading-line/835547-xpo-ascii.html

Nope. Wrong. My method did not work, so the only good method is finanzaonline's.

Here's what I got with my method:

And it is not ascii. Ascii looks like poetry compared to this crap.

So now I'll have to stay up until I solve this goddamn thing.

MOTHER ****ER!!!! ALL i had to do was restart it. It was a goddamn bug.

If you reboot pc and restart it all over again all you have to do is start global server, choose FILE - IMPORT DATA - GLOBALSERVER FORMAT (use exchange traded time when asked) maybe via the edit symbol first (import data into symbol) and then you just start the gbl.orw file and it works.

But this time I will save to txt once and for all. It is a ****ing nightmare and i don't want to experience it again.

I have done it finally. One day I will have a celebration and party and invite all the people who wrote posts that helped me on the internet, such as this precious post here:

http://www.finanzaonline.com/forum/trading-line/835547-xpo-ascii.html

Now I have the GBL data in ascii format instead of .xpo and all it took me was a few seconds. Thanks, nait, for your 12 thousand useful messages.

OK, done, no more problem with GBL.xpo.

Now I could go back to sleep but I want to tell you a little story, without telling you everything. Besides, I am just talking to myself here, most of the time.

Anyway, the breakout system works and guess what? It works, with the same settings, on all futures: currencies, stock indexes, gold, oil, natural gas, bonds. It doesn't work THAT well, but it works well enough to be traded along with all my other systems (except on stock indexes). It doesn't trade THAT often, but it doesn't matter if you trade it with a bunch of systems. It doesn't have SUCH a regular equity curve, but it's ok, too, because if you put them all together they do have a straight equity curve. I think we're going to hit 70 systems soon. Yeah, cause it was at 63 right now, so we're adding 4 currencies, 2 bonds, gold, no wait: it fails on gold as well. Well, it succeeds, with the same code, on 8 out of 13 futures (on 3 it breaks even, on 2 it loses), so that is good enough for me. I still have not checked the out of samples, but will be good for sure in their majority.

Last edited:

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

homework for December 4 and 5

Resuming from here:

http://www.trade2win.com/boards/trading-journals/85510-my-journal-2-a-180.html#post1336218

Now I will have to select another system to backtest:

I have done this step now, so I know what is next, but maybe will work on it next weekend, because first I have to get done with the automation of the other 8 systems - presumably, if they don't fail the out-of-sample. The out-of-sample for me has gone from not using it at all to being sacred, it's like getting your grade for an exam. Suspense. By the way I have to watch a movie now, to relax a bit.

Resuming from here:

http://www.trade2win.com/boards/trading-journals/85510-my-journal-2-a-180.html#post1336218

Now I will have to select another system to backtest:

Las reglas originales del sistema de las tortugas (Inglés)

Done

Sistema 1,2,3 (Inglés)

This is next

Ruptura de canales de Donchian (Castellano)

Done, because it's the same as the turtles/tortugas.

Sistema 3 barras + stochastic (Castellano)

Sistema SVBreak -Ruptura de rangos de volatilidad (Castellano)

Estrategia Bandas de Bollinger (Inglés)

Discarded, because I can't automate it on excel.

Dinamic Break Out Strategy (Inglés)

Método Lowry de Medias móviles (Castellano)

I have done this step now, so I know what is next, but maybe will work on it next weekend, because first I have to get done with the automation of the other 8 systems - presumably, if they don't fail the out-of-sample. The out-of-sample for me has gone from not using it at all to being sacred, it's like getting your grade for an exam. Suspense. By the way I have to watch a movie now, to relax a bit.

Last edited:

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

the problem/limit of my automation on excel and of my brain

I need to think of how I will deal with a serious problem of my automation on excel.

For example, this member writes about the Andrews Pitchfork and how it is a profitable thing to use:

http://www.trade2win.com/boards/trading-journals/95392-goldmine.html

Great video about it by this guy: http://www.forexoma.com/about/

So, here I am, wondering how well it works. But there's a problem. Two problems:

1) Those 3 goddamn lines are not easy to draw on tradestation. I mean - they're easy to draw manually, but not with code.

2) Those 3 goddamn lines are even harder to automate on excel.

The same applies to the Bollinger method, suggested by Urraca (see post above).

This is all beyond my reach due to my choice of excel. And due to my choice of my brain and training. I should not have studied ****ing political science but physics, computer science, math. Better to be a retarded science student than a proficient student of political science, which is a waste of time.

Now because of these limits of mine (of course I chose excel for the same reason: I am not smart/knowledgeable enough to do anything better) I am unable to try half of the things I should be trying. Either the strategy is simple or I can't do it on tradestation, let alone excel.

All the strategies that draw lines on the chart are not for me.

I need to think of how I will deal with a serious problem of my automation on excel.

For example, this member writes about the Andrews Pitchfork and how it is a profitable thing to use:

http://www.trade2win.com/boards/trading-journals/95392-goldmine.html

Great video about it by this guy: http://www.forexoma.com/about/

So, here I am, wondering how well it works. But there's a problem. Two problems:

1) Those 3 goddamn lines are not easy to draw on tradestation. I mean - they're easy to draw manually, but not with code.

2) Those 3 goddamn lines are even harder to automate on excel.

The same applies to the Bollinger method, suggested by Urraca (see post above).

This is all beyond my reach due to my choice of excel. And due to my choice of my brain and training. I should not have studied ****ing political science but physics, computer science, math. Better to be a retarded science student than a proficient student of political science, which is a waste of time.

Now because of these limits of mine (of course I chose excel for the same reason: I am not smart/knowledgeable enough to do anything better) I am unable to try half of the things I should be trying. Either the strategy is simple or I can't do it on tradestation, let alone excel.

All the strategies that draw lines on the chart are not for me.

...They're writing songs of love,

But not for me.

A lucky star's above,

But not for me.

With Love to Lead the Way,

I've found more skies of Gray

Than any Russian play

Could Guarantee...

Last edited:

Re: the problem/limit of my automation on excel and of my brain

It sounds easy but automated line drawing is not easy. Some things that make it tricky include:

- do you use a log Y scale?

- where does the line start exactly?

- what if there is a brief dip through the line. Is it still valid?

- which of the [5] lines you draw do you trust to use?

Etc.

Having said all of that, I find support & resistance lines very useful in many markets. But automating that could be a PhD topic 😱

I need to think of how I will deal with a serious problem of my automation on excel.

For example, this member writes about the Andrews Pitchfork and how it is a profitable thing to use:

http://www.trade2win.com/boards/trading-journals/95392-goldmine.html

Great video about it by this guy: http://www.forexoma.com/about/

So, here I am, wondering how well it works. But there's a problem. Two problems:

1) Those 3 goddamn lines are not easy to draw on tradestation. I mean - they're easy to draw manually, but not with code.

2) Those 3 goddamn lines are even harder to automate on excel.

The same applies to the Bollinger method, suggested by Urraca (see post above).

This is all beyond my reach due to my choice of excel. And due to my choice of my brain and training. I should not have studied ****ing political science but physics, computer science, math. Better to be a retarded science student than a proficient student of political science, which is a waste of time.

Now because of these limits of mine (of course I chose excel for the same reason: I am limited in my programming abilities) I am unable to try half of the things I should be trying. Either the strategy is simple or I can't do it on tradestation, let alone excel.

All the strategies that draw lines on the chart are not for me.

It sounds easy but automated line drawing is not easy. Some things that make it tricky include:

- do you use a log Y scale?

- where does the line start exactly?

- what if there is a brief dip through the line. Is it still valid?

- which of the [5] lines you draw do you trust to use?

Etc.

Having said all of that, I find support & resistance lines very useful in many markets. But automating that could be a PhD topic 😱

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Good point. I could sense it was hard, but now you have shown in detail how hard it is. After all, my limits could be a blessing. The smarter guy will go for the automation of those "tricky" lines and he will work on it for years before he achieves anything (he probably will quit altogether). Me, on the other hand, or I, on the other hand, will create 60 simple systems in the meanwhile, without even trying to do what he's doing. That is why I know some engineers who've been working on a trading system for several years and haven't placed a live trade yet.

A solution would be to open an account with tradestation securities and that way, if I can do it on tradestation, it will also be traded (and it will be traded the same way it was back-tested). This sounds very good and if it were free to use tradestation, I would do it.

But it is not, and I don't like to be prisoner of tradestation securities. If one day IB dies, I can move strategies elsewhere, with my excel workbook. If I do everything on tradestation and rely on them as brokers - because they force you to do that - they will have me by the balls for life. Not good. That's why I keep thinking about doing it, and I keep discarding it after thinking about it for a couple of minutes.

On the other hand, also excel is a software so I am relying on one software rather than another, but the big difference is that once you have excel 2003 you can keep it for life - even if you stay offline, and you can use it with any broker. Instead if you have to rely on tradestation securities being ONLINE, to execute your tradestation orders, that is a different thing. I mean: I am using excel but I don't have to use microsoft as a broker. Whereas if I rely on tradestation to EXECUTE my strategies, then I do have to rely on tradestation securities as a broker and they can charge me any fee they want. They could suck as a broker and I'd still have to keep them.

Yeah. So I think about it for 2 minutes, and then I say "screw that".

So, guess what, everyone. I will go for a walk. I am officially leaving the house for an hour. Wish me luck. I am going to have lunch at the restaurant on the other side of the block.

A solution would be to open an account with tradestation securities and that way, if I can do it on tradestation, it will also be traded (and it will be traded the same way it was back-tested). This sounds very good and if it were free to use tradestation, I would do it.

But it is not, and I don't like to be prisoner of tradestation securities. If one day IB dies, I can move strategies elsewhere, with my excel workbook. If I do everything on tradestation and rely on them as brokers - because they force you to do that - they will have me by the balls for life. Not good. That's why I keep thinking about doing it, and I keep discarding it after thinking about it for a couple of minutes.

On the other hand, also excel is a software so I am relying on one software rather than another, but the big difference is that once you have excel 2003 you can keep it for life - even if you stay offline, and you can use it with any broker. Instead if you have to rely on tradestation securities being ONLINE, to execute your tradestation orders, that is a different thing. I mean: I am using excel but I don't have to use microsoft as a broker. Whereas if I rely on tradestation to EXECUTE my strategies, then I do have to rely on tradestation securities as a broker and they can charge me any fee they want. They could suck as a broker and I'd still have to keep them.

Yeah. So I think about it for 2 minutes, and then I say "screw that".

So, guess what, everyone. I will go for a walk. I am officially leaving the house for an hour. Wish me luck. I am going to have lunch at the restaurant on the other side of the block.

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

back

I made it. It took me about an hour as expected. It was raining. I was the only customer sitting outside. Then I talked to the waiter and to the owner of the restaurant. She offered me a cigarette. Actually I asked her to lend me a cigarette.

"Let us be lovers, we'll marry our fortunes together

I've got some real estate here in my bag"

So we bought a pack of cigarettes and Mrs. Wagner pies

And walked off to look for America

"Kathy," I said as we boarded a Greyhound in Pittsburgh

"Michigan seems like a dream to me now"

It took me four days to hitchhike from Saginaw

I've come to look for America

Laughing on the bus

Playing games with the faces

She said the man in the gabardine suit was a spy

I said "Be careful, his bowtie is really a camera"

"Toss me a cigarette, I think there's one in my raincoat"

"We smoked the last one an hour ago"

So I looked at the scenery, she read her magazine

And the moon rose over an open field

"Kathy, I'm lost," I said, though I knew she was sleeping

"I'm empty and aching and I don't know why"

Counting the cars on the New Jersey Turnpike

They've all come to look for America

All come to look for America

All come to look for America

http://en.wikipedia.org/wiki/America_(Paul_Simon_song)

http://en.wikipedia.org/wiki/Kathy_Chitty

http://www.amazon.com/Paul-Simon-Songbook/dp/B0001LYGVC

http://en.wikipedia.org/wiki/The_Paul_Simon_Songbook

http://en.wikipedia.org/wiki/The_Sounds_of_Silence_(song)

http://www.amazon.com/Wednesday-Morning-3-Am-Exp/dp/B00005NKKW

http://en.wikipedia.org/wiki/The_Sounds_of_Silence_(song)

I made it. It took me about an hour as expected. It was raining. I was the only customer sitting outside. Then I talked to the waiter and to the owner of the restaurant. She offered me a cigarette. Actually I asked her to lend me a cigarette.

"Toss me a cigarette, I think there's one in my raincoat"

"We smoked the last one an hour ago"

"Let us be lovers, we'll marry our fortunes together

I've got some real estate here in my bag"

So we bought a pack of cigarettes and Mrs. Wagner pies

And walked off to look for America

"Kathy," I said as we boarded a Greyhound in Pittsburgh

"Michigan seems like a dream to me now"

It took me four days to hitchhike from Saginaw

I've come to look for America

Laughing on the bus

Playing games with the faces

She said the man in the gabardine suit was a spy

I said "Be careful, his bowtie is really a camera"

"Toss me a cigarette, I think there's one in my raincoat"

"We smoked the last one an hour ago"

So I looked at the scenery, she read her magazine

And the moon rose over an open field

"Kathy, I'm lost," I said, though I knew she was sleeping

"I'm empty and aching and I don't know why"

Counting the cars on the New Jersey Turnpike

They've all come to look for America

All come to look for America

All come to look for America

http://en.wikipedia.org/wiki/America_(Paul_Simon_song)

http://en.wikipedia.org/wiki/Kathy_Chitty

...He met Kathy Chitty on 12 April 1964 at the very first English folk club he played, the Railway Inn Folk Club in Brentwood, Essex. She was 17, he was 22 and they fell in love. Later that year they visited the US together, touring around mainly by bus. Kathy returned to England on her own with Simon returning to her some weeks later. When he was back in London he recorded the album The Paul Simon Songbook that included "Kathy’s Song", and had a photo of Simon and Kathy on the cover...

http://www.amazon.com/Paul-Simon-Songbook/dp/B0001LYGVC

http://en.wikipedia.org/wiki/The_Paul_Simon_Songbook

...The album cover shows Simon and his then-girlfriend, Kathy Chitty, sitting on "narrow streets of cobblestone" in London, the city Simon had adopted as his home...

http://en.wikipedia.org/wiki/The_Sounds_of_Silence_(song)

http://en.wikipedia.org/wiki/Wednesday_Morning,_3_A.M."The Sound of Silence" is the song that propelled the 1960s folk music duo Simon and Garfunkel to popularity. It was written in February 1964 by Paul Simon in the aftermath of the November 22, 1963 assassination of U.S. President John F. Kennedy.[1] After being later re-mixed with electric instruments, this commercial version has been called the "quintessential folk rock release".[2]

The song features Simon on acoustic guitar and both Simon and Garfunkel singing. It was originally recorded as an acoustic piece for their first album Wednesday Morning, 3 A.M. in 1964 but on the initiative of the record company's producer, Tom Wilson, it was later overdubbed with electric instruments and rereleased as a single in September 1965...

...Simon began working on the song sometime after the Kennedy assassination. He had made progress on the music but had yet to get down the lyrics. On 19 February 1964 the lyrics apparently coalesced, as Simon recalled:

“ The main thing about playing the guitar, though, was that I was able to sit by myself and play and dream. And I was always happy doing that. I used to go off in the bathroom, because the bathroom had tiles, so it was a slight echo chamber. I'd turn on the faucet so that water would run — I like that sound, it's very soothing to me — and I'd play. In the dark. 'Hello darkness, my old friend / I've come to talk with you again'.[5] ”

Simon showed the new composition to Garfunkel the same day, and shortly afterward, the duo began to perform it at folk clubs in New York. In the liner notes of their debut album, Wednesday Morning, 3 A.M., Garfunkel claims:

“ 'The Sound of Silence' is a major work. We were looking for a song on a larger scale, but this is more than either of us expected.[6] ”

The duo recorded it for the first time on March 10, and included the track on Wednesday Morning, 3 A.M., which was released that October...

http://www.amazon.com/Wednesday-Morning-3-Am-Exp/dp/B00005NKKW

http://en.wikipedia.org/wiki/The_Sounds_of_Silence_(song)

...On June 15, 1965, immediately after the recording session of Bob Dylan's "Like a Rolling Stone," Wilson took the original acoustically instrumented track of Simon & Garfunkel's 1964 version, and overdubbed the recording with electric guitar (played by Al Gorgoni), electric bass (Bob Bushnell), and drums (Bobby Gregg), and released it as a single without consulting Simon or Garfunkel. The lack of consultation with Simon and Garfunkel on Wilson's re-mix was because, although still contracted to Columbia Records at the time, the musical duo at that time was no longer a "working entity".[3][8][9] Roy Halee was the recording engineer, who in spirit with the success of The Byrds and their success formula in folk rock, introduced an echo chamber effect into the song.[3] Al Gorgoni later would reflect that this echo effect worked well on the finished recording, but would dislike the electric guitar work they technically superimposed on the original acoustic piece...

...For the B-Side, Wilson used an unreleased track he cut with the duo a few months earlier on which they had tried out a more "contemporary" sound. The record single "Sounds of Silence"/"We've Got a Groovey Thing Going" entered the U.S. pop charts in September 1965 and slowly began its ascent. In the first issue of Crawdaddy! magazine, January 30, 1966, Paul Williams, in reviewing the later album, wrote that he liked this B-side song which he found pure "rock and roll", "catchy", with a "fascinating beat and melody" and great harmony.

Simon learned that it had entered the charts minutes before he went on stage to perform at a club in Copenhagen, Denmark, and in the later fall of 1965 he returned to the United States. By the end of 1965 and the first few weeks of 1966, the song reached number one on the U.S. charts...

Last edited:

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

zulutrade vs collective2

Somehow I resumed my work instead of watching a movie.

My mind has been wondering about zulutrade, I don't know how it got to it.

So I did a search on google with "zulutrade is a scam".

Found some interesting links:

...

Oh, wait. I remember: I was reading the Forex Morning thread. Then there was a guy who had copied markfric's system and was selling it or something like that.

Then this guy has a web site, and he says "check out my trades at zulutrade".

Then I went to zulutrade and that site looked too good to be true. Some systems had 100% of wins.

Then I did a search on elitetrader and I found mixed reviews.

Then I did my google search, and I came across a link of forexpeacearmy, but that link was listing opinions of readers like "john from italy" and "masa from japan". So the forex auditing site itself looked like a scam. As if those comments had been made up.

So I decided to look up collective2 on it, to see if it was real people with real knowledge and opinions or just fake messages. Yeah, 'cuz I know collective2 is not all bad.

And my search found gold and here it is, in that it combines brains, knowledge and an opinion on both collective2 and zulutrade:

http://www.forexpeacearmy.com/public/review/www.collective2.com

These posts are from 2 years ago almost. If collective2's owner is not a scamster then the technical problems might have been solved. I believe zulutrade is a scam, so things cannot improve there. Matthew Klein graduated from a top university in the states, he writes and publishes novels:

http://www.collective2.com/mediakit/C2_Founder_Bio.pdf

You can tell this guy is not just after making money. Not to be racist, but he has a reputation to preserve I think. To the contrary, these guys look fishy to me:

http://www.zulutrade.com/Company.aspx#company-management

Let's keep reading at any rate.

I will quote in random order, as I browse, always providing the link before the quote. If I don't provide the link before a quote, the quote comes from the last link provided.

Major quality link from elitetrader:

http://www.elitetrader.com/vB/showthread.php?threadid=148324

Everyone in the 2008 thread complains about speed of execution (mostly system developers) but no one about collective2 being a scam.

Another thing: on ET's automated trading (and it is a serious place) there's 68 hits for collective2 and only 30 for zulutrade.

Great one here now:

http://www.forexpeacearmy.com/public/review/www.collective2.com

http://www.forexpeacearmy.com/forex...tal-non-performance-its-signal-providers.html

http://www.forexjustice.com/Review_Section/Forex_Signal_Reviews/Zulu_Trade.html

http://www.subzin.com/s/in five years the corleone

Holy cow! Check this out:

Now let's see what the same web site has to say about my baby, collective2.

I did a search on the site's engine and it doesn't show anything. So I used google:

http://www.google.com/search?hl=en&q=collective2+site:www.forexjustice.com

Guess what: so honest that they are not even listed on the forexjustice web site. Let's look for covestor, just in case:

http://www.google.com/search?hl=en&q=covestor+site:www.forexjustice.com

Told you so: the honest companies do not show.

Now it's really time to relax. I have to find the strength to stop working and relax. And watch a movie or tv. No more work, no more research. Or tomorrow I'll skip work again due to insomnia. Yeah, because I keep working while I sleep as well.

Somehow I resumed my work instead of watching a movie.

My mind has been wondering about zulutrade, I don't know how it got to it.

So I did a search on google with "zulutrade is a scam".

Found some interesting links:

...

Oh, wait. I remember: I was reading the Forex Morning thread. Then there was a guy who had copied markfric's system and was selling it or something like that.

Then this guy has a web site, and he says "check out my trades at zulutrade".

Then I went to zulutrade and that site looked too good to be true. Some systems had 100% of wins.

Then I did a search on elitetrader and I found mixed reviews.

Then I did my google search, and I came across a link of forexpeacearmy, but that link was listing opinions of readers like "john from italy" and "masa from japan". So the forex auditing site itself looked like a scam. As if those comments had been made up.

So I decided to look up collective2 on it, to see if it was real people with real knowledge and opinions or just fake messages. Yeah, 'cuz I know collective2 is not all bad.

And my search found gold and here it is, in that it combines brains, knowledge and an opinion on both collective2 and zulutrade:

http://www.forexpeacearmy.com/public/review/www.collective2.com

Mirko, Germany

Rating:

Date of Post: 2010-09-04

Review: Collective2 has changed over the years. They have much better APIs right now and work more stable, support more orders (like limit and stop order which they did not have before) and maximum loss.

It is up to the user to learn which signals are made to trade via Collective2 (you can not scalp via C2 because the volume are to low in many markets) but if you choose a good swing trade signal you are able to make money.

For me the main problem is that many signal provider fake their signals or results and for that reason many trader have unrealistic dreams about what is possible. C2 provides the real view on the markets - and that is a de-illusion for many traders. It is hard to find a system which is profitable on the long run in reality. On ZU** it is easy to fake the results through the MT4 History. For me C2 is a good an honest company with some smaller technical issues which may be fixed sooner or later.

Marty, Belgium

Rating:

Date of Post: 2010-01-16

Review: Collective2 is an honest signal provider service. It hosts over 10000 of which 95% are indeed very bad systems. The guy behind it, Matthew Klein, is very ambitious, helpful and cheerful. (contact is best via posting on the forum, he hardly answers emails). I've been sending signals via Collective2 since '07 and it has been nice for me.

Recently however, the site was hacked, which was not fun for us providers, as our cc info was compromised!!. The site is legit, provider raking iss honest, rebates are good. That can not be said of its main sompetor Zu.. you know which one. We all know there are so many scammers in the forex world but trust me, Collective2 is the place to look for a system (you'll have to look good but there are good ones)

Bob, USA

Rating:

Date of Post: 2009-07-04

Review: As other reviewers have noted, they rarely if ever respond to emails. Even the simplest question gets ignored. That is inexcusible in my opinion. If they are too busy, hire a freaking secretary. Even a "form" email response is better than nothing at all.

Second, 99% of the trading systems on the site are complete junk (I've tried several). I set up "auto trading" and lost 50% of my account when the "trader" I was subscribed to went AWOL and left the trades he opened just sitting there going further and further into loss. I had to go onto the site and hit "emergency stop" which closed my positions, otherwise I would have lost my entire account.

Any idiot can post a system on there (go to the site and look under "sell a trading system", and you can post one there yourself right now). For all you know, you have subscribed to a "system" being traded by some 12 year old out of his bedroom.

The concept is great, but someone mentioned Zulu trade, so I may check that out and give them a try. Although it is a good idea, they have a LOT to learn about proper customer service, and probably need some kind of filters to keep out all the worthless BS systems that exist there.

Ahmed, Germany

Rating:

Date of Post: 2009-04-30

Review: i opened an account on C2 to sell my signals and actually its very good idea BUT the problem that the website has allot of bugs and the Founder of the website actually dont know How to deal with Customers , so i opened my account for providing signals since 4 months and i made around 60% from the capital but the problem that his system is very very slow , has allot of bugs , errors , its not accurate his statistics has allot of wrong calculation, like the draw down i dont know how he count????

what made me so angry from this service on the 28th of this month i took short position on the G/U and i made my target 1.4516 and the price hited the target and the system didnt close it!!!

i contacted Mattew ''the founder of the website'' i said to him the problem he sent me very cold message ''The price not hit c2 price feed' his price feed is FXCM , i have a friend he has Real account there i met him and i opened the account and i found that the price hit 1.45142' that means my position should be closed , i contacted him again and i sent him the chart and the price he didnt answer me and ignored me!!!!

plus that he has horrible customer service no even Telephone number , when you want to register with him and you dont have credit card he dont accept another solution like paypal ''he has already pay pal'' i have friend has another account there too and he owns him 200$ and he dont sent to him as check because his rult to send just checks when the amount is more than 250$ , and my friend dont have paypal because he is from Egypt and he gave him another paypal for his friend he said no i cant send it

until i still have my trade open and i said to him i will not close it and i will leave the system like this and open some where else

thanks

Brandon, USA

Rating:

Date of Post: 2009-03-21

Review: After trying out ZuluTrade there is no comparision. Collective2 is not catered to currency traders like Zulu and there are no systems on C2 that are consistent. Their software is also full of bugs and you can't adequately control risk. Your trades are based on a percentage of how many lots the signal provider trades and the max lots feature only applies to one signal provider on one currency pair, which means you could theoretically have 30 trades open at once (since there are about 30 different pairs) even if you had the max lots set to 1 with the lowest percentage possible. This is idiotic and shows they don't understand forex.

2009-02-01 3 Stars First off, I have lost a significant percentage of my account from using C2, so keep that in mind. What I have learned is this: The performance of each system is not doctored and is for real. The systems I traded matched to the fraction of the pip of the opened and closed positions. I am using FXCM as the broker, which is probably the best for this type of service.

The difficulty with C2 is finding a consistent system. I chose two systems that were performing amazing for 3 months and they both collapsed soon after I subscribed (ShadowBanker and NewsProfiteer aka FXNewsWiz).

I am still searching for a system that is consistent. I would say only stick with systems that have been profitable for 4 months or longer, has a high sharpe ratio, and doesn't have large drawdowns. There are too many systems on there that only last a couple of months.

One other thing I don't like about C2 is the money management. They make you set a percentage of each trade, not a set amount of lots per trade. They say they do this so you can follow the system's money management rules, but this isn't always a good idea. I would like to see an option to trade a set amount of lots per trade signal instead of a percentage. The website is a little buggy, but they seem to stay on top of fixing any issues. For example, their auto sync feature will automatically enter you into any open trades a system has if you subscribe to a system that has open trades. This is a hidden danger that should be changed. There can also be oscillation of positions if you don't set the percentage right (opening then closing the same trade because the system thinks you have overleveraged).

Anyone else who has used C2 please post your results and experience. Thanks.

These posts are from 2 years ago almost. If collective2's owner is not a scamster then the technical problems might have been solved. I believe zulutrade is a scam, so things cannot improve there. Matthew Klein graduated from a top university in the states, he writes and publishes novels:

http://www.collective2.com/mediakit/C2_Founder_Bio.pdf

A graduate of Yale University, Mr. Klein also is a critically acclaimed

novelist who has published two financial thrillers. In 2007, the New

York Times said Mr. Klein's most recent work, Con Ed, is "funny, full

of tricks, and very, very hard to put down." The Book Place called Mr.

Klein's Switchback, "One of the most accomplished and daring debut

crime novels of 2006," adding that it is "a fantastic read."

You can tell this guy is not just after making money. Not to be racist, but he has a reputation to preserve I think. To the contrary, these guys look fishy to me:

http://www.zulutrade.com/Company.aspx#company-management

Let's keep reading at any rate.

I will quote in random order, as I browse, always providing the link before the quote. If I don't provide the link before a quote, the quote comes from the last link provided.

Major quality link from elitetrader:

http://www.elitetrader.com/vB/showthread.php?threadid=148324

1. There are no 7000+ ACTIVE systems on C2. That number is probably all systems since the website has started.

There are probably about 200 systems that are at least 3 months old, still active and profitable...

2. Sure one could enter a bunch of systems, but it costs money and time, and it also shows, so it takes even more time to cover the ownership.

3. The survivors still have to perform in the long run.

Everyone in the 2008 thread complains about speed of execution (mostly system developers) but no one about collective2 being a scam.

Another thing: on ET's automated trading (and it is a serious place) there's 68 hits for collective2 and only 30 for zulutrade.

Great one here now:

http://www.forexpeacearmy.com/public/review/www.collective2.com

Alan, México

Rating:

Date of Post: 2009-02-27

Review: I am broadcasting my signals in C2, and I think the idea and the service is awsome!!!

Yo will find a lot of system and traders, but most of them are not constent enough, and the most of them are very risky, thats because probably they doesn't trade their own trades!!, and the drawdowns are really big in some of them. The in-depth statistics help to see what's the risk involved with each signals provider.

As the C2 creators says... Anybody can be the next Warren Buffet on C2, so you don't know if you are paying for a newbie's signals, or for the ones of a real pro...

Conclusion: Service Excellent!!!!, providers Average...

http://www.forexpeacearmy.com/forex...tal-non-performance-its-signal-providers.html

On the other hand, no one has sued collective2....I have lost in total 20000 usd in all my above stated accounts due to poor signal providers of zulutrade on whom there were no proper checks from zulutrade to verify their credentials and due to hiding of important information of signal providers having multiple names. Hence I claim refund for this lost amount along with interest period from the time they have been funded and causing mental stress. I am marking of copy of this mail to Mr. Matthew Lange of the NFA to whom I have complained with proof of the above facts of zulutrade hiding information either deliberately or due to no proper checks on their signal providers or their site administrators.

I have given one week for zulutrade to refund me back the amount as above failing which I shall be forced to initiate other ways including arbritration from NFA or from forexpeacearmy.

regards

Balaji Iyengar

http://www.forexjustice.com/Review_Section/Forex_Signal_Reviews/Zulu_Trade.html

It's not that I want to buy signals. I just want to know which web site hosts serious systems and which one does not.Tuesday, 13 April 2010

Written by Mark M from Germany

Hello,

Im a zulutrade user for some time now and so far im very satisfied.

The only difficult part is to find a good signal provider...this needs much testing

Also zulutrade has changed their ranking system and it now includes open trades and its much more "fair" now for the top providers.

But remember everything you do, first test it on a demo account.

Thursday, 18 February 2010

Written by Paul VH from Netherlands

To those who know, FOREX business is risky and zulutrade doesnt defy this rule. I have been trading with zulutrade for some time now and through careful choice of signal providers (DONT choose one of the top 5) and custom settings, i have managed to get a nice ROI. Try opening some demo accounts first before putting real money, dont let the brokers' advertising tricks "drag" you...

That sums it up well: good luck figuring out who is a serious trader and who is a scamster. I don't want to be searching like crazy for an honest trader. Zulutrade NO GOOD.SCAMSunday, 31 January 2010

Written by Roy Lange from USA

Zulutrade is a SCAM. I opened a $5000 cash account after tracking the top trader "LowestDD" who they claim has a 99 percent win rate and 12% drawdown. Here is the problem. He opened multiple positions on the same pair to kind of "double down" on any losing trade. He will risk hundreds and hundreds of pips just to take very small pip wins. Fact is that his drawdowns a MASSIVE.

It is like a roulette wheel strategy where you keep doubling your bet until you win. AVOID THIS SITE UNTIL THEY CHANGE TO REAL CASH ACCOUNTS FOR THE PROVIDERS WHERE THEY SHOW THEIR REAL CASH RESULTS AND THEY MUST HAVE STOP LOSS RULES AND ALSO ONLY ONE LOT PER PAIR TRADED AT A TIME.

There may be some good traders in Zulutrade, but good luck figuring out who they are!!! Their #1 guy did nothing but lose for me!

Mmh... I am changing my mind. Let's say that if you look hard, you can find good systems in zulutrade, too. But it's not as easy. Even the fact that the dollar sign has appeared ONLY in 2010 means that it started out as a scam. Maybe they're now becoming legitimate, like the Corleone family:Tuesday, 26 January 2010

Written by N*** from Singapore

I have used Zulu since May 2009. So far I have made profit around 2000 pips.

Zulu is just an interface for you to choose your own signal provider.

Signal provider is trader who execute to open and close positions for you automatically.

The trick is to find safe and good signal provider.

There are a lot of signal provider who just gamble open and close position because they are only using dummy account. Start from this year (2010) you can select signal provider who is using their own money. You need to find signal provider who used '$' (dollar) sign, which means they used their own money to trade (give signal)

If you are not confident, I would recommend you to try using Zulutrade using your Micro account.

Deposit maximum $1000 and trade max 10 lot per signal provider you choose.

You may find some signal provider have very big drawdown, but since you have 10000 pips ($1000) you are save to keep open the position.

I my self have been trading and try so many forex robot. I prefer Zulu much more because from many signal providers you can learn how they execute their position. Beside that I can always decide not to choose the same signal provider if their performance become worst.

There are a lot of signal provider

http://www.subzin.com/s/in five years the corleone

02:14:39 In five years the Corleone family is going to be completely legitimate.

Holy cow! Check this out:

I am starting to suspect this. Zulutrade rips both providers and buyers of signals to split the gains with the broker. It would be a huge scam in this case.Sunday, 03 January 2010

Written by tony from USA

I have been trading stocks,options,futures and currencies for 30 years and came across ZULUTRADE and joined on as a signal provider.As a signal provider you must complete 30 trades before you become public.I was testing the system and had 30 winning trades for 30 attempts......so far so good.To my horror I began to notice that my close orders were not processed and was unable to close no matter what I attempted and incurred extremely large draw-downs and every attempt to have ZULUTRADE correct the situation resulted with a complete run around.What seemed to be a great idea turned out to be a complete disaster.At the time I had 60 followers and could only watch their accounts dwindle.I felt very badly for those people and stopped trading with ZULUTRADE.I strongly suggest you do the same!

Yes, I am totally done with zulutrade. They're scamsters. I don't care if they're slowly becoming legitimate like the Berlusconi family or not.SCAM Sunday, 03 May 2009

Written by mike from United Kingdom

worst service ever!

their signal provider dont stick with their promises .

use very high SL (not always)

i have tried their service with total wipe out!

SCAM Thursday, 30 April 2009

Written by Dave Sidwell from USA

Apr. 2009

I have been a customer of ZuluTrade for 4 months. The first time they missed an exit signal from my selected provider, I caught it just in time, and it 'only' cost me 46 pips.

Couple months later, ZuluTrade again missed the exit signal, this time cost me 540 pips and wiped me out. Their 'rep' acknowleded the mistake, but ZuluTrade would not own up to their mistake. Never ever trade with ZuluTrade.

Now let's see what the same web site has to say about my baby, collective2.

I did a search on the site's engine and it doesn't show anything. So I used google:

http://www.google.com/search?hl=en&q=collective2+site:www.forexjustice.com

Guess what: so honest that they are not even listed on the forexjustice web site. Let's look for covestor, just in case:

http://www.google.com/search?hl=en&q=covestor+site:www.forexjustice.com

Told you so: the honest companies do not show.

Now it's really time to relax. I have to find the strength to stop working and relax. And watch a movie or tv. No more work, no more research. Or tomorrow I'll skip work again due to insomnia. Yeah, because I keep working while I sleep as well.

Last edited:

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

major question about collective2: real money?

I've been searching their web site to find out about something of major importance.

If we say zulutrade is a scam and we say it because they just inserted the "$" symbol saying which account is trading real money and which is not, then we must also make sure that all collective2 systems are indeed trading real money.

I've been searching and I have not found this out yet.

Premise: I've already searched covestor and they state clearly that they must be able to monitor your account and you must trade your own strategy, whether you're building a personal track record or selling a model. They won't tell us how much a system developer is investing, but we know that he's investing something into it. Even though an interesting question would be: what if he is investing just a few thousands? How much does he really care about failing? So I guess we can't find out but we're missing important information by not knowing how much money someone is investing in his own strategy (whether a personal track record or investment model).

Now, since on collective2 there is no distinction of personal track record vs model, then they must be all live, except it doesn't say it clearly anywhere.

Here's the page where I am on right now:

http://www.collective2.com/static/systemDeveloper.htm

I already got here and still they did not say anything about whether it is real money or what:

How much does Collective2 cost for system developers?

Nothing yet, zero. Now listen: why would you need a broker account as a system vendor, if you don't use it to place orders? And yet it doesn't specifically say anywhere that you have to place orders. What if I use IB's account and use their paper trading? I don't get it. It's something that is extremely important, so it is not clear or even fishy why they are not stating it clearly.

Now I am here:

http://www.collective2.com/cgi-perl/system/grid.mpl

Nothing. It doesn't even have a list of subscribers per system, which would be important to know. Nothing of the individual pages of the systems either.

Now I am here:

http://www.collective2.com/startSystem

Oh, good... I am going forward in the process of creating a system to see what they ask and here it is, finally:

http://www.collective2.com/cgi-perl/offer.mpl

Damn, no! It talks about a fake account. This is not real money, or else they would not say what they are saying. I am going to finish this process to get to the bottom of this thing. To know how good the system vendors are I have to pretend I am one. What I can say right away is that I didn't have to give my name nor my account. So I am not too happy about that, considering I want the vendors selection to be as strict as possible. All I had to give was my email, which means nothing basically. So far I could have created 10 of these accounts, whereas the same does not hold true for covestor.

Ok, here we go. I created my system, "this is a test". It is totally free to create it, so I guess I am ok so far. However, it is not free to use it (after 5 signals you have to pay). And indeed i will not use it.

Now I know that my ONLY guarantee that the signals vendors will be serious and honest is that they are paying 100 dollars per semester. And that is if they decide to go beyond the fifth free signal. Otherwise they can just keep on opening new accounts. Until they get five straight winners. This is not too much of a guarantee, but on the other hand no one chooses any systems that have placed less than the 50 trades. However, the only guarantee then is the 100 dollars they pay every semester. They could also not be trading real money as far as I know. At least as far as i could find out up to here.

Disclaimer: I might be more stupid than the average trading system developer - I am indeed, because they are a smart bunch.

Ok, folks. I have gone through the whole web site. This is my conclusion.

If I wanted to get subscribers for a system that sucks - even if I were in good faith - a system that is overoptimized and a system that will fail once the market changes (say for example that the dollar starts rising instead of falling, or the Dow Jones reverses), then all I need to do is pay 100 dollars per semester. And not even risk another cent of my own money.

Not just that. I don't even risk any of my reputation. Because I can create more systems, delete the old unprofitable ones, or even better, create more identities. Which is probably breaking the rules, but it's probably the only thing against the rules.

Having this in mind, if someone places 30 trades per month, and keeps paying 100 dollars... let me do some basic math here.

Worst Case Scenario

Let's say you are a crooked money manager and you build 10 different systems. And you subscribe for them all, paying just 100 dollars per semester. You spend just 2000 dollars in a year.

You pick 5 different markets and trade two opposing methods per market. After a year you either have 10 breakeven systems (they don't count costs). Or, more likely, you have some losing systems and some winning systems.

Then, after that year, you get rid of the losing systems. And you are left with just 5 winning systems. Of which some will be quite good.

Someone who is inexperienced will subscribe to you, since you have a track record longer than a year. Where will it say that you deleted some unprofitable systems?

I have to see if this shows or not. If it doesn't show, we're screwed.

Not just this.

Why don't we hypothesize this. Even if you dropped systems will show somewhere, you could open ten different accounts (all it asks is an email address) and use one account per system. That way you will be a winning trader with no bad systems and a track record of one year.

All you've spent until here is 2000 dollars: and here they say that...

http://www.collective2.com/static/systemDeveloper.htm

I am saying one has to be very careful here. This is what I am saying. If I find out more about it, I'll write it here.

For now, I stop. Conclusion: some of the trading systems may be in good faith and profitable. Others may be in good faith, unprofitable, and yet get subscribers because they're lucky. Others may be scamsters. I'd say about 33% for each group of vendors.

With covestor this is less probable, but you still don't know how much they're investing in their strategy.

Still, collective2 remains a great place to look for ideas for new systems.

------------------------

Now I am looking into that problem I mentioned: if you delete a system, does it show somewhere? Can I search by members and vendors?

The forum, search engine, all this stuff totally sucks on collective2. I wonder if it's on purpose or just a limit. They're quite good programmers, so either way it's a big fault.

http://www.collective2.com/cgi-perl/t200.mpl?want=finder

For example: why can't I search systems by:

1) name

2) member's name

Why can't I find out the number of subscribers?

Why can't I find out how many systems a person has deleted?

This all goes against the credibility of the service.

This right here totally sucks, check it out for yourself:

http://www.collective2.com/cgi-perl/t200.mpl?want=finder

It goes against the logic of any search engine.

It would be as if you searched something on google and, before doing your search, it forced you select whether you wanted hits of this type:

1) cool

2) fun

3) serious

Geez...

"Hidden gems"

I am forced to select either of a series of choices among which "Hidden gems", which I don't even know what it means: what is this a restaurant menu?

Why can't I select "all"?

For being a site by scientific people for other scientific people, this really sucks. They must have hired a couple of stupid girlfriends, too. Probably they are in charge of the search engine and the forum.

My best bet is using the "grid":

http://www.collective2.com/cgi-perl/system/grid.mpl

Ok, here's how I will select (you can fill in the green-shaded boxes) what I think might be safe.

1) age more than 200 days

2) trades more than 200

and that cuts it down to 40 systems

3) sharpe > 1

and we're down to 33

No, wait, I was only doing "futures".

Have to restart all over again.

Ok, all as above.

4) profit factor > 1

5) annual return more than 22%

Ok, they've got 51 good systems all in all:

If I set age to >500 then the number goes down to 33, which is really the systems I should study.

These 33 systems all have C2 scores between 751 and 1000.

max dd between 8 and 76 % which means nothing unless you know their return. We should have Return On Account but we don't.

Now, they don't count costs, so we'd have to consider better those that trade less.

Number of trades goes from 200 to 10 thousands. That one must suck in terms of profit ("gulf stream" systems).

Sharpe goes from 1 to 2.6.

Half of the systems trade stocks, the rest is futures and some forex.

Average trade length goes from 1 hour to 4 weeks, and this is the filter I did not use.

...

Basically I have managed to copy past those results onto my excel sheet and I don't have to list them to remember them. Not only that: I have found out that you can see columns that did not show when you see them. There's like hidden columns which show on excel but don't show on the web. Wow, excel rules. It even makes me see hidden columns. Too bad the grid cannot be exported. Which is another thing that sucks about this web site.

http://www.collective2.com/cgi-perl...dhilite=3538&searchstartat=3538#msgid24934138

No ****, the question got asked already, but no one answered it. It was asked 4 years ago. I guess he's considered like a troublemaker or something.

Ok, the grid has a feature that allows to save the searches, which solves part of my problem. For the rest I can copy paste onto excel.

Also, the grid has a feature to choose columns.

So a lot got explained.

However I just looked around and found another problem. Look at this guy, the guy who wanted to export the grid like me:

He quit and where does his system show except near his name on the forum? Anywhere?

Where is the list of the forum members by the way?

The "system is no longer supported". Since you boast having 13000 systems, then give me a list of them and tell me which ones are and aren't supported any longer, because the guy quit. You say you want to be transparent? Be transparent then. Also tell me how many subscribers each system has, and everything you know that doesn't violate their privacy.

Ok, I also found how to search systems by name.

All right, overall it's not that bad, provided that I select the systems that have been trading for at least two years.

I've been searching their web site to find out about something of major importance.

If we say zulutrade is a scam and we say it because they just inserted the "$" symbol saying which account is trading real money and which is not, then we must also make sure that all collective2 systems are indeed trading real money.

I've been searching and I have not found this out yet.

Premise: I've already searched covestor and they state clearly that they must be able to monitor your account and you must trade your own strategy, whether you're building a personal track record or selling a model. They won't tell us how much a system developer is investing, but we know that he's investing something into it. Even though an interesting question would be: what if he is investing just a few thousands? How much does he really care about failing? So I guess we can't find out but we're missing important information by not knowing how much money someone is investing in his own strategy (whether a personal track record or investment model).

Now, since on collective2 there is no distinction of personal track record vs model, then they must be all live, except it doesn't say it clearly anywhere.

Here's the page where I am on right now:

http://www.collective2.com/static/systemDeveloper.htm

I already got here and still they did not say anything about whether it is real money or what:

How much does Collective2 cost for system developers?

Nothing yet, zero. Now listen: why would you need a broker account as a system vendor, if you don't use it to place orders? And yet it doesn't specifically say anywhere that you have to place orders. What if I use IB's account and use their paper trading? I don't get it. It's something that is extremely important, so it is not clear or even fishy why they are not stating it clearly.

Now I am here:

http://www.collective2.com/cgi-perl/system/grid.mpl

Nothing. It doesn't even have a list of subscribers per system, which would be important to know. Nothing of the individual pages of the systems either.

Now I am here:

http://www.collective2.com/startSystem

Create your own trading system

If you are interested in selling your trading advice, you first create a "trading system." Collective2 tracks results by trading system, and customers subscribe to particular systems. You may create as many trading systems as you like.

Ed.: meaning you don't have to trade them with real money?

In general, trading systems are organized around general principles or philosophies ("buying when things are oversold"), but they do not have to be. Opportunistic traders may simply want to create a "system" which is not really a system at all -- but is rather a set of recommendations and picks by one person.

Let's start by filling out information about your trading system. Don't worry too much about your answers; you'll be able to change them later.

And - remember - it's absolutely free to start a system and begin entering trades. So there's no risk to try it.

Oh, good... I am going forward in the process of creating a system to see what they ask and here it is, finally:

http://www.collective2.com/cgi-perl/offer.mpl

Damn, no! It talks about a fake account. This is not real money, or else they would not say what they are saying. I am going to finish this process to get to the bottom of this thing. To know how good the system vendors are I have to pretend I am one. What I can say right away is that I didn't have to give my name nor my account. So I am not too happy about that, considering I want the vendors selection to be as strict as possible. All I had to give was my email, which means nothing basically. So far I could have created 10 of these accounts, whereas the same does not hold true for covestor.

Ok, here we go. I created my system, "this is a test". It is totally free to create it, so I guess I am ok so far. However, it is not free to use it (after 5 signals you have to pay). And indeed i will not use it.

Now I know that my ONLY guarantee that the signals vendors will be serious and honest is that they are paying 100 dollars per semester. And that is if they decide to go beyond the fifth free signal. Otherwise they can just keep on opening new accounts. Until they get five straight winners. This is not too much of a guarantee, but on the other hand no one chooses any systems that have placed less than the 50 trades. However, the only guarantee then is the 100 dollars they pay every semester. They could also not be trading real money as far as I know. At least as far as i could find out up to here.

Disclaimer: I might be more stupid than the average trading system developer - I am indeed, because they are a smart bunch.

Ok, folks. I have gone through the whole web site. This is my conclusion.

If I wanted to get subscribers for a system that sucks - even if I were in good faith - a system that is overoptimized and a system that will fail once the market changes (say for example that the dollar starts rising instead of falling, or the Dow Jones reverses), then all I need to do is pay 100 dollars per semester. And not even risk another cent of my own money.

Not just that. I don't even risk any of my reputation. Because I can create more systems, delete the old unprofitable ones, or even better, create more identities. Which is probably breaking the rules, but it's probably the only thing against the rules.

Having this in mind, if someone places 30 trades per month, and keeps paying 100 dollars... let me do some basic math here.

Worst Case Scenario

Let's say you are a crooked money manager and you build 10 different systems. And you subscribe for them all, paying just 100 dollars per semester. You spend just 2000 dollars in a year.

You pick 5 different markets and trade two opposing methods per market. After a year you either have 10 breakeven systems (they don't count costs). Or, more likely, you have some losing systems and some winning systems.

Then, after that year, you get rid of the losing systems. And you are left with just 5 winning systems. Of which some will be quite good.

Someone who is inexperienced will subscribe to you, since you have a track record longer than a year. Where will it say that you deleted some unprofitable systems?

I have to see if this shows or not. If it doesn't show, we're screwed.

Not just this.

Why don't we hypothesize this. Even if you dropped systems will show somewhere, you could open ten different accounts (all it asks is an email address) and use one account per system. That way you will be a winning trader with no bad systems and a track record of one year.

All you've spent until here is 2000 dollars: and here they say that...

http://www.collective2.com/static/systemDeveloper.htm

This means that even if you get unlucky and even if you suck as a trader you will break even with this kind of scheme. And your investment will be zero (just the 2000 dollars in fees for the 10 systems). Now let's even say that you are not that bad. You won't gamble with your own money, but just with paper trading. However those following you will not know this.Earn money selling your signals. With over 37,000 registered users, and hundreds of millions of dollars of automated transactions flowing through our platform each week, Collective2 is the dominant trading system platform. If your system performs well at C2, you will make money. How much? That obviously depends on your system, but we can give you some benchmarks: top systems on Collective2 earn between $9,000 and $15,000 per month in subscription revenue. Almost half of systems that are profitable have earned at least $1,000 in subscription revenue.

I am saying one has to be very careful here. This is what I am saying. If I find out more about it, I'll write it here.

For now, I stop. Conclusion: some of the trading systems may be in good faith and profitable. Others may be in good faith, unprofitable, and yet get subscribers because they're lucky. Others may be scamsters. I'd say about 33% for each group of vendors.

With covestor this is less probable, but you still don't know how much they're investing in their strategy.

Still, collective2 remains a great place to look for ideas for new systems.

------------------------

Now I am looking into that problem I mentioned: if you delete a system, does it show somewhere? Can I search by members and vendors?

The forum, search engine, all this stuff totally sucks on collective2. I wonder if it's on purpose or just a limit. They're quite good programmers, so either way it's a big fault.

http://www.collective2.com/cgi-perl/t200.mpl?want=finder

For example: why can't I search systems by:

1) name

2) member's name

Why can't I find out the number of subscribers?

Why can't I find out how many systems a person has deleted?

This all goes against the credibility of the service.

This right here totally sucks, check it out for yourself:

http://www.collective2.com/cgi-perl/t200.mpl?want=finder

It goes against the logic of any search engine.

It would be as if you searched something on google and, before doing your search, it forced you select whether you wanted hits of this type:

1) cool

2) fun

3) serious

Geez...

"Hidden gems"

I am forced to select either of a series of choices among which "Hidden gems", which I don't even know what it means: what is this a restaurant menu?

Why can't I select "all"?

For being a site by scientific people for other scientific people, this really sucks. They must have hired a couple of stupid girlfriends, too. Probably they are in charge of the search engine and the forum.

My best bet is using the "grid":

http://www.collective2.com/cgi-perl/system/grid.mpl

Ok, here's how I will select (you can fill in the green-shaded boxes) what I think might be safe.

1) age more than 200 days

2) trades more than 200

and that cuts it down to 40 systems

3) sharpe > 1

and we're down to 33

No, wait, I was only doing "futures".

Have to restart all over again.

Ok, all as above.

4) profit factor > 1

5) annual return more than 22%

Ok, they've got 51 good systems all in all:

If I set age to >500 then the number goes down to 33, which is really the systems I should study.

These 33 systems all have C2 scores between 751 and 1000.

max dd between 8 and 76 % which means nothing unless you know their return. We should have Return On Account but we don't.

Now, they don't count costs, so we'd have to consider better those that trade less.

Number of trades goes from 200 to 10 thousands. That one must suck in terms of profit ("gulf stream" systems).

Sharpe goes from 1 to 2.6.

Half of the systems trade stocks, the rest is futures and some forex.

Average trade length goes from 1 hour to 4 weeks, and this is the filter I did not use.

...

Basically I have managed to copy past those results onto my excel sheet and I don't have to list them to remember them. Not only that: I have found out that you can see columns that did not show when you see them. There's like hidden columns which show on excel but don't show on the web. Wow, excel rules. It even makes me see hidden columns. Too bad the grid cannot be exported. Which is another thing that sucks about this web site.

http://www.collective2.com/cgi-perl...dhilite=3538&searchstartat=3538#msgid24934138

No ****, the question got asked already, but no one answered it. It was asked 4 years ago. I guess he's considered like a troublemaker or something.

Subject: Export The Grid to Excel?

Posted by: Donald Pirl ( C2 Score: 128)

Ignored by 0% of those who use ignore feature.

Ignore user's posts for week month forever

When: 2/02/07 (14:05)

Systems: Sand 2 Pirls 652015

Why not have an 'export to Excel' button for those (probably most) who have Excel? Then we can sort and filter to our heart's content.

Ok, the grid has a feature that allows to save the searches, which solves part of my problem. For the rest I can copy paste onto excel.

Also, the grid has a feature to choose columns.

So a lot got explained.

However I just looked around and found another problem. Look at this guy, the guy who wanted to export the grid like me:

He quit and where does his system show except near his name on the forum? Anywhere?

Where is the list of the forum members by the way?

The "system is no longer supported". Since you boast having 13000 systems, then give me a list of them and tell me which ones are and aren't supported any longer, because the guy quit. You say you want to be transparent? Be transparent then. Also tell me how many subscribers each system has, and everything you know that doesn't violate their privacy.

Ok, I also found how to search systems by name.

All right, overall it's not that bad, provided that I select the systems that have been trading for at least two years.

Last edited:

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

insomnia, again

Another question to answer is how these % returns are achieved, if with a fixed investment or with compounding. I would like it better if it was with a fixed investment.

I am going to do it now since I can't sleep anyway. It's two things:

1) as usual, my brain doesn't want to be turned off

2) i want to skip work, subconsciously i rebel against the whole deal, like a student who skips class (like I did often) - somehow it would not be so bad if I got fired.

So, here's more work for me: compounding or not? It's a major question in assessing performance.

Two places I'll do my search on:

1) http://www.google.com/search?hl=en&q=compound+site:www.collective2.com

2) http://www.collective2.com/cgi-perl/board.mpl?want=searchstatus (searched for "compound")

I am still digesting the lunch of several hours ago. It's always like this.

Ok, it seems that "compounded" is the deal. Let's look for "non-compound":

1) http://www.google.com/search?hl=en&q="not+compounded"+site:www.collective2.com

2) http://www.collective2.com/cgi-perl/board.mpl?want=searchstatus (searched for "non-compound" and similar)

This is all I've found on google:

http://www.collective2.com/cgi-perl/c2systems.mpl?systemid=33283025

http://www.collective2.com/cgi-perl/c2systems.mpl?systemid=19811124

http://www.collective2.com/cgi-perl...dhilite=7982&boardid=9323885&displayblock=8_7

People talking about non-compounded performances...

There is a lot on the forums and this just about sums it up, about how stupid they are in using "compounded returns" (of course he's "ignored", since he's a troublemaker, like the other one suggesting a feature to export the grid in excel format):

http://www.collective2.com/cgi-perl...=9323885&msghilite=42339847#msgdirect42339847

Yeah, of course I forgot to mention that also the previous post was dead on target on the idea of "fixed buy power".

Yeah, so since the crappy stats use compounded returns I just don't know what the hell to do. I should just ignore returns but that's impossible. On the other hand, sharpe ratio discounts that, so i could ignore returns and only use sharpe ratio.

It's a ****ing mess. Another problem is that now that i see how this whole deal works, i know also that a person could change his system during the race and no one would say anything. He could change the number of contracts. He could start doing discretionary trades even... a mess. The worst problem remains that a person might not be trading that system at all with real money. They keep mentioning here and there some sort of connection to the broker for systems vendors, but I don't see it as a requirement. A lot hints to the the fact that it is not a requirement. Unlike covestor they don't audit your account basically. They audit your paper trading record - that is what seems to be the case. Huge difference.

I either have it all wrong or Matthew Klein is not doing things properly. He is only doing half of the things properly, he may not be in bad faith, but then he's not as intelligent as I thought.

I've identifed these problems so far, in random order:

1) bad forum altogether

2) bad help section

3) bad searching functions

4) accounts not being audited, just the paper trading record is (unlike covestor and even zulutrade)

5) bad statistical data, badly organized, important data missing

6) bad auditing of even just the paper trading record, because I can easily register as often as I'd like. And i can delete my non-profitable systems without them being shown

7) problem with compounded returns

8) problem with returns without deducted costs

Still, overall this is better than nothing, and it remains the best financial web site for automated trading, which is the best thing for trading, so it is the best financial web site period. There's a concentrated quality you can't find anywhere else.

You see, even the objection on the forum are teaching me to reason the right way about this stuff. It's a great gym for automated trading... too bad the users are way better than the web site administrators, who suck big dicks.

What saves this web site is the quality of a few system vendors: once these are gone because there's a new web site offering a better service, this web site is going nowhere.

In fact the only difference between collective2 and zulutrade is this:

1) http://www.google.com/search?hl=en&lr=&q=collective2+scam 665 hits.

2) http://www.google.com/search?hl=en&lr=&q=zulutrade+scam 19600 hits.

They will never be a full-blown scam, but they might be surpassed by a better web site, soon. Maybe it exists already and I don't know about it.

Let's do it, let's find it:

http://www.google.com/search?q=collective2+covestor+site:www.elitetrader.com

Its name might appear next to covestor and collective2.

Here's one:

a project to compete with Collective 2

Nope, didn't seem to get anywhere. It was a perfect idea, but didn't make it happen.

Good thread here, but haven't found a substitute yet:

http://www.elitetrader.com/vb/printthread.php?threadid=195311

1) only a few systems are good,

2) a lot of people get ripped off and