I am glad you're liking my approach. You see, i realized that the more I try to impress myself and others by posting doubling up or tripling up my account with just a few trades, the more I am encouraged to not use the stoploss when something goes wrong, counting on the fact that I'll either get lucky or I'll simply not post my results (in case I blow out my account). But this is not a healthy approach for two reasons:

1) In real trading, I don't have to impress people but increase my capital, and it's unconceivable that I'll blow out my account every once in a while, and impress people with my returns the other times.

2) What i really need to find out is if I have an edge and if I am profitable, and I measure that simply by listing my next 20 trades, making 20 trades at a time (because i'd get tired with more and start underperforming).

The 20 trades at a time will teach me to use the stoploss and will tell me if I have an edge, or help me develop it. Then I will try to write down univocally what it is that I do (for using it in real trading). But even before doing that, I will develop a very useful confidence, which I never had: I've never really felt confident about my own

discretionary profitability, since with automated trading I have been profitable for years.

Which brings me to another point. Why have i been profitable with automated trading and not with discretionary trading? For the same reason that I find it easier to be profitable with the chart game: time, patience. With automated trading and with the chart game, I don't have to wait around for the right time and then act. The computer does it all for me (it's fully automated). And in the chart game, I cause one week to pass by clicking a button. Why can't I do this in my own discretionary or rather "manual" trading? Because I am not patient enough. But with automated trading and with the chart game, waiting is not an issue.

Which brings to answering your initial question. With such a huge edge (no "waiting" issues), the last thing we should worry about is a potential "entry" edge given by the chart game. At any rate, such an edge in my opinion does not exist, because - you might not notice it if you play one week at a time - you actually enter one day later than you want.

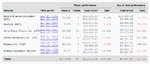

Anyway, here's my first 20 trades after setting that as a target. Let me state it once again: the objective is to learn to grow capital by using the stoploss rather than trying to impress readers by achieving huge returns. I just want to know that I have a constant edge, and that I never blow out my account out of every 20 trades.

I traded SHORT, as I've been doing lately. I failed a few times, but it seems, from these 20 trades, that I definitely have an edge (but I can only make sure of this, by trying this approach another few dozens of times):