Geez; pop out to the dentist and P/L reduced by 1/2 🙁

Well this is a tricky one; do we take profits; reverse; or sit it out? TBH I havent decided yet. I'm still about 125+ pips in the black...

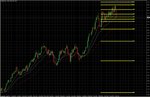

Earlier I mentioned that I might roll this into another portfolio and play it as a positional trade. If I look at it this way, I am still bearish on the pair - On the technical side, on the dailies we are still in a lower low and lower high phase, and I can't see a great deal of confluence from S/R at current levels (put it another way; if I was flat, I certainly wouldn't be looking to go long on this evidence alone). Our rising wedge pattern has broken, and we would have expected to see a bigger move down than we've been given so far. But if I want to play it positionally, I should also consider the fundamentals. the break of the RW was due to the dissapointing IFO figures yesterday, which suprised everyone a bit, and IMO set the ball rolling. Going into the weekend, there is probably some profit taking going on, Euro M(3) and the MCC revision, which could be propping the pair up for now. Next week is going to be v. interesting - lots of data wed, thurs, and fri. IMO the key issue is whether the fed statement takes a turn to the hawkish, indicating that rate cuts may pause; coupled with the general sentiment that seems to be "is that a light at the end of the tunnel?" (will the spoos break 1400????), and the case for being bullish on the pair is weak. So given the circumstances, I want to see the bears test a more significant level of support than the 1.5600 level, at least try to set new lows, with 1.5400 after that.

😱

just read the post; went on a bit, so in short, both my technical and fundamental message is "Don't panic Mr. Mainwaring!". I'm going to see how we get on into the close of the US session, she's good for 100pips either way.