ekanters

Active member

- Messages

- 106

- Likes

- 5

Watching u/j closely , not only for jpy pairs direction but looking for equities direction. U/J stalled even before 97.20, before 96.15 even and stalled at wr1 pivot at 95.68. If you view JPY as number one risk aversion currency as I do , you should be selling JPY against everything, in risk appetite mode . You are not , not against USD/JPY and not against CAD/JPY

In the past the carry trade or borrowing JPY against low rates and buying other currencies against higher interest rates was a great way to make a good income specialy because of the extra percentage made because the bought currency went up after big demand. Ad to that investments in the stockmarkets and you could have end up with a 30% or more investment over the year.

But things are changing fast and deflation has hit all over the world. Differences in interest rates between countries are getting smaller and could change what was common.

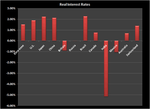

Below is a graph of real interest rates at present. Just something to think about.