GU - example for Tro's questions 7 and 8

Morning TRO

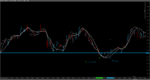

I am going to use the GU from Thursday 15th and yesterday -( chart above) Friday 16th.

A great example of a manipulated or false move set up from say 10 00 am UK time to after 11 51 am when the GU was in a bullish structure above Thursday's low area of 6735 - 50 and then on Friday had continued bullish up above 6800+ and with the 3 longer Lrs - ie the white dotted - green dotted and green line all in a bullish structure - on above the other.

When price was tried to take below 6800 and then 6780 - this was totally against the LR structure for that last 4-12 hrs - and although it was a clear scalp sell down to the support area - it was in fact -

1 - a stop hunt on existing intraday bulls who had been buying since the Opens

2, An organised attempt to get more bears in - and then of course - fry them

3. Nothing illegal - if you have the money you can move price anyway - but obviously retail traders and small commercials cannot do it - only liquidity providers and larger players

4. the main objective was to take the buys of existing traders - get bears in - have them both and then the players are able to buy again at a lower price - so to make more money.

5. So i am scalp selling after 10 30 - 11 00 am time - but knowing that this move will turn - at a support area and then it will be a buy again

6. My quicker white Lr's and the red Lrs follow the fall as a scalp sell - but then when they go back under price - time to buy again and then load on more as the proper bullish LR structure appears on the 1 min - ie whites - then red - yellow - green and then dotted gree and dotted white .

7. As we stand on Friday US session - the GU was a scalp sell after 6844 top - but as you can see on this chart - more than likely supports will hold again - and then price will rise again from 6800 area

8. We would need the scalp sell to breach under 6800 and 6780 to hold for longer sells - and more than likely we will turn - and then try up for 6840+ again - and either do a LH - and another drop - or breach 44 and 6850 - and try higher again

LR 1 min structure assists me to read PA better and to plot future waves

I am not fortune teller - ie try to guess daily or weekly movements - as its not so profitable - needing larger stops and longer time to make trades with RR's of 3+

Hope this make sense to you - and please fire away the next questions

Regards

F