You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I can't seem to find a good risk/reward ratio. Please help.

- Thread starter trade2finind

- Start date

- Watchers 8

pedro01

Guest

- Messages

- 1,058

- Likes

- 150

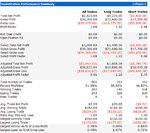

OK - first test.

Lets run this with stop loss of 3 points & target of 3 points:

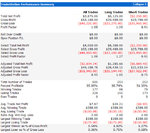

Now adjust to stop loss 3 points, target 6 points:

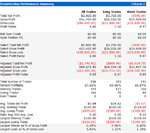

Now 6 point stop loss, 3 point target :

OK - so according to my hypotheseis

RR 1:1 - 50% win rate (avg winner = avg loser)

RR 3:6 - 33% win rate (avg winner double size of average loser)

RR 6:3 - 66% win rate (avg winner half size of average loser)

All for RANDOM entry.

The results bear out my hypothesis. What you see is that as you adjust the R:R, you also adjust the average size of losers & winners. Net effect is zero.

Sure - some show a marginal profit but given a test over a greater period, this will level out.

So - if you use R:R 6:3 and have a win rate of 66% - you are tossing coins.

Of course IF YOU HAVE AN EDGE - you will exceed a 66% win rate with a 6:3 RR.

Code:

Inputs : StopLossPoints(3), ProfitTargetPoints(3);

Vars : HeadsOrTails("heads");

if time = 1030 then begin

if HeadsOrTails = "heads" then begin

buy next bar at market;

HeadsOrTails = "tails";

end else begin

sell short next bar at market;

HeadsOrTails = "heads";

end;

end;

setstopcontract;

SetStopLoss(StopLossPoints * BigPointValue);

SetProfitTarget(ProfitTargetPoints * BigPointValue);Lets run this with stop loss of 3 points & target of 3 points:

Now adjust to stop loss 3 points, target 6 points:

Now 6 point stop loss, 3 point target :

OK - so according to my hypotheseis

RR 1:1 - 50% win rate (avg winner = avg loser)

RR 3:6 - 33% win rate (avg winner double size of average loser)

RR 6:3 - 66% win rate (avg winner half size of average loser)

All for RANDOM entry.

The results bear out my hypothesis. What you see is that as you adjust the R:R, you also adjust the average size of losers & winners. Net effect is zero.

Sure - some show a marginal profit but given a test over a greater period, this will level out.

So - if you use R:R 6:3 and have a win rate of 66% - you are tossing coins.

Of course IF YOU HAVE AN EDGE - you will exceed a 66% win rate with a 6:3 RR.

Attachments

zupcon

Experienced member

- Messages

- 1,162

- Likes

- 322

Changing Risk/Reward ratio doesn't guarantee an increase or decrease in the winning rate! Period.

Lets just capture that one for propserity so its there whenever fancies soiling themselves laughing at crass stupidity of this remark

Something tells me however that our "ledgendary" member is going to dig himself into yet a deeper hole before the night is through.

pedro01

Guest

- Messages

- 1,058

- Likes

- 150

The point is, your "system" is random. On OTHER SYSTEMs or METHODs, the entries are NOT RANDOM and so as R/R not random! And therefore, changing R/R doesn't guarantee an increase or decrease of win ratio

CP - it seems you ave been disagreeing with me without even reading my posts.

OF COURSE what I was showing was the impact of manipulating the R:R on a system with no inherent edge.

That's the point. If you do not understand that, then you cannot properly assess the impact of manipulating the R:R on a system with an edge 🙄

In any case - if you double the size of your stop without changing any other factor - your win rate WILL increase.

zupcon

Experienced member

- Messages

- 1,162

- Likes

- 322

The point is, your "system" is random. On OTHER SYSTEMs or METHODs, the entries are NOT RANDOM and so as R/R not random! And therefore, changing R/R doesn't guarantee an increase or decrease of win ratio

OK lets use an extreme example to demonstare the falicy of your argument. Pick your best "non random" method for forex on a daily timeframe. Now replace the usual stop with a 1 pip stop. Youve just massively changed the R/R, so do you think that just might effect the win rate ?

I guarentee you that it will

QED 😆

pedro01

Guest

- Messages

- 1,058

- Likes

- 150

Pedro, don't you understand that your formula here is completely wrong? My 1st response was about this thing!

%win rate = (100 / profit ticks + stop loss ticks) x stop loss ticks

Please explain why this is valid???????????

Sorry - are all your rants because I missed some brackets ????

%win rate = (100 / (profit ticks + stop loss ticks)) x stop loss ticks

Feel better ? Let's see

3:3

(100 / (3+3)) * 3 = 50%

6:3

(100 / (6+3)) * 6 = 66.66%

3:6

(100 / (3 +6)) * 3 - 33.33%

Looks fine to me for a random entry system and is in line with the results I published.

As for me not using standard algebraic notation - shoot me. I'm not a mathematician.

zupcon

Experienced member

- Messages

- 1,162

- Likes

- 322

zupcon, I didn't say 1pip stop, that's insane!

I agree that its insane, Im just using to demonstate a point, that the closer the stop, the greater the probability that the stop will be hit. If was 2 pips, the win rate would increrase, and if it was 3 pips, the win rate woud be even higher, and if was 1000 pips, the win rate would be extremely high, and if there where no stop at all, the system would never have a trade stopped out.

Pedro's talking about random trades, with fixed targets and stops, and the equation he's proposing works perfectly under those conditions. However the application of stops and targets also effects non random entries, and the basic principle applies

reducing the size of the target is equivelent to having a horse race over a 3 mile distance but If one of the horses only has to run 500 metres, then in all likelihood its going to win the race ! the horse isnt more likely to lose by giving it such an advatage is it ?

pedro01

Guest

- Messages

- 1,058

- Likes

- 150

I understand your idea and supposely bracket in your formula, but it is completely wrong!

This far you have provided nothing in the way of evidence to support that.

On the other hand, I have provided much evidence to support my position on the matter.

If you want to debate, then put some meat on the bone, either pull apart the ample evidence I have provided or provide your own evidence that provides a contrary view.

Saying "That is wrong" over and over again does not back up your opposing view at all.

cpngtw

Experienced member

- Messages

- 1,525

- Likes

- 18

OK, "Mr. Know It All", any serious or seasonal traders MUST know what a WINNING RATE (or RATIO) is, and what a RISK/REWARD RATIO is. Your definition and formula that "links" win rate & risk/reward ratio is lame at best, st***d at worse.

win rate, officially called win/lost ratio, is nothing simpler than a ratio between wining trades vs losing trades over a period of time.

win/lost raion = # winning trades / # losing trades

REGARDLESS of how much money won or lost per trade

Risk/Reward Ratio = expected risk / expected reward on ONE TRADE

Win Rate & Risk/Reward Ratio are 2 DIFFERENT variables. The former for a number of trades (let say, 100 trades) over a period of time. The latter is PER TRADE.

If this concept is hard to swallowed, then I'd truely doubt your (boasting) trading experiences and skills

Other readers, if you are new to trading and would like to learn more the basic terms and terminologies, these links would help you much more than listening to the so called "experts" here:

Win/Loss Ratio

Risk/Reward Ratio

So what the heck is this?

pedro01

Guest

- Messages

- 1,058

- Likes

- 150

So what the heck is this?

It appears to be a badly spelt attempt at turning this into a semantical argument.😛

On a random entry - win rate is absolutely determined by the risk:reward ratio. I have proven this and you have done nothing to dispute it.

In the OPs post - he has a fixed number of ticks stop and fixed number of ticks target, hence that is his risk:reward.

So - on random entry, it has been demonstrated that win rate is determined by risk:reward. On a non-random entry - as Zupcon demonstrated in his '1 tick' example, playing with these numbers will indeed impact your win rate but not necessarily your profit. Knowing the difference is crucial.

pedro01

Guest

- Messages

- 1,058

- Likes

- 150

Impact is the right word, but not neccessary increase or decrease your win rate. And that depends on your system. And that can't be generalize using some common formula like yours!

Again - all you seem to be able to say is "that's not right". You fail to bring any evidence to the table.

The formula WILL work for a RANDOM entry over time. That is what it is intended for and that is ALL it is intended for.

Now - please feel free to show us a system where making the stop loss wider reduces the number of winners. 🙄

trade2finind

Junior member

- Messages

- 43

- Likes

- 0

I think my opinion is pretty clear - pedro talks sense.

I'm so sure I don't even have to read his posts 🙂

Sarcasm ?!

You asked perfectly reasonable questions and pedro tried hard to be very helpful to you.

When someone else came in attacking him, both zupcon and myself suggested you listen to pedro. I expressed the belief and confidence in pedro that what he advises is so good I didn't even need to read it to know it would be good.

If you think that is sarcasm you have misunderstood something which I thought I'd made clear. No offence or sarcasm was intended.

Just to emphasise this, there are some of us who go out of our way to help people and you have clearly mis-read my intention.

Regrets that I misread your 1st post above. Just that when you said "...don't even have to read his posts 🙂" it was confusing to me.

trade2finind

Junior member

- Messages

- 43

- Likes

- 0

GammaJammer

Guest Author

- Messages

- 1,246

- Likes

- 830

I'm a daytrader and trying to maintain good money mgt. Still, I am not sure on what my risk/reward ratio should be and am wondering how you guys have developed yours. My understand of a good ratio setup is, say, you should stop loss at -2 ticks and sell at +5 ticks from your buy price, and assuming that one's accuracy rate is near 50% and the $ amount of the +5 ticks is greater than the $ loss of the -2 ticks, then one should be set up profit in the long-run.

Can someone please correct if above is wrong and also tell how you reached your ratio setup? All advice is welcomed. Thanks.

What you are describing, in a nutshell, is expectancy. Which you want to be positive, and as large as possible ideally.

But your main problem with what you are going to achieve is this;

1) If you are 'scalping' your explicit and implicit transaction costs are going to be suicidally high as a proportion of your trade metrics, so the real numbers are gonna have to be far higher to compensate.

2) You are basically trading noise, and in the wider context of the markets that simply won't register in terms of smart analysis. So you're gonna find yourself caught on the wrong side of a trend far more often than is sensible, and you're gonna find the standard deviation of your returns, and with it, the confidence in your expectancy estimate is blown out the water.

As a result you're gonna p1ss your account away within a very short space of time, and the bad news is if you keep on this road there's nothing you can do about it.

So take a step back, give up the scalping and don't look at any chart shoter than say a 4h one until you have been making money 6 months say.

Genuine advice, well meaning, and sorry to be blunt it's just quicker

GJ

Similar threads

- Replies

- 1

- Views

- 8K

- Replies

- 210

- Views

- 103K

- Replies

- 8

- Views

- 4K