Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

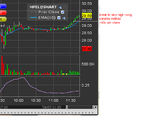

I found EXPE today scanning a few minutes into market open. A nice very strongly trending stock showing the rising candles method as in this thread.

+115c per share profit

This is not a hard set up if you have a pre-market alert list and then scan during market hours as well. What some people seem to find difficult to understand is that there isn't an optimal entry point. They think there must be a pre-ordained entry point because most methods use one so they are self conditioned into thinking there must be one.

Think of it this way, in Britain we used to have open platform buses you could jump on even when they were moving. The idea is the same. Are you and the moving bus at the same place at the same time? Yes, the "best" place to get on the bus is at the bus stop - the entry point - but you can still get on when it's moving if the platform is open.

+115c per share profit

This is not a hard set up if you have a pre-market alert list and then scan during market hours as well. What some people seem to find difficult to understand is that there isn't an optimal entry point. They think there must be a pre-ordained entry point because most methods use one so they are self conditioned into thinking there must be one.

Think of it this way, in Britain we used to have open platform buses you could jump on even when they were moving. The idea is the same. Are you and the moving bus at the same place at the same time? Yes, the "best" place to get on the bus is at the bus stop - the entry point - but you can still get on when it's moving if the platform is open.