You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

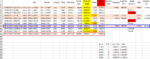

I'm posting an update as we have had two pieces of action this week:

1. The Hong Kong 50 trade opened on the 8th October closed out for a nice profit of £707.76

2. A new trade to report the EUR/USD forex. As the market is alread open, I placed a trade in my dummy account.

As with previous updates, trades which have been closed out are highlighted in pink and the profit/loss recorded. Those trades still open, the current value is also recorded as at 24/11

Becks

1. The Hong Kong 50 trade opened on the 8th October closed out for a nice profit of £707.76

2. A new trade to report the EUR/USD forex. As the market is alread open, I placed a trade in my dummy account.

As with previous updates, trades which have been closed out are highlighted in pink and the profit/loss recorded. Those trades still open, the current value is also recorded as at 24/11

Becks

Attachments

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

It's a matter of YOUR choice of course but I see you are employing a rigid 5% take profit and a 10% stop loss.

Just a thought but have you considered altering these figures based on past performance of your system on these specific instruments ?

It may work better on some than others.

Just a thought but have you considered altering these figures based on past performance of your system on these specific instruments ?

It may work better on some than others.

Thanks Pat, it is something worth considering as perhaps a 5% rise in any index does seem quite high.

I did think at the time of reading the manual that for any index to rise 5% in a matter of weeks or months might be a big ask, but having said that some of them have actually done that.

One thing I am changing from the rules, is that I won't let a trade carry on regardless until it either hits it's profit target or gets stopped out. For my test, if a trade hasn't been closed in the quarter period it was originally opened in, it must do so in the next quarter or I'll close it manually.

Becks

I did think at the time of reading the manual that for any index to rise 5% in a matter of weeks or months might be a big ask, but having said that some of them have actually done that.

One thing I am changing from the rules, is that I won't let a trade carry on regardless until it either hits it's profit target or gets stopped out. For my test, if a trade hasn't been closed in the quarter period it was originally opened in, it must do so in the next quarter or I'll close it manually.

Becks

I didn't have time to write this update till now, so I'm posting it late as we have had 1 trade closed and another one opened:

1. The US 500 trade opened on the 17th September closed out for a nice profit of £682.47 on 28th November

2. A new trade to report the EUR/JPY forex. As the market opened late on Sunday, I placed a trade in my dummy account.

As with previous updates, trades which have been closed out are highlighted in pink and the profit/loss recorded. Those trades still open, the current value is also recorded as at 4th Dec

Becks

1. The US 500 trade opened on the 17th September closed out for a nice profit of £682.47 on 28th November

2. A new trade to report the EUR/JPY forex. As the market opened late on Sunday, I placed a trade in my dummy account.

As with previous updates, trades which have been closed out are highlighted in pink and the profit/loss recorded. Those trades still open, the current value is also recorded as at 4th Dec

Becks

Attachments

Hi Becks100

good to see your making progress with it

can i ask, do you follow the list of indices and fx pairs as in the manual and do you use the broker as suggested in the manual ?

ps, have had a sales email recently where you can sign up for £50 a month and receive the signals rather than looking for and managing trades yourself

good to see your making progress with it

can i ask, do you follow the list of indices and fx pairs as in the manual and do you use the broker as suggested in the manual ?

ps, have had a sales email recently where you can sign up for £50 a month and receive the signals rather than looking for and managing trades yourself

Hi Panda,

Apologies, Christmas and holidays was a bit hectic to say the least. I’ll post another screenshot of the latest results to the end of the year. There is now only 1 trade remaining open.

There will be one big loss to report, several wins, which will include ones which although not hit their target levels, I’ve closed out anyway as I don’t like the idea of rolling trades on indefinitely

I do use all the Indices and Forex pairs covered in the manual, but I don’t use the broker - I use IG.

A friend of mine got that email you mentioned and is signing up for it and sharing with me. I’ll post the results later this month. I’ve been impressed with HAV Trading, I definitely think there is something in it, whether or not it can still deliver the goods when there is a downturn remains to be seen.

I’m covering Diff Code Global at the moment and might start another thread on that.

Regards

Becks

Apologies, Christmas and holidays was a bit hectic to say the least. I’ll post another screenshot of the latest results to the end of the year. There is now only 1 trade remaining open.

There will be one big loss to report, several wins, which will include ones which although not hit their target levels, I’ve closed out anyway as I don’t like the idea of rolling trades on indefinitely

I do use all the Indices and Forex pairs covered in the manual, but I don’t use the broker - I use IG.

A friend of mine got that email you mentioned and is signing up for it and sharing with me. I’ll post the results later this month. I’ve been impressed with HAV Trading, I definitely think there is something in it, whether or not it can still deliver the goods when there is a downturn remains to be seen.

I’m covering Diff Code Global at the moment and might start another thread on that.

Regards

Becks

Hi Becks100

good to see your making progress with it

can i ask, do you follow the list of indices and fx pairs as in the manual and do you use the broker as suggested in the manual ?

ps, have had a sales email recently where you can sign up for £50 a month and receive the signals rather than looking for and managing trades yourself

Hi Becks

no need for apologies, it is/was xmas and it's YOUR thread.

I agree, it does seem to be performing well and looking at the results over on Traders Bulletin, has been for several years. Re the downturn, i imagine as long as there's a trend without being choppy it should be robust ?

Iv'e had the manual for a few years but not traded it (various reasons) but am going to take the next trade signal and go from there, probably use ETX though as IG's min size is a bit rich.

Likewise, i have DCG on trial and am happy to start real this coming week, of course that's another broker !

Best Wishes

Panda

no need for apologies, it is/was xmas and it's YOUR thread.

I agree, it does seem to be performing well and looking at the results over on Traders Bulletin, has been for several years. Re the downturn, i imagine as long as there's a trend without being choppy it should be robust ?

Iv'e had the manual for a few years but not traded it (various reasons) but am going to take the next trade signal and go from there, probably use ETX though as IG's min size is a bit rich.

Likewise, i have DCG on trial and am happy to start real this coming week, of course that's another broker !

Best Wishes

Panda

Hi All,

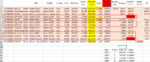

I’ve attached the final test results for this trial, which I will say has been a successful one.

Latest updates:

1. Row 7 Japan 226 hit the target profit

2. The remainder of the highlighted rows expired naturally in December with a couple of big wins and a couple of losses (these were December contracts and I didn’t roll them forward)

3. Row 14 remains open as it is a March 18 contract and as it was £221 in profit so far, I’ll let it run.

Hi Panda - I decided not to open an account with ETX as I was fed up of opening accounts with different brokers. they all seem to want you to open with different brokers and I’m sure it’s to do with commissions

Perhaps later this month I will conduct another HAV trial based on the email signals received under the scheme mentioned by Panda above. I’ve not signed up myself, but a friend has and he’ll send me the details and I’ll do the same for him for Diff Code Global.

Regards

Becks

I’ve attached the final test results for this trial, which I will say has been a successful one.

Latest updates:

1. Row 7 Japan 226 hit the target profit

2. The remainder of the highlighted rows expired naturally in December with a couple of big wins and a couple of losses (these were December contracts and I didn’t roll them forward)

3. Row 14 remains open as it is a March 18 contract and as it was £221 in profit so far, I’ll let it run.

Hi Panda - I decided not to open an account with ETX as I was fed up of opening accounts with different brokers. they all seem to want you to open with different brokers and I’m sure it’s to do with commissions

Perhaps later this month I will conduct another HAV trial based on the email signals received under the scheme mentioned by Panda above. I’ve not signed up myself, but a friend has and he’ll send me the details and I’ll do the same for him for Diff Code Global.

Regards

Becks

Attachments

Hi,

no I’ve decided not to bother with Diff Code Global because in short it’s utter rubbish!

Apparently it’s not had a winning month since November. I’ve tested it for real since January and it’s been a disaster. It’s supposed to return 70% win ratio rather than just over 50% I got for January and as for Feb, just 1 winner and 6 losers!!!

Looks like Diff Code is one of those products that is fine when the market is doing well, but when the market goes down or up and down, then it’s not fit for purpose.

I would urge everyone to stay well clear of any Diff Code product.

It could be worse, I could have done the Diff Code Transatlantic which was even worse by all accounts

Regards

Becks

no I’ve decided not to bother with Diff Code Global because in short it’s utter rubbish!

Apparently it’s not had a winning month since November. I’ve tested it for real since January and it’s been a disaster. It’s supposed to return 70% win ratio rather than just over 50% I got for January and as for Feb, just 1 winner and 6 losers!!!

Looks like Diff Code is one of those products that is fine when the market is doing well, but when the market goes down or up and down, then it’s not fit for purpose.

I would urge everyone to stay well clear of any Diff Code product.

It could be worse, I could have done the Diff Code Transatlantic which was even worse by all accounts

Regards

Becks

Similar threads

- Replies

- 277

- Views

- 35K