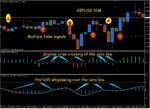

Any idea what could be used as a filter for chop?

Well done Lucca nice to see you in profit.

I would ask the same question - does anyone have a response to the chop the market throws up regularly?

Given that

MACD is generally used for momentum, or strength of the trend, and

Stochastic Oscillator is generally used to indicate a

CHANGE of Momentum then there may be a use for a combination of these two indicators, to assist with filtering signals.

I do not know or understand which of these ProFx has used in construction of the system, because the instructions are not clearly enunciated in the manual. I would like someone to

list what the 7 ProFx indies are, and what their function is in relation to the signals given - for example we know that all of the indies need to be in agreement, but what are these indicators, and how much weight can we put on them, in order to have some understanding of the kind of trend that is likely to result from a signal?

If we can begin to answer some of these questions, then answers will come.

Personally I like to have a look at what the 15M and the 1H charts are also doing, before entry.

Some folks like to say that because the 4H trend is up, then that is the trend, and so we should be trading with the trend. ie only take LONG positions.

But that fails when the trend changes. Remember trend is set by tick data, and big trends must eventually give way to what the "rudder" - ie the smaller trend - is doing. It is all well and good to accept that once a strong trend is established, then the smaller trends are just 'noise" within the trend, but at some point, the "noise" will be listened to, and the higher TF trend will fail because of the constant pressure of price movement in the lower TF.

Big trends are built from small ones, but once established, small trends are swept along with big trends. "CHOP" is the result of indecision in the trends, as a battle goes on for dominance within trends.

Hope I explained that well enough - someone else might also have a view on this.

So, where is this going?

What we need to have in our tool-kit, is an indicator that tells us that uncertainty is creeping in, and the strength of the trends is no longer reliable.

For me, stochastic fits the bill, and MACD also has a role here.

But does ProFx already have such a filter?

If so, has such filter not been properly explained yet?

After all,

ProFx 03 and 04 must have a greater role than we have been told about to this point. And I would like to hear how others have found the reliability of

ProFx 05 and 06. A bit has been said about them on the Fisherman thread, but I think if we can explore these a little more diligently here, we may have a better way to filter the trades that simply can not give us our targets.

Failing that, I am loathe to begin adding other indicators, but if it has to be done, then possibly a Stochastic Oscillator, set at the appropriate period, would be my first choice.

Finally, I say to you Lucca, thank you for persevering with your stated aims. Although this week the method has not put surplus pips in your basket, at least you have been able to show what is happening in the lower TF, and the profitability of that.

Have you tried to operate in the 1H TF? I have not actively traded this TF myself, but looking through the charts, I find that a lot of chop is eliminated.

Larger SL needs to be used in the higher TF, which may translate to larger drawdown.

Great work here, and thank you to all contributors.

Best wishes

Ivan