Traders who try to pick the tops and bottoms of the market throughout the day end up with mostly misery. Also inexperienced fellows in forex departments even in first division clubs try to pick the tops and bottoms, believing that this is where the real big money is. No wonder why such traders turn to losers. When you start trading the first thing you should do is to destroy your ego and fear in the market. Once your ego and fear are reasonably cured, you will be able to make money.

Of course preparing yourself mentally and emotionally will not be enough to win this battle. A working strategy is what you need. If you go unarmed, you won’t last long. The system that I will explain (HAMA Forex Strategy) combines 2 strong methods: Heiken Ashi and Moving Averages. You can use this strategy to trade any major currency pair on any time frames. Remember that trading success is all about making as much as one can when one is right and losing as little as possible when one is wrong. That is the essence of this business.

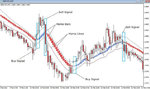

Please have a look at the chart before tell about details:

see the figure:1

If the price closes above the upper band of Hama Line and if Hama bar is blue, you are going to open long position (buy signal).

If the price closes below the lower band of Hama Line and if Hama bar is red, you are going to open short position (sell signal).

T/P and S/L levels depend on what you trade as well as time frame. After applying the template on your chart, you can have an idea about it. Study the system so that you can discover what pair or time frame which suits your needs. When I trade on GBP/USD (30M chart) I look for 30-35pips and my stop loss is 30 pips. However while trading on 4H chart I look for 80-100 pips at least.

Please check the chart below as well:

see the figure:2

Of course preparing yourself mentally and emotionally will not be enough to win this battle. A working strategy is what you need. If you go unarmed, you won’t last long. The system that I will explain (HAMA Forex Strategy) combines 2 strong methods: Heiken Ashi and Moving Averages. You can use this strategy to trade any major currency pair on any time frames. Remember that trading success is all about making as much as one can when one is right and losing as little as possible when one is wrong. That is the essence of this business.

Please have a look at the chart before tell about details:

see the figure:1

If the price closes above the upper band of Hama Line and if Hama bar is blue, you are going to open long position (buy signal).

If the price closes below the lower band of Hama Line and if Hama bar is red, you are going to open short position (sell signal).

T/P and S/L levels depend on what you trade as well as time frame. After applying the template on your chart, you can have an idea about it. Study the system so that you can discover what pair or time frame which suits your needs. When I trade on GBP/USD (30M chart) I look for 30-35pips and my stop loss is 30 pips. However while trading on 4H chart I look for 80-100 pips at least.

Please check the chart below as well:

see the figure:2