barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

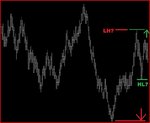

I find it quite interesting that most amateurs I know tend towards looking for turning points (maybe in the buy low, sell high camp) whereas the few professionals I know tend towards looking for momentum and going with the flow (maybe in the buy high, sell higher camp).

Whether or not my experience is truly reflective of a professional vs amateur difference I don't know - I wish I did 🙂

jon

Whether or not my experience is truly reflective of a professional vs amateur difference I don't know - I wish I did 🙂

jon