peterpr

Established member

- Messages

- 609

- Likes

- 7

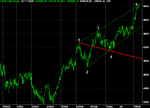

2nd attempt - original ended up on the "Where's the DOW going thread !!

Another quick tit-bit for you to chew on:

Just spotted we reached 366 point above the 200DMA today. That's higher than at any point this side of the 2000 crash. Nearest was 330 on 15th November last (a retrace of 97 points followed).

Then 6th Oct 04 at 279 - a retrace of 162 followed. then 293 on 4th Jan 04 - a retrace of 294 followed.

In other words its 10% further above its 200 DMA than at ANY time in the past 7 years or more. Beginning to take on the trappings of a parabolic spike to me - which means a hefty correction at least.

Another quick tit-bit for you to chew on:

Just spotted we reached 366 point above the 200DMA today. That's higher than at any point this side of the 2000 crash. Nearest was 330 on 15th November last (a retrace of 97 points followed).

Then 6th Oct 04 at 279 - a retrace of 162 followed. then 293 on 4th Jan 04 - a retrace of 294 followed.

In other words its 10% further above its 200 DMA than at ANY time in the past 7 years or more. Beginning to take on the trappings of a parabolic spike to me - which means a hefty correction at least.