ppplaci

Active member

- Messages

- 133

- Likes

- 6

Day 8 (Week 2)

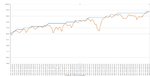

Month's plan beginning balance: £50

daily target is 5% (£2.50)

base stake: £0.1/tick

max stake £0.8/tick

Account start balance: £50.00 on 21st July 2014

current balance: £72.60

Account balance percentage:

plan:140%

actual:145.2%

********************************************

Overdid it, too much profit compared to the plan.

Today I was waiting for the long breakout so I went mostly long, entered short on the lower high, but exited accidentally. Bad mistake. On confirmation of long breakout failure went short again, and had to force myself to exit, because daily target met, although I saw an opportunity for the price to go at least as low as ~1133 to touch the triangle. May happen may not.

Spread cost me £6.30 today.Real markets it would be half of it.

(10$/tick 1 spread plus 5 dollar round turn, altogether like 1.5 tick spread as cost compared to 3 here)

I have been over this before, can't help thinking about it though 🙂

Month's plan beginning balance: £50

daily target is 5% (£2.50)

base stake: £0.1/tick

max stake £0.8/tick

Account start balance: £50.00 on 21st July 2014

current balance: £72.60

Account balance percentage:

plan:140%

actual:145.2%

********************************************

Overdid it, too much profit compared to the plan.

Today I was waiting for the long breakout so I went mostly long, entered short on the lower high, but exited accidentally. Bad mistake. On confirmation of long breakout failure went short again, and had to force myself to exit, because daily target met, although I saw an opportunity for the price to go at least as low as ~1133 to touch the triangle. May happen may not.

Spread cost me £6.30 today.Real markets it would be half of it.

(10$/tick 1 spread plus 5 dollar round turn, altogether like 1.5 tick spread as cost compared to 3 here)

I have been over this before, can't help thinking about it though 🙂

Attachments

Last edited: