Market update by Solid ECN

WTI Crude Oil, "black gold" rushed to new highs

Against the backdrop of the start of a military operation announced by the Russian authorities in Donbas, the price of Crude Oil shows an uptrend in trading. Interest in risky assets is rapidly falling, as investors expect the situation on the Ukrainian borders to worsen.

Against this background, the quotes of "black gold" reach new highs around $99 and approach the level of $100. If the military conflict develops, the price may rush to the levels of $110 – $115.

The US President Joe Biden announced the imposition of sanctions against the operating company Nord Stream 2 and its corporate executives, and also announced the US readiness to take further steps in the event of an escalation of the situation around Ukraine. The rhetoric of the head of the White House raises concerns among investors about a possible shortage of energy resources due to growing global demand, and, as a result, leads to an increase in the price of oil and its products.

Meanwhile, the EU authorities are also expanding the package of sanctions measures against Russian companies and individuals, which pushes energy prices up and could lead to an increase in quotations to $150 per barrel.

De-escalation of tension around Ukraine is not yet expected, so a breakdown of the level of $100 is most likely. The next growth target will be at #105. Investors will continue to follow geopolitical situation, which is now coming to the fore.

Support and resistance

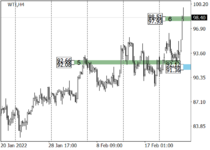

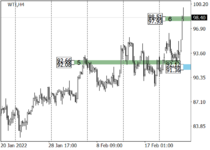

The long-term trend is upward. Today, the price of the asset tested 99.00, approaching as close as possible the level of $100, the breakdown of which, as well as fixing the price above it, will most likely reach the next target in the area of $105.

As part of the medium-term uptrend, the oil price reached the target zone 6 (98.51–97.93). A breakout of this area and consolidation of the price above it will lead to an increase in prices towards the area of the target zone 7 (104.36–103.78). Key support is shifting to 92.12–91.36.

Resistance levels: 100, 105, 110.

Support levels: 95, 92.4, 89.