Thanks for your input tomorton and timsk. Any input is very helpful to me, if it is along my lines of thinking it makes me a bit more confident, and if it is contrary to my thinking it forces me to justify my reasoning to myself and reconfigure if I can't.

1 - simplest is best:

a) easier to follow rules in real time

b) more accurate backtesting is possible

c) the basis of the system should be in line with actual price tendencies

Completely agree with this. I have a tendency to over-complicate things. The probability trade 1.0 was more time consuming to trade in real time since it required checking a basket of stocks and monitoring them until I got what I felt was a good entry point. I have addressed this with the revised version. Once it was entered, it was fairly easy to manage since the rules were clear but I still spent a lot of time screen watching since I didn't have confidence in it (rightfully so) and I ramped up my risk on it to fast. Not a good combo and one I won't repeat.

Another flaw with the 1.0 system was it was not based on the underlying in the moment trend of the stock. I have addressed this with the revised version.

Due to the nature of how these systems have been derived, I do not feel backtesting them is vital. However, as I think you are indicating, it is vital that they should

be able to be backtested fairly easily. If something is extraordinarily difficult to backtest accurately (which the 1.0 system would have been), I can't expect it to be traded reliably. During my testing of the 1.0 system, nearly every day about 7 of the 10 stocks I was watching for the day were knocked out on open by hitting either the target sell or both target entry and target sell points within a few minutes...that really should have been a big red flag from the start and that is why the 1.0 would have been exceptionally time consuming to backtest.

2 - test with variance on one parameter at a time, then you can quantify its effect in isolation

There are tweaks I can make to the 2.0 system if it proves successful to extract more from each trade, but I think I will resist the temptation. It is likely I was overfitting each stocks buy and sell points in the 1.0 system. I do not think this caused it to fail, but it would have likely been an issue had it proven semi-successful.

There is only one item I may play with some if the 2.0 system is not working to my satisfaction. This is the ranking criteria. I will keep this in mind if I get to that point, but I do not expect I will modify it much since I am only using the ranking to get the best possibilities and then am using the line technique and a bit of discretion to make the final decision.

4 - all stocks tend to move together when strong forces hit the market: a varied range of forex pairs would be less correlated with each other.

I was noticing that stocks tend to follow the overall market the more I tested the system. Since I believe the direction of the market as a whole is down, it seems silly to be favoring making long trades. It goes against what I am seeing and what I am thinking.

My impression (which could be completely wrong) is that you're trading U.S. equities in isolation without putting them in the context of their sector and the market as a whole? ... So, going forward, whatever your micro criteria is for stock selection, entry and exit, I urge you to start with a macro view of sector and the market as a whole first - and be guided by what's going on there.

You are absolutely correct in your assessment timsk. I have not been looking at the sectors to see the overall trends first. I believe you are right in that this is vital to do and to use as a basis for the direction of the trade. I have implemented this in my 2.0 system as a final validation for my trade selections. Thank you for the link to the thread with the market breadth indicators.

The simplest is to look at charts of the cash index, along with market breadth indicators such as these if swing trading, and futures charts if day trading. Always take your cue from them and never trade against them.

I think I understand what you are getting at with this but I don't think I understand it completely. At the end of this post I explain my first selection in the 2.0 system which uses general industry indicators. My main confusion is why shouldn't I use market breadth indicators for all the trades made? I thought futures were more for commodities...used by companies with large exposure to specific commodities to hedge the risk of large price fluctuation in the future (and apparently used to hedge the risk of snowfall which I find very comical).

The trade I have narrowed down for Tuesday and possibly the entire week is ARMH (semiconductor). Are you suggesting I take a look at silicon futures before making a daytrade with ARMH since this is a main commodity they use (I'm not sure that even exists...)? Why wouldn't I just look at the general trend of semiconductors instead?

Probability Trade (version 2.0)

The revamped probability system is summarized as follows (note this is a short sell system but I can flip it to be a long system as well):

- Find stocks that are in a downtrend by looking at how many days they have had open to close decreases. I am looking at a 60 day time period, a 15 day time period, and a 5 day time period. The stocks are ranked with the most emphasis given to the 15 day time period using the basic formula: rank = 2.0 * (15 day period down days / 15) + 1.0 * (60 day period down days / 60) + 0.5 * (5 day period down days / 5). The basic screening criteria is the stock must be priced over $20, and the stock must have an average daily volume exceeding 250,000 shares over the past 50 days.

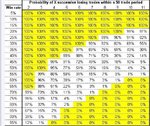

- Look at the top ranked stocks and determine which stocks over the past 15 days exhibit a risk:reward trade as close to 1:1 as possible. This is done by looking at the percent of the time the stocks decrease 1%, 1.5%, 2%, 2.5% and 3% as well as increase those amounts from their open during the day. The target sell is set at the ~50% decrease mark and the stop loss is set at an increase mark only reached a minimal amount (ideally only once over the past 15 days).

- Look at the overall trend of the final stock selections as well as the trend of the sectors they are in. Final selection is based on the stock with the clearest trend that is in adherence to sector trend.

- Once the stock is selected, the trade execution is simple. Short sell at or near the open at or near the open price for the day. Set a limit order for the target buy to cover price and set an alert for when the stop loss price is being approached. If the alert is triggered, buy to cover at the stop loss. If the target buy is not reached, buy at the end of the day (limit order between bid and ask 10 minutes prior to market close, buy at ask if still not bought 5 minutes prior to market close).

To illustrate this fully, I arrived at my selection for Tuesday and likely the entire next week as follows:

After running my screener, the following were the top 8 picks based on the rank.

I eliminated the top pick for a discretionary as well as a strategic reason. Discretionary reason being - although I do not think the oil sector is going to be going up in the short term, I also do not think it will go down much further. I expect it will remain highly volatile in the near future with people trying to guess the bottom. Strategic reason being - target sell would be 2.5% decrease but target stop loss would be in excess of 3%. A 3.5%:2.5% risk:reward is 1:0.714 which is ok, but there are better.

The second pick looks much more promising with a target sell of 1.5% and a stop loss of 1.5% (risk:reward of 1:1).

The third pick looks good based purely on the stats, but since this is a fairly recent addition, it is still trying to find it's baseline which is why there are wild fluctuations. It does seem to have found the baseline where the IPO was set at and I expect this one to disappear from my list in a few days.

The fourth, fifth, and sixth picks look ok, but not a good as the second. I will be keeping a close eye on CBS though since this one has a very clear down trend developed and appears to be consolidating right now before continuing.

The seventh pick does not have a good R:R, and the eight does not have a very well defined trend.

So, since ARMH is my favored pick, I took a closer look at the trend it is in as well as the trend the semiconductor industry is in.

To me, ARMH looks to have a very clear down trend dropping a bit and the consolidating to around the main trend line before dropping down again. It appears to have reached close to the end of it's current consolidation period, so I am expecting it to start dropping again on Tuesday or Wednesday next week. If the price breaks through the main trend (or a better stock presents itself) I will stop trading this stock.

This stock is following the semiconductor trend (clearest when looking at the weekly chart) closely with a drop beginning in June. There appears to be a major support point around the 545 mark and a possible area of support around the 600 level (just above current location).