BigInTheCity

Active member

- Messages

- 134

- Likes

- 2

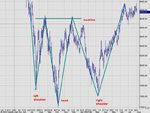

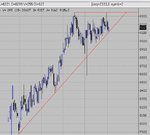

If my analysis is correct the Dow has reached its high for the year!

This was 9361.37 on 31st July 2003

Next stop the 7000s in my humble opinion

GL & GT

This was 9361.37 on 31st July 2003

Next stop the 7000s in my humble opinion

GL & GT