Clash of Styles/Timeframes ?

in real time they are - !!

Please tell me where to get off as the charts are in the wrong place for a long term trade for me, so im at the mercy of the candles - :|

Based on

slow stochs - which is not a hyperactive indicator - a low for a rally was a distinct possibility ....I think I said within 48hrs ...

Whilst I did not go long near the bottom

🙂|)I had to applaud someone who did .... cos the risk was fairly low - using stops (possibly ~ 40pts depending on risk appetite) and the upside for a "multi day" player was pretty good.

The speed of the move was a bit of good fortune

🙂clover: :cheesy

🙂 clearly but that move was in the works ... as I waffled about at the time

😆 ......... when a certain doggy fellow was getting very bearish ..

🙂

Good one RT

----------------------------------------------------------------------------------------------------------------------------------

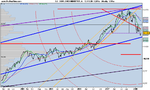

The S&p is slamming into that underside of the old trading range ......... (

everyone can see the potential for overbought near term so I'l skip that..... )

Point is spx

needs to solidly regain (break and hold) 1320...... FIRST.

Okay It sounds silly/obvious cos that's where we closed but it stuck out on the charts for me. Sort of simillar to my observation about the ftse yesterday in advance (better than real time

😆).

Lastly ........ the spx futs have hit around 50% retrate circa 1331 today not sure if it matters or will matter but thought i'd just SHARE it worthless though it may be ........

Good Trading Everyone !