catracho

Well-known member

- Messages

- 355

- Likes

- 34

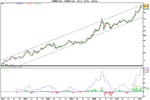

Is FTSE the lead...or the laggard

Long term charts of DOW and DAX show we are at trendline support..but another week "hanging" at these levels may mean another stab lower...(as per FTSE) or has FTSE overdone it on downside (maybe some opportunity there in THAT case)...

All to be revealed soon:clap:

Japan doing its own thing in down trend channel since 1990..!

Long term charts of DOW and DAX show we are at trendline support..but another week "hanging" at these levels may mean another stab lower...(as per FTSE) or has FTSE overdone it on downside (maybe some opportunity there in THAT case)...

All to be revealed soon:clap:

Japan doing its own thing in down trend channel since 1990..!