Ultima markets

Active member

- Messages

- 132

- Likes

- 0

Trade war risks intensify, putting pressure on the US dollar and limiting the upward trend of US stocks

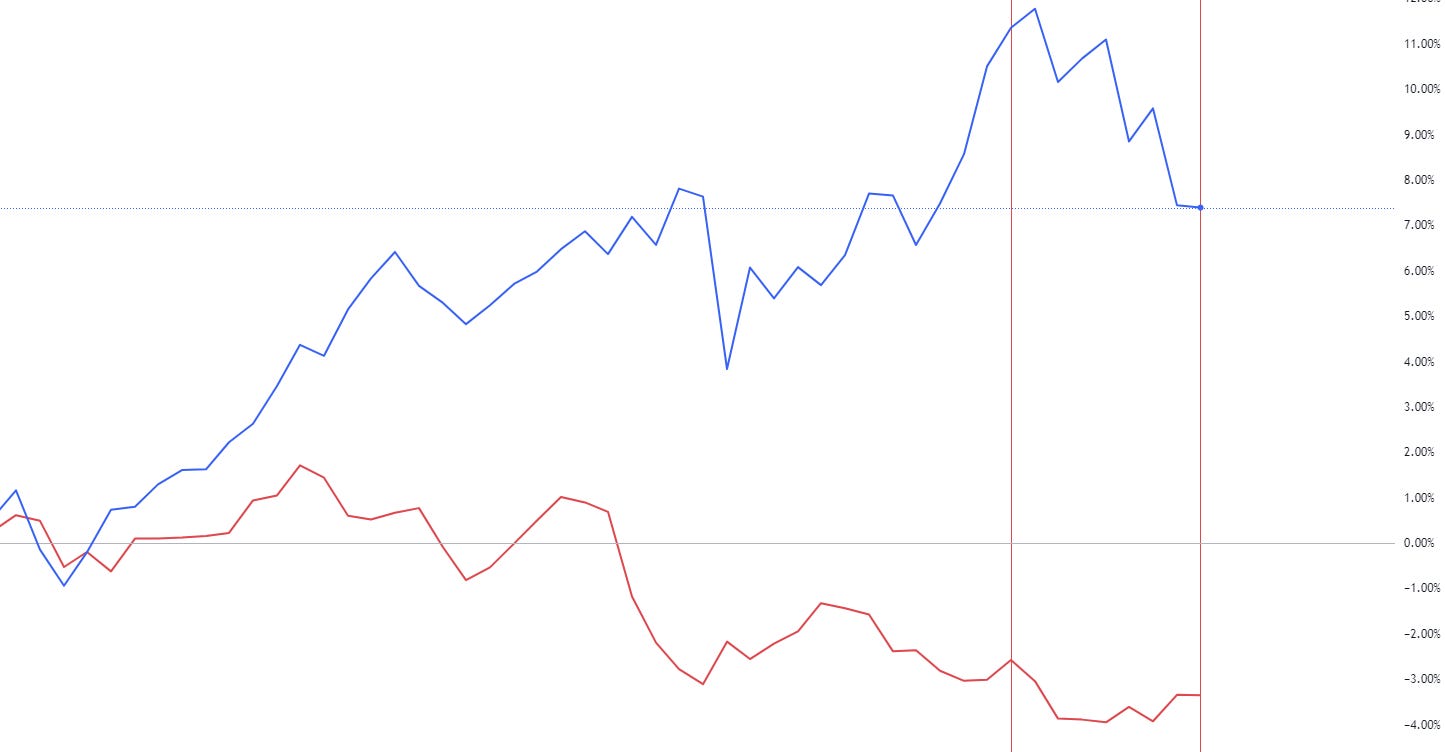

US-China trade relations remain a central focus for global markets. Former US President Trump’s latest comments, including the possibility of imposing a 100% tariff on Chinese imports and a tough stance on China’s rare earth export controls, have further exacerbated tensions.Against this backdrop, the market is balancing optimistic expectations of further Federal Reserve easing on the one hand, and lingering trade risks on the other. This intertwined situation has led to cautious market sentiment, which could quickly shift to risk-off mode if trade tensions escalate.

Market Outlook and Technical Analysis

US dollar: Continued pressure from dovish sentiment

Federal Reserve Chairman Jerome Powell’s earlier dovish comments continued to weigh on the dollar. He cited a significant slowdown in job growth and increased downside risks as reasons for the Fed’s shift to a more accommodative policy stance. Markets are currently pricing in two more rate cuts this year.From a technical perspective, the US Dollar Index (USDX) has fallen below the key support level of 98.50 . This is seen as a bearish signal , suggesting that the US dollar may enter a deeper correction phase.

USDX, daily chart | Source: Ultima Markets MT5

US stocks: Upward momentum capped by trade risks

US stocks remain range-bound. While strong earnings reports and easing expectations have provided a brief respite, trade tensions remain a major upward barrier. The Nasdaq 100 Index faces key resistance between 24,800 and 25,000 points . Failure to break through this range could lead to renewed downward pressure.

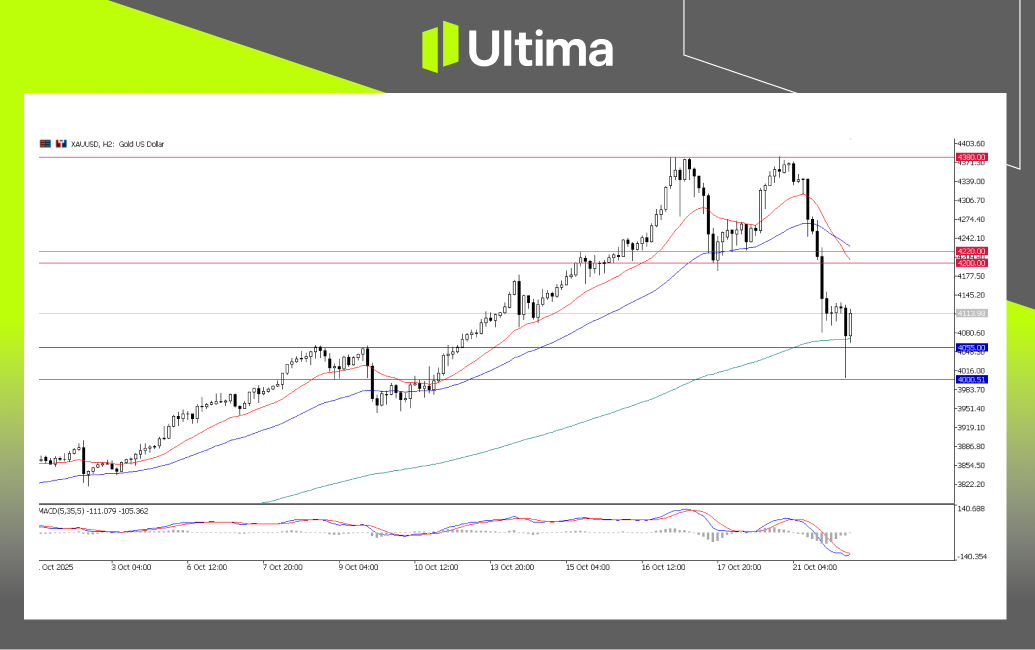

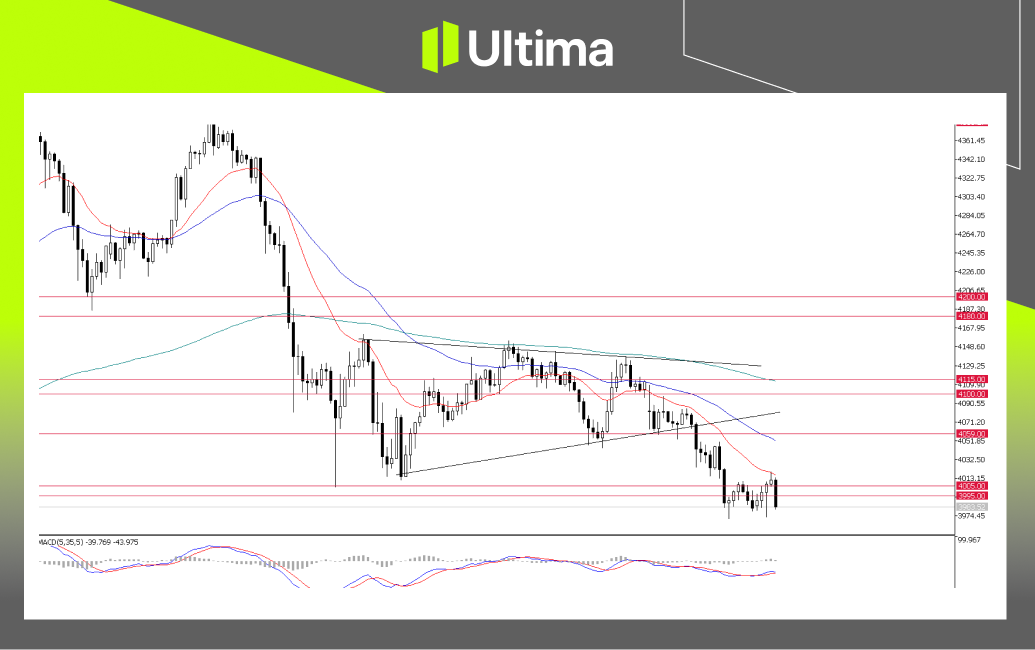

NAS100, 4-hour chart | Source: Ultima Markets MT5

EUR/USD: Swinging between dollar volatility and growth concerns

The Euro/USD pair’s performance is primarily influenced by the US dollar’s dynamics. After breaking below the 1.1600 support level, the pair has rebounded, forming a short-term double bottom pattern . A sustained break above the 1.1600–1.1630 range could pave the way for further gains.

EUR/USD, 2-hour chart | Source: Ultima Market MT5

Risk Warning : Trading leveraged derivatives involves a high level of risk and may result in capital loss.

Disclaimer : The commentary, news, research, analysis, prices, and other information contained herein are for informational purposes only and are intended to assist readers in understanding market conditions. They do not constitute investment advice. Ultima Markets has taken reasonable steps to ensure the accuracy of this information, but its accuracy cannot be guaranteed and is subject to change without notice. Ultima Markets assumes no liability for any loss or damage (including, without limitation, lost profit) arising directly or indirectly from the use of or reliance on such information.