Ultima markets

Active member

- Messages

- 132

- Likes

- 0

US CPI remained stable in July, but core inflation rose to a six-month high! Betting on a September rate cut heats up, and the dollar weakens

The latest US Consumer Price Index (CPI) data for July presented mixed signals. While the headline CPI remained stable at 2.7% year-over-year, in line with market expectations for contained inflation, core inflation, excluding food and energy, unexpectedly accelerated, jumping to 3.1% year-over-year, the largest annual increase in six months. This data boosted market optimism that the Federal Reserve (Fed) will cut interest rates in September, contributing to a weakening of the US dollar and pushing US stocks to new record highs.The dual signals behind the data: Inflation is controllable vs. core stubbornness

- Overall inflation remained stable, with energy and food prices declining : The overall CPI rose by 2.7% year-on-year in July, slightly below market expectations. This was mainly due to falling energy prices, including a 2.2% drop in gasoline prices in July, while annual food inflation remained at 2.9%.

- Core inflation accelerated, with service prices being the main driver : The annual core inflation rate jumped from 2.9% to 3.1%, the fastest pace in six months. The increase was mainly driven by service prices, including sharp increases in airfare, medical care, and housing.

Market reaction: Over 90% of bets on a September rate cut push the stock market to a new high

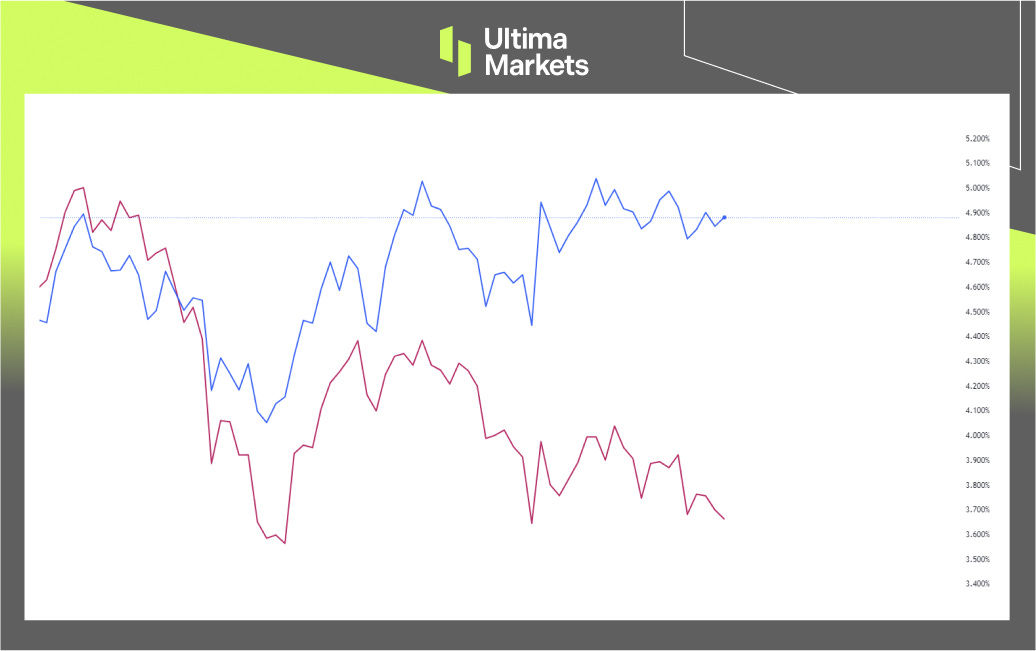

The data, which showed inflation was under control but stubborn at its core, temporarily eased market concerns about stagflation and strengthened risk appetite. Wall Street reacted positively:- Stocks : The S&P 500 and Nasdaq both hit record highs, while the Dow Jones also posted gains.

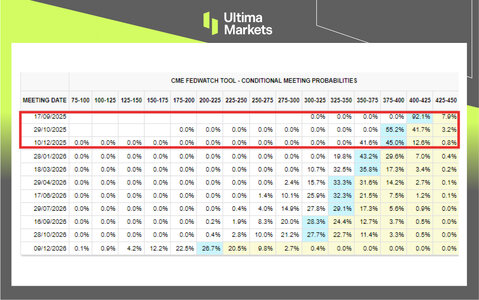

- Rate cut expectations : According to CME FedWatch data, the interest rate swap market is currently betting that the probability of the Federal Reserve cutting interest rates by 25 basis points in September has exceeded 90%, and it is expected that there may be as many as three cumulative rate cuts in 2025.

- Probability of a rate cut at the Federal Reserve meeting

Image Credit: Source: CME Group

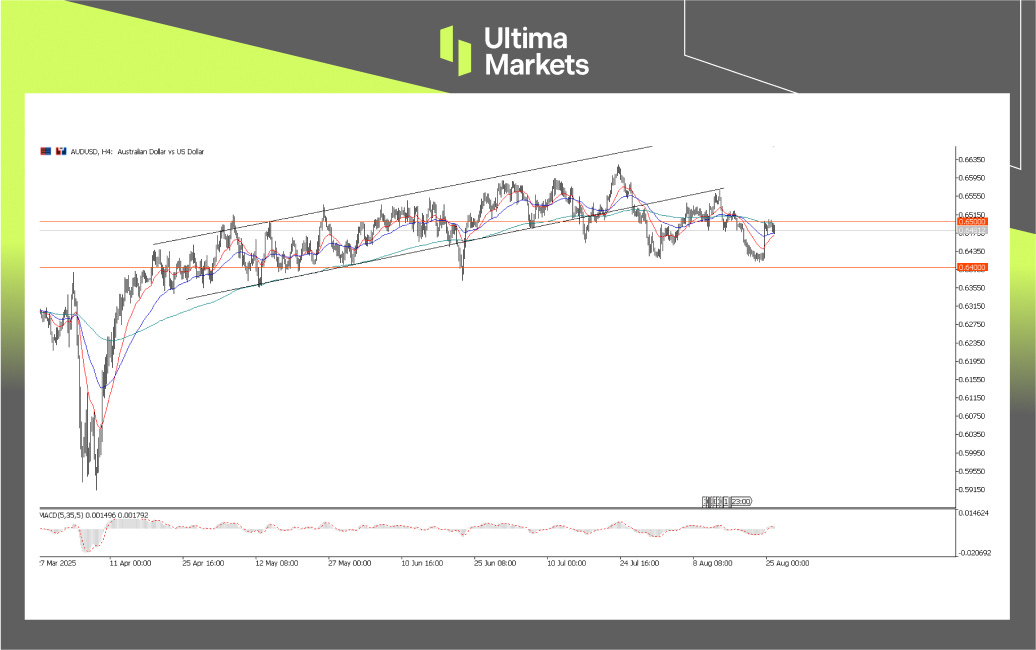

The US dollar weakens, and technical analysis focuses on key support

Compared with the strong performance of the stock market, the US dollar weakened as the market increased its bets on the Federal Reserve's easing. The US dollar index (USDX) fell below 98, but remained above the recent low of around 97.80.Image source: US Dollar Index (USDX) daily chart | Source: Ultima Market MT5

If the US dollar index clearly falls below 97.80, it may open up further downward space; on the contrary, if this level can provide solid support, the US dollar still has a chance to stabilize.

Follow-up observation: Producer Price Index (PPI) and the impact of tariffs

While the CPI data provided a brief boost of optimism, stubborn core inflation remains a concern. Market attention will next turn to Thursday's Producer Price Index (PPI) data, which will provide clearer insights into how the new tariffs are transmitting to US inflation. A cooling PPI reading could further support stocks and weaken the dollar; a strong reading could reverse market optimism surrounding a Federal Reserve rate cut.Risk Warning: Leveraged derivatives are complex and come with a high risk of losing capital rapidly due to the leverage effect. You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your capital.