NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

hey all

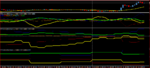

interesting morning.....one had to brave a USD YEN divorce to trade that Dow rise .....the USD is certainly having a good Feb so far and wont be sold 😎

GBP and Yen sure make strange bedfellows....although both are certainly the Dogs of the G8 in the last month or so......

N

interesting morning.....one had to brave a USD YEN divorce to trade that Dow rise .....the USD is certainly having a good Feb so far and wont be sold 😎

GBP and Yen sure make strange bedfellows....although both are certainly the Dogs of the G8 in the last month or so......

N