You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Correlation Trading - Basic Ideas and Strategies

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

here we are again ..

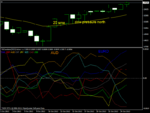

Heres the core charts I use .............left is a 20ma daily ..........right is a weekly Xmen on a 1ma

last 2 weeks in my absence have seen a strong AUD (week 1) dog currencies were USD and Yen

Week 2 has seen a flying Euro this week....... and the NZD got hit ......

CAD has also been pretty poor overall in last 2 weeks

the key to trading is keeping it simple .............the stuff above may not have fancy bells and whistles on it but it works :smart:

and its all here for free so why not take some time to look over strengthmeter based trading and see if it could work for you ?......😎

N

Heres the core charts I use .............left is a 20ma daily ..........right is a weekly Xmen on a 1ma

last 2 weeks in my absence have seen a strong AUD (week 1) dog currencies were USD and Yen

Week 2 has seen a flying Euro this week....... and the NZD got hit ......

CAD has also been pretty poor overall in last 2 weeks

the key to trading is keeping it simple .............the stuff above may not have fancy bells and whistles on it but it works :smart:

and its all here for free so why not take some time to look over strengthmeter based trading and see if it could work for you ?......😎

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Whoever created that stupid trading on the beach image that is in all the fast talking sellinars here's an alternative image of trading in the sun

This was me about 10 mins. Before a virus Attacked my laptop and took me out for the rest of the holiday

Hahahahaaha. 🙂

N

This was me about 10 mins. Before a virus Attacked my laptop and took me out for the rest of the holiday

Hahahahaaha. 🙂

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

hey all

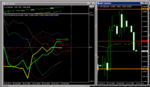

heres the 2 main charts i use on this thread now .....

on the left I see a AUD getting south now on the daily (20ma).....and its into week 2 of sells on the right chart (1 ma) weekly

tempting sell missed on the AUD...........probably was into USD to stick to my general plan of USD pairs........or go for CAD or Yen buys as both moving north on the weekly

on the last chart can you see 2 entry options ..... the middle horizontal lines

1 line was when AUD was falling below the Zero (aggressive / early) 0.9563

next line was when AUD crossed the USD on the pairs 20ma 0.9548

both were acceptable.........i would still prefer the Dow to be falling though

N

heres the 2 main charts i use on this thread now .....

on the left I see a AUD getting south now on the daily (20ma).....and its into week 2 of sells on the right chart (1 ma) weekly

tempting sell missed on the AUD...........probably was into USD to stick to my general plan of USD pairs........or go for CAD or Yen buys as both moving north on the weekly

on the last chart can you see 2 entry options ..... the middle horizontal lines

1 line was when AUD was falling below the Zero (aggressive / early) 0.9563

next line was when AUD crossed the USD on the pairs 20ma 0.9548

both were acceptable.........i would still prefer the Dow to be falling though

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

I am also waiting for the GBP to falter below the Zero on the left chart for a cheeky G/U sell trade........😉

and that is my call on the weekly trading competition .......

I just need the GBP to fall below the Zero which I anticipate to be at in or around the 1.6090's ................(right chart )

but it must show on the indicator .......:smart:

N

and that is my call on the weekly trading competition .......

I just need the GBP to fall below the Zero which I anticipate to be at in or around the 1.6090's ................(right chart )

but it must show on the indicator .......:smart:

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

heres something I found on my recent travels through my archives......just some background on Currency Indexes and some historic observations......

I am developing my own "absolute" indexes at present and may launch something in the future regarding longer term hedge / trading of currencies.........

N

I am developing my own "absolute" indexes at present and may launch something in the future regarding longer term hedge / trading of currencies.........

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Whoever created that stupid trading on the beach image that is in all the fast talking sellinars here's an alternative image of trading in the sun.......

you need power feeds .....a decent secure internet link and speeds .....a shady place to see the damn screen ......and some peace and quiet ...........😎

This was me about 10 mins. Before a virus Attacked my laptop and took me out for the rest of the holiday

Hahahahaaha. 🙂

N

you need power feeds .....a decent secure internet link and speeds .....a shady place to see the damn screen ......and some peace and quiet ...........😎

This was me about 10 mins. Before a virus Attacked my laptop and took me out for the rest of the holiday

Hahahahaaha. 🙂

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

I am also waiting for the GBP to falter below the Zero on the left chart for a cheeky G/U sell trade........😉

and that is my call on the weekly trading competition .......

I just need the GBP to fall below the Zero which I anticipate to be at in or around the 1.6090's ................(right chart )

but it must show on the indicator .......:smart:

N

mornin all

yesterday that g/u sell trade above went on.......... i'm about 50 pips up then in the weekly trading competition ......I advocate to go to B/E and let it run ......

and interestingly the trigger would have been for me the USD going above the Zero instead of the anticipated Red fall below the Zero..........a matter of a few pips here and there but every pip counts

the hell .....its only a competition 😉

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

me again

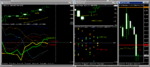

ok heres the more usual charts I post daily

with the continued bullish action on the dow (4th week of rises) I really would expect to see some renewed pressure on the Yen and or the USD to fall again now.....

so calling sells on A/U and G/U (shown) this week are probably short-termist trades that I would be very surprised will survive the week....so be warned.....

on the left daily FXcorrelator 20ma setting........can you see all those nasty convergence (heading back to Zero) signals on most of the lines ? .........we are therefore experiencing a reduction in market momentum on this particular chart/pattern/phase......

only the yellow Yen and the red GBP are showing DIVERGENCE .......both peeking south of the Zero with early early bear signals ....

my money is on a Yen run south for rest of the week ......and watch the flying NZD.......but dont quote me 🙄

later

N

ok heres the more usual charts I post daily

with the continued bullish action on the dow (4th week of rises) I really would expect to see some renewed pressure on the Yen and or the USD to fall again now.....

so calling sells on A/U and G/U (shown) this week are probably short-termist trades that I would be very surprised will survive the week....so be warned.....

on the left daily FXcorrelator 20ma setting........can you see all those nasty convergence (heading back to Zero) signals on most of the lines ? .........we are therefore experiencing a reduction in market momentum on this particular chart/pattern/phase......

only the yellow Yen and the red GBP are showing DIVERGENCE .......both peeking south of the Zero with early early bear signals ....

my money is on a Yen run south for rest of the week ......and watch the flying NZD.......but dont quote me 🙄

later

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

ok must go as duty calls

after my earlier musing here on the ole thread I decided to call it a day on the trading game .......that G/U wont hold to the pips I have .............

closed around 50 pips ......I think i will hold to 4th place for October ..not bad seeing as I missed 2 weeks of the month ?

cheers

N

http://www.trade2win.com/boards/t2w...oct-2013-week-5-final-week-2.html#post2211920

after my earlier musing here on the ole thread I decided to call it a day on the trading game .......that G/U wont hold to the pips I have .............

closed around 50 pips ......I think i will hold to 4th place for October ..not bad seeing as I missed 2 weeks of the month ?

cheers

N

http://www.trade2win.com/boards/t2w...oct-2013-week-5-final-week-2.html#post2211920

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

ok must go as duty calls

after my earlier musing here on the ole thread I decided to call it a day on the trading game .......that G/U wont hold to the pips I have .............

closed around 50 pips ......I think i will hold to 4th place for October ..not bad seeing as I missed 2 weeks of the month ?

cheers

N

http://www.trade2win.com/boards/t2w...oct-2013-week-5-final-week-2.html#post2211920

Mornin all

That post of mine yesterday sums up the paradigms and paradoxes of trading that will drive you crazy ..........and bear in mind this is discussing a trade that had a positive outcome vs the many that will leave newbies in loss.....:whistling

take the money or let it run ?

I took about 50 pips profit off a trade I knew would retrace & potentially go negative ..........

The Trade at this point had actually maxed at 70 pips ...so I missed 20 pips profit.....

The trade then went back to about just 20 pips profit vs entry......

and now is back at around 80 pips profit and already having maxed at 100 pips

so there you have it .........based on the spread I could have been between 20 pips and 100 pips in profit based on my exit .......

so is 50 pips good or bad ?

welcome to trading :smart:

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

hey all

not much to say really .......I am teased by my G/U early exit which is pretty much the only trade on offer below looking at the divergences on the left 20ma chart.......Yen is joining USD north of the zero......contra to Dows strength

so perhaps back into the breach dear friends ? 🙄

N

not much to say really .......I am teased by my G/U early exit which is pretty much the only trade on offer below looking at the divergences on the left 20ma chart.......Yen is joining USD north of the zero......contra to Dows strength

so perhaps back into the breach dear friends ? 🙄

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

hmmmm........

as mentioned .....just got a feeling on this pair............time will tell

N

hmmmm

difficult one ..........it came into trade signal area but dont hold your breath as Yen has gone positive as already discussed

frustrating :whistling

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

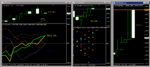

hey all

final day of the week...........

USD and Yen are pushing harder now on that left daily chart (daily 20ma)......and Dow consolidates in support.......

Euro taking hits and in terms of weeks Sell movements....and the CAD has gone king kong bull on that middle chart ....(weekly 1ma xmen)

so the trade of the week is a EURCAD reversal (see right chart).....300 pips so far

that would have been a very very good call.....but we would have needed lower TF charts to pick it up earlier 😱

and the damn G/U taunts me with renewed selling action :whistling

later

N

final day of the week...........

USD and Yen are pushing harder now on that left daily chart (daily 20ma)......and Dow consolidates in support.......

Euro taking hits and in terms of weeks Sell movements....and the CAD has gone king kong bull on that middle chart ....(weekly 1ma xmen)

so the trade of the week is a EURCAD reversal (see right chart).....300 pips so far

that would have been a very very good call.....but we would have needed lower TF charts to pick it up earlier 😱

and the damn G/U taunts me with renewed selling action :whistling

later

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Mornin all

That post of mine yesterday sums up the paradigms and paradoxes of trading that will drive you crazy ..........and bear in mind this is discussing a trade that had a positive outcome vs the many that will leave newbies in loss.....:whistling

take the money or let it run ?

I took about 50 pips profit off a trade I knew would retrace & potentially go negative ..........

The Trade at this point had actually maxed at 70 pips ...so I missed 20 pips profit.....

The trade then went back to about just 20 pips profit vs entry......

and now is back at around 80 pips profit and already having maxed at 100 pips

so there you have it .........based on the spread I could have been between 20 pips and 100 pips in profit based on my exit .......

so is 50 pips good or bad ?

welcome to trading :smart:

N

ok ok ......I bailed at 50 pips profit (sensing the retrace) and was not around for the second sell signal

its recovered to now be at 150 pips now from the original levels ...............I bloody hate the G/U !!!!

hahahaha :innocent:

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Similar threads

- Replies

- 0

- Views

- 3K