hmm, having thought about this some more, if a company is trading below book value is this not because smarter people that me are looking in detail at the FA of the company and are selling it down to those levels. Is FA already in the price?

belflan

Belflan

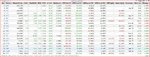

Starting with the book value - although it is governed by regulatory rules that define how items should be treated for accounting purposes it is not an exact science. Take a look at the following link which shows the balance sheet for Yahoo

Financial Statements for Yahoo! Inc. - Google Finance

There is a range of subjectivity in the breakdown of the book value of this company. Figures such as the cash & equivalents have a low level of subjectivity - it's basically what the bank statements say. "Accounts receivable - trade net" has more subjectivity. This represents the amount owing to the company from customers who have not yet paid their invoices. This will include an evaluation of bad debt write-off from customers who might not pay, so it contains more of a subjective element. "Goodwill - net" is more subjective still - it represents that element of the business that makes it more than just the (to use an earlier analogy) bricks and mortar. It represents brand loyalty and awareness for example. Thus the book value itself is not precise, but it has adhered to strict accounting guidelines and will have been audited.

The book price will of course form a basis upon which the market price is based, but the market price will bring into play other factors that have not been or cannot be (for accounting reasons) included in the book price. The market price depends upon the market's perception of the company and what it is worth to the shareholder as a dividend stream and/or capital growth potential.

This will include factors such as whether directors are buying/selling company shares, profit warnings, news about new research/potential orders, directors resignations/appointments, potential legal action, takeover bids and a whole host of other factors. So fundamental analysis goes beyond looking at just what is reflected in the books.

The market price will also reflect the general mood of the market. If the market as a whole is a bull market then market price may increase even though the book value remains static (and in fact even if the specific fundamentals of the company remain static).

If you look at the links from Damoradan that I posted recently you will see that asset valuation is not precise and there are many ways to value a company or its shares. There is no single correct answer as Damoradan takes pains to point out.

Eventually, in any timeframe, discrepancies in value i.e. overbought and oversold situations should resolve themselves and the cycle will reverse. This is in my view the underlying concept behind Grey1's strategy for both long term swings (with bias on FA evaluation of OB/OS) and short term intraday (with bias on TA evaluation of OB/OS)

Charlton