We should all know the 2% rule. Devised by Dr Alex Elder. Says capital risked per trade should be not more than 2% of your total account.The 2 % is fine for experienced and skilled traders ,but IMHO average traders should not risk more than 0.5 % per trade.

Many new traders will have a untested system/method and will be moving from method to method , until they find their comfort zone.During this learning curve , they will make a lot of mistakes , these mistakes will be additional losses , in addition to the system losses .If a method has a draw down period of 15 losses, the beginner will probably have 30 to 40 losses.

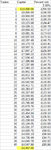

If a novice risks 2% per trade ,40 losses will amount to 80% of account.If the novice risks 0.25 % per trade , 40 losses will amount to 10 % of the equity loss .So this is sound figure to risk.

To learn about traders and mistakes , ....