Dentalfloss

Legendary member

- Messages

- 63,404

- Likes

- 3,726

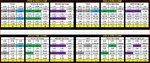

15320 area still magnetic

all trades based on that area for the last 10 days...crazy stuff

could have sat on a beach and placed the orders from my phone

no need to be in front of a computer

all trades based on that area for the last 10 days...crazy stuff

could have sat on a beach and placed the orders from my phone

no need to be in front of a computer