You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Dentalfloss

Legendary member

- Messages

- 63,404

- Likes

- 3,726

mornin all

Average hourly earnings is the big number for today

what percentage up or down

Average hourly earnings is the big number for today

what percentage up or down

mornin all

Average hourly earnings is the big number for today

what percentage up or down

isn't NFP today?

isn't NFP today?

yes

things have been too quiet on this board. I think most people have a new year's resolution of not to gamble, I mean trade.[/QUOTE]

good trading is not gamble, is work........ I was watching the screen for two hour before I took my only trade today, some days I take none.......

the other week I took 17 in 4 hours and yes I was gambling....

things have been too quiet on this board. I think most people have a new year's resolution of not to gamble, I mean trade.[/QUOTE]

good trading is not gamble, is work........ I was watching the screen for two hour before I took my only trade today, some days I take none.......

the other week I took 17 in 4 hours and yes I was gambling....

I was provoking a response to get some comments on this board otherwise it just looks like Jessi and me are spamming it 👍

Dentalfloss

Legendary member

- Messages

- 63,404

- Likes

- 3,726

** U.S.A. - December Payrolls / Unemployment **

- Market expectations for today's Payrolls look to be skewed to the upside of the consensus forecast of 240K headline and 230K Private, in no small part predicated on the modestly better than expected ADP reading and solid ISM Employment indices. However December ADP misses relative to official Payrolls have often been quite large in recent years, with a skew to Payrolls turning out weaker than the ADP (above all in the preliminary estimate), and then there are the usual caveats about revisions. Be that as it may, the December reading would have to be far weaker (sub 150K) than expected for the Q4 monthly average gain to be lower than Q3's +239K. Given that the December NFIB survey of small businesses (which are the key contributor to job creation) saw "Plans to hire" improve 4 points to a net 15% (seasonally adjusted), with the NFIB noting that this was “one of the stronger readings” in the survey's history, the downside risks look to be rather limited, even though the NFIB survey also noted that companies were struggling to find qualified workers. The Household survey is expected to show a further drop in the Unemployment Rate to 5.7% from 5.8%, but both the Underemployment Rate which fell to a cyclical low of 11.4% in November, and the Participation Rate, which at 62.8% is languishing just above its cyclical low of 62.7% will also require attention. In terms of measuring the overall health of the economy the Average Workweek remains key and this is seen unchanged at its cyclical high of 34.6, but for markets fretting about the timing of the first Fed rate hike, Average Hourly Earnings will be perhaps most sensitive, with a more modest 0.2% m/m rise expected after a 0.4% m/m jump in November (though this followed a protracted period of lower than expected readings), which would see the y/y rate edge up to 2.2% from 2.1%, but still short of the July 2011 cyclical high of 2.3%, and per se benign.

from marc ostwald

- Market expectations for today's Payrolls look to be skewed to the upside of the consensus forecast of 240K headline and 230K Private, in no small part predicated on the modestly better than expected ADP reading and solid ISM Employment indices. However December ADP misses relative to official Payrolls have often been quite large in recent years, with a skew to Payrolls turning out weaker than the ADP (above all in the preliminary estimate), and then there are the usual caveats about revisions. Be that as it may, the December reading would have to be far weaker (sub 150K) than expected for the Q4 monthly average gain to be lower than Q3's +239K. Given that the December NFIB survey of small businesses (which are the key contributor to job creation) saw "Plans to hire" improve 4 points to a net 15% (seasonally adjusted), with the NFIB noting that this was “one of the stronger readings” in the survey's history, the downside risks look to be rather limited, even though the NFIB survey also noted that companies were struggling to find qualified workers. The Household survey is expected to show a further drop in the Unemployment Rate to 5.7% from 5.8%, but both the Underemployment Rate which fell to a cyclical low of 11.4% in November, and the Participation Rate, which at 62.8% is languishing just above its cyclical low of 62.7% will also require attention. In terms of measuring the overall health of the economy the Average Workweek remains key and this is seen unchanged at its cyclical high of 34.6, but for markets fretting about the timing of the first Fed rate hike, Average Hourly Earnings will be perhaps most sensitive, with a more modest 0.2% m/m rise expected after a 0.4% m/m jump in November (though this followed a protracted period of lower than expected readings), which would see the y/y rate edge up to 2.2% from 2.1%, but still short of the July 2011 cyclical high of 2.3%, and per se benign.

from marc ostwald

Jessi_trader

Veteren member

- Messages

- 4,110

- Likes

- 172

short @ 9806

if we can close below 9824 at 10am then we have some more downside for sure

You can thank me now :clap:

Jessi_trader

Veteren member

- Messages

- 4,110

- Likes

- 172

short @ 9806

limit 9750

I was provoking a response to get some comments on this board otherwise it just looks like Jessi and me are spamming it 👍

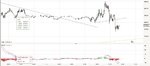

I see.......and I was just trying to make conversation or communication......😢 here my only trade: clearly a range day and I shorted the new extreme below the reversal bar, risk 5 made 10. (EU)

Also yesterday only on e trade, I like 4 per day, but not every day is Christmas .....

Attachments

limit 9750

9760 surely?

I see.......and I was just trying to make conversation or communication......😢 here my only trade: clearly a range day and I shorted the new extreme below the reversal bar, risk 5 made 10. (EU)

Also yesterday only on e trade, I like 4 per day, but not every day is Christmas .....

Good stuff, I appreciate the contribution

Jessi_trader

Veteren member

- Messages

- 4,110

- Likes

- 172

9760 surely?

adjusted to 9760, yes

Jessi_trader

Veteren member

- Messages

- 4,110

- Likes

- 172

adjusted to 9760, yes

Actually it goes bit lower than 9760

Have a look at chat and see the yellow line which is upper boundary of channel I posted yesterday.

Attachments

Jessi_trader

Veteren member

- Messages

- 4,110

- Likes

- 172

Actually it goes bit lower than 9760

Have a look at chat and see the yellow line which is upper boundary of channel I posted yesterday.

yes around 56 on my chart, but i allow 5 points or so just to make sure limit is reached

Similar threads

- Replies

- 1

- Views

- 2K