Posting this at 2am London Time so that traders who follow the London

and NY Sessions of the S&P 500 Futures can review and react when they start

their day.

Here is an example of the preliminary prediction we provide for students, for the coming week

----------------------------------------------------

The E-Mini S&P 500 Future continuous contract is currently trading around

$6,879.50, having closed the previous week with modest gains. Here's a breakdown of what to expect:

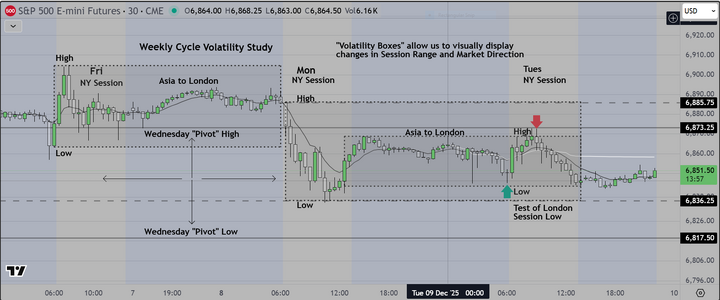

- Consolidation: The primary driver for muted action is the lack of major economic reports scheduled for release on Monday, December 8. The significant events, including the US Consumer Inflation Expectations and the Federal Reserve's rate decision, are later in the week. This typically leads to a "wait-and-see" approach from institutional investors, keeping the price in a relatively tight range.

- Lack of Overnight Volatility: Overnight futures action has been little changed, with S&P 500 futures inching only slightly higher on Sunday evening after the major indexes logged their second straight weekly gain. This continuation of stability suggests no major surprises over the weekend that would trigger a gap open or significant directional bias.

- Technical Levels: The market has strong support and resistance levels from last week's trading range of approximately $6,856.75 to $6,905.00. Traders should look for the open to respect these boundaries unless new, unexpected information emerges

Important note

- Potential for Intraday Swings: While the open might be quiet, as the day progresses, we could see typical intraday volatility as participants jockey for position ahead of the week's key risk events. Watch for potential quick moves if any minor news crosses the wire or large orders are executed in low volume periods.

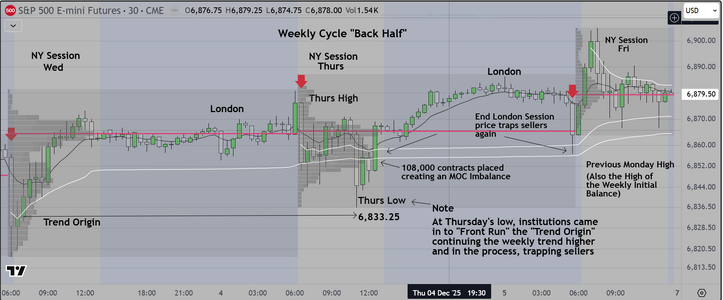

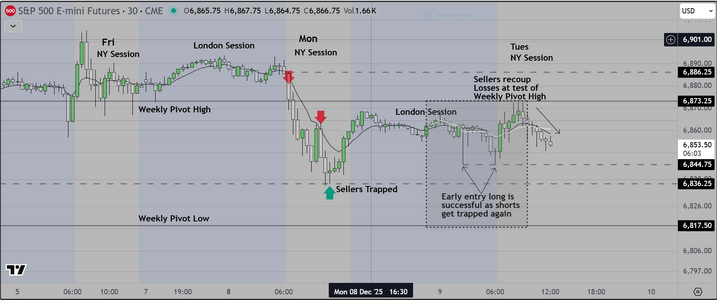

Previous price action (New York Session) is characterized as follows

1) Trading Range Open (overlapping candles with prominent tails).

2) Breaking our of the range (lower) first to Test a Key Reference (Previous Charts Identify "Key References")

3) At each Downside "Test" Institutions came in to buy (with increased volume) trapping sellers.

4) Buyers remain "in control" currently. Mobilizing significant "buy volume" at critical Downside tests.

5) Institutional Sellers have been unwilling to commit enough sell volume to offset buyers

PREDICTION

Until we see more "high impact" economic news, we expect previous pattern to continue.