Hello Everyone

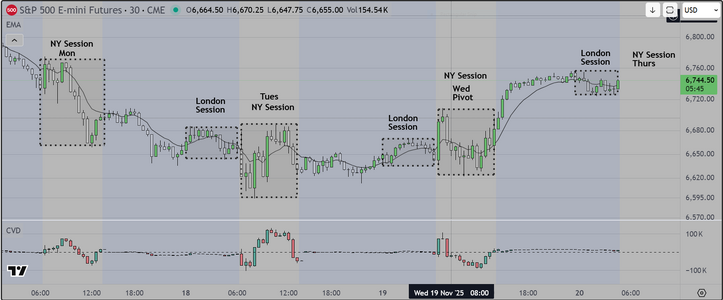

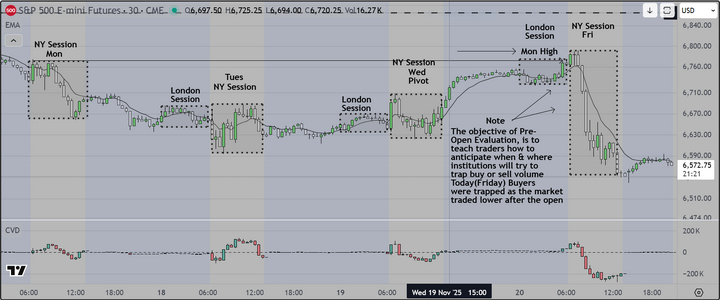

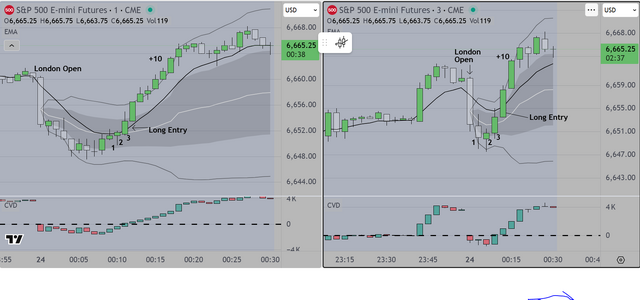

Here is a "Market Recap" chart showing the price action from the previous sessions

It starts with Asia, moving to London, and finally to NY session. It covers the ES/Euro

"Overlap" period which is what most professionals choose to trade, because of the

opportunities it can provide.

1)The basic premise is that the London Session often exhibits "drift" (there is research on

this subject from the NY Fed), so when it moves directionally, one has ask "what is the

purpose"? In this instance, the London market is "staging" inventory (getting short)

in anticipation of upcoming negative news? We think so. AND that negative news

would be A) the US FED deciding not to lower interest rates, and B) Economic News

that might show that the US economy is having problems (inflation for example).

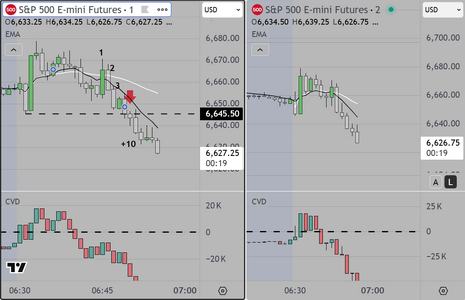

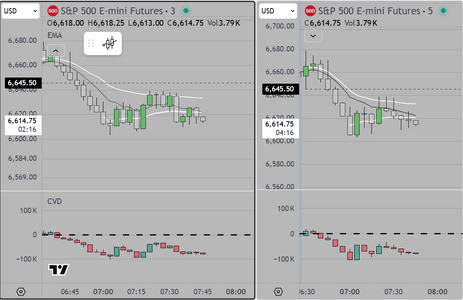

2) When the NY session opens, the Market tries to move higher twice and fails. We

have already described this in previous posts (professionals call this a "H2") and once we

see that second attempt fail, most skilled operators will be ready to sell it down.

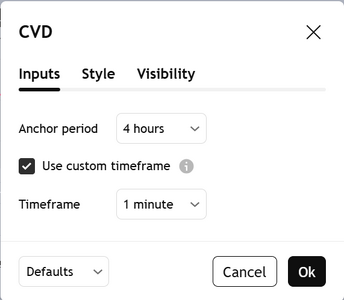

Timing

We outlined the open and close of the US/Euro Overlap. Notice how the market moves

lower right at the CLOSE of the overlap. Skilled traders learn to think in terms of "timed

opportunities" and when the timing and price action lines up, they are able to trade

with confidence (they can take a position and hold it long enough to make significant

profit, rather than just scalping for 1 or 2 points and hoping not to get stopped out.

Its all about understanding the logic prior to the open, then confirming the price action

in real time, and finally, taking, and managing the trades. These are the skills a good

professional has to learn.

Good luck

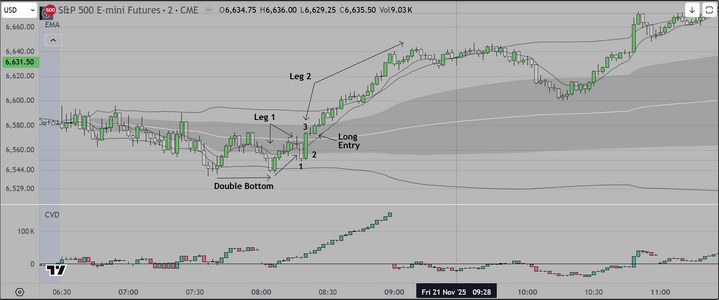

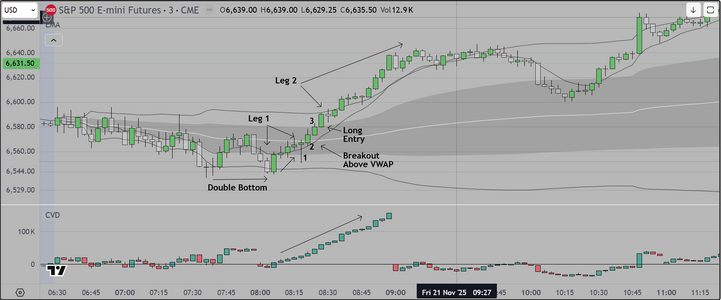

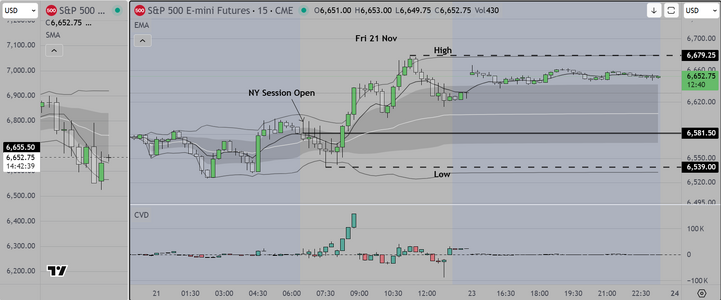

Here is a "Market Recap" chart showing the price action from the previous sessions

It starts with Asia, moving to London, and finally to NY session. It covers the ES/Euro

"Overlap" period which is what most professionals choose to trade, because of the

opportunities it can provide.

1)The basic premise is that the London Session often exhibits "drift" (there is research on

this subject from the NY Fed), so when it moves directionally, one has ask "what is the

purpose"? In this instance, the London market is "staging" inventory (getting short)

in anticipation of upcoming negative news? We think so. AND that negative news

would be A) the US FED deciding not to lower interest rates, and B) Economic News

that might show that the US economy is having problems (inflation for example).

2) When the NY session opens, the Market tries to move higher twice and fails. We

have already described this in previous posts (professionals call this a "H2") and once we

see that second attempt fail, most skilled operators will be ready to sell it down.

Timing

We outlined the open and close of the US/Euro Overlap. Notice how the market moves

lower right at the CLOSE of the overlap. Skilled traders learn to think in terms of "timed

opportunities" and when the timing and price action lines up, they are able to trade

with confidence (they can take a position and hold it long enough to make significant

profit, rather than just scalping for 1 or 2 points and hoping not to get stopped out.

Its all about understanding the logic prior to the open, then confirming the price action

in real time, and finally, taking, and managing the trades. These are the skills a good

professional has to learn.

Good luck