You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Our final trade for Friday 11-7

We acknowledge that this is not for everyone

as it is evening in London and people have lives to live.

For those who may want to obtain this kind of reward

THIS is the cost in time, and of course there is very real

risk involved as well

This last trade of the evening was profitable at +20 if held

The reason we held (it is 1pm in the afternoon here) is that

We anticipated that institutions would place MOC (Market on Close)

orders that would create an imbalance on the "Buy Side" toward

the close of the session. That is exactly what happened, lifting

the market.

Our mentor offered the following comment regarding the "Power Hour

Trade in general.. We asked him whether this kind of trading was considered

"aggressive", and he replied "yes it certainly is" and "I have lost money on

occasion with this trade." When pressed further, he suggested the following

"Generally speaking, "aggressive trading works well if you are skilled

and accept that sometimes you will lose. It's the world in which we operate

We are paid to accept (and manage) risks like this. The best traders I know tend to

be aggressive and like professional athletes, they learn not to let the inevitable

periodic losses injure them emotionally. Just stay within the parameters of

your account size. Never risk more than 1 or 2% max.

Good Luck

We acknowledge that this is not for everyone

as it is evening in London and people have lives to live.

For those who may want to obtain this kind of reward

THIS is the cost in time, and of course there is very real

risk involved as well

This last trade of the evening was profitable at +20 if held

The reason we held (it is 1pm in the afternoon here) is that

We anticipated that institutions would place MOC (Market on Close)

orders that would create an imbalance on the "Buy Side" toward

the close of the session. That is exactly what happened, lifting

the market.

Our mentor offered the following comment regarding the "Power Hour

Trade in general.. We asked him whether this kind of trading was considered

"aggressive", and he replied "yes it certainly is" and "I have lost money on

occasion with this trade." When pressed further, he suggested the following

"Generally speaking, "aggressive trading works well if you are skilled

and accept that sometimes you will lose. It's the world in which we operate

We are paid to accept (and manage) risks like this. The best traders I know tend to

be aggressive and like professional athletes, they learn not to let the inevitable

periodic losses injure them emotionally. Just stay within the parameters of

your account size. Never risk more than 1 or 2% max.

Good Luck

Attachments

Last edited:

Hello London & Euro Traders

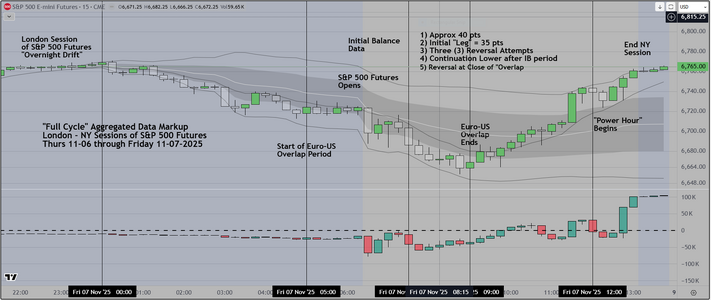

It is Saturday and I have completed my "Full Cycle" Markup

for the time period Thursday 6 Nov to Friday 7 Nov 2025

This chart shows the price action and presents (some though not all)

of the "aggregated" data that we obtained during these periods. We

use this to inform our trades in subsequent sessions. Skilled operators

who know how to use this data, have a significant edge over non-skilled

participants. For example, because I do this every weekend, I knew prior to the

NY open, that the "First Leg" would likely provide an opportunity to obtain

(at minimum) +10 and likely +20 pts IF I could find a reasonable setup to trade

in the direction of the previous trend (professionals call this "the drift")

After that, one looks for evidence that the market is responding to current news

which is either economic releases or political and can be anticipated using any

Economic Calendar. The Chart divides the session(s) into Five (5) distinct "windows"

during which a skilled operator can make money, depending on the price action they see.

Using this context, we plan a trading day, by predicting how it might play out, then making

adjustments as necessary

As with most pursuits it takes a short while to learn but after that, success depends on applying

the basics (system edge, execution, risk management, record keeping). No different than any

other business really. People willing to do the work find that money is put into their accounts

while the other side is having money subtracted from theirs. As regards the impact of random

chance, yes, it is a part of this profession. Skilled participants learn to use it to their advantage.

The "White Glove" system we are going to release shortly uses this process to evaluate the trade

Students are advised to watch first, while we trade it with a specific goal to reach +10 within the first "window"

After that we provide the services necessary to go from amateur to professional status. For example

we show the student how to determine whether they are in a limit order or MIT environment and

how to automate their orders in order to avoid slippage.

Good Luck

Postscript...Corrected a "typo"

It is Saturday and I have completed my "Full Cycle" Markup

for the time period Thursday 6 Nov to Friday 7 Nov 2025

This chart shows the price action and presents (some though not all)

of the "aggregated" data that we obtained during these periods. We

use this to inform our trades in subsequent sessions. Skilled operators

who know how to use this data, have a significant edge over non-skilled

participants. For example, because I do this every weekend, I knew prior to the

NY open, that the "First Leg" would likely provide an opportunity to obtain

(at minimum) +10 and likely +20 pts IF I could find a reasonable setup to trade

in the direction of the previous trend (professionals call this "the drift")

After that, one looks for evidence that the market is responding to current news

which is either economic releases or political and can be anticipated using any

Economic Calendar. The Chart divides the session(s) into Five (5) distinct "windows"

during which a skilled operator can make money, depending on the price action they see.

Using this context, we plan a trading day, by predicting how it might play out, then making

adjustments as necessary

As with most pursuits it takes a short while to learn but after that, success depends on applying

the basics (system edge, execution, risk management, record keeping). No different than any

other business really. People willing to do the work find that money is put into their accounts

while the other side is having money subtracted from theirs. As regards the impact of random

chance, yes, it is a part of this profession. Skilled participants learn to use it to their advantage.

The "White Glove" system we are going to release shortly uses this process to evaluate the trade

Students are advised to watch first, while we trade it with a specific goal to reach +10 within the first "window"

After that we provide the services necessary to go from amateur to professional status. For example

we show the student how to determine whether they are in a limit order or MIT environment and

how to automate their orders in order to avoid slippage.

Good Luck

Postscript...Corrected a "typo"

Attachments

Last edited:

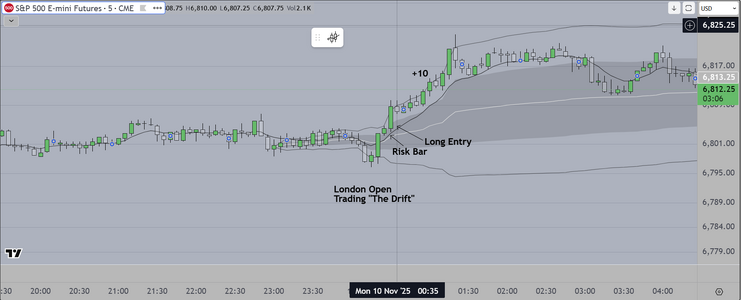

Hello London Traders

Currently it is 5pm in the City

We had a good "Split Session" from this US based trader's

perspective. We traded "The Drift", which is a high odds of success,

timed entry setup that occurs at the Open of the London Session

of the S&P500 Futures, then got some sleep before coming back

to trade the NY open of the same market

We attach charts of both

"The Drift" is a phenomena written about by the NY Fed, and in summary

it states that a significant amount of earnings are made during this time

period (just prior to, during and after the London Open). Professionals call

this a "layup" because when the setup occurs it is low risk, high profit.

and our standard markup for the NY session. Here we rely on our pre-market

research and notes. News relating to the ongoing train wreck of the US economy

caused by our President, continues to wreak damage. Institutions have little to rely

on because economic news is delayed. They are going to private sources for info

and acting very cautiously, and yet they still have to put money to work. What you are

seeing is the predictable opening and trading range behavior followed by a trend move

and then nothing until the end of the US-Euro Overlap

In this 2nd attached chart we show a "liquidity sweep"

Good Luck

Currently it is 5pm in the City

We had a good "Split Session" from this US based trader's

perspective. We traded "The Drift", which is a high odds of success,

timed entry setup that occurs at the Open of the London Session

of the S&P500 Futures, then got some sleep before coming back

to trade the NY open of the same market

We attach charts of both

"The Drift" is a phenomena written about by the NY Fed, and in summary

it states that a significant amount of earnings are made during this time

period (just prior to, during and after the London Open). Professionals call

this a "layup" because when the setup occurs it is low risk, high profit.

and our standard markup for the NY session. Here we rely on our pre-market

research and notes. News relating to the ongoing train wreck of the US economy

caused by our President, continues to wreak damage. Institutions have little to rely

on because economic news is delayed. They are going to private sources for info

and acting very cautiously, and yet they still have to put money to work. What you are

seeing is the predictable opening and trading range behavior followed by a trend move

and then nothing until the end of the US-Euro Overlap

In this 2nd attached chart we show a "liquidity sweep"

Good Luck

Attachments

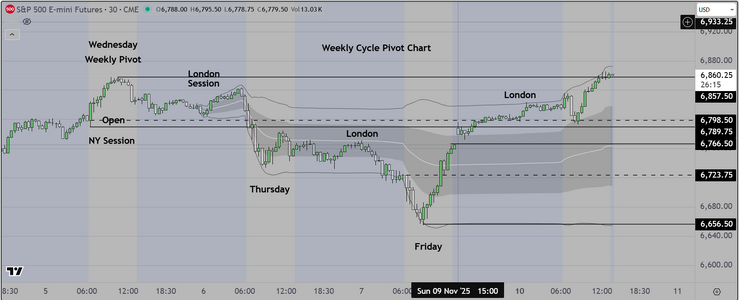

Hello London & Euro Based Traders

It is 9:35 in the City

As we draw closer to the start of my trading Livestream

I thought it appropriate to post this chart, which is a part of the

Weekly Preparation Process. It is called the "Weekly Cycle Pivot"

Most professionals divide the week into a front and back half. The

Front half obviously starts on Monday, and the H/L range is the "IB"

or Initial Balance. Institutional participants look at this framework

to provide guidance as regards market bias, and opportunities to

add or subtract from existing positions. On shorter time frames

speculators and other commercials look to trade for short term

profit based on a "Test/Fail" protocol. Each day or evening we

assess the previous price development and create an initial prediction

and from that a trading plan (If A, then B format). When we train

other professionals, we provide both aggressive and conservative

risk models. Now that we are considering training Retail we will

provide less aggressive risk models, with more emphasis on risk

management. This is why on the charts we post, we identify a "risk bar"

whose purpose is to show where to place a stop loss, AND we also

show the minimal profit target (about +10). In truth we always suggest

that traders trade at least 2 contracts, taking partial profit at at a

low risk point that is known as "buying a stop". Once a trader books

that initial profit, we suggest they use an automated system

to let the residual run as long as possible. One possible automated

order example is Chuck LeBeau's "Chandelier Stop".

Good Luck

It is 9:35 in the City

As we draw closer to the start of my trading Livestream

I thought it appropriate to post this chart, which is a part of the

Weekly Preparation Process. It is called the "Weekly Cycle Pivot"

Most professionals divide the week into a front and back half. The

Front half obviously starts on Monday, and the H/L range is the "IB"

or Initial Balance. Institutional participants look at this framework

to provide guidance as regards market bias, and opportunities to

add or subtract from existing positions. On shorter time frames

speculators and other commercials look to trade for short term

profit based on a "Test/Fail" protocol. Each day or evening we

assess the previous price development and create an initial prediction

and from that a trading plan (If A, then B format). When we train

other professionals, we provide both aggressive and conservative

risk models. Now that we are considering training Retail we will

provide less aggressive risk models, with more emphasis on risk

management. This is why on the charts we post, we identify a "risk bar"

whose purpose is to show where to place a stop loss, AND we also

show the minimal profit target (about +10). In truth we always suggest

that traders trade at least 2 contracts, taking partial profit at at a

low risk point that is known as "buying a stop". Once a trader books

that initial profit, we suggest they use an automated system

to let the residual run as long as possible. One possible automated

order example is Chuck LeBeau's "Chandelier Stop".

Good Luck

Attachments

Copying this post from another thread for the benefit of interested readers

------------------

I have pointed this out a couple of times previously

Reading order flow is fine IF you have the skills and can keep up

with fast market conditions. Few (if any) retail traders have the skills

or the talent. I have been doing this for many years and still find it

challenging to keep up and make good decisions. What makes it

easier to is to consolidate the data using CVD (once you learn how

to set it up to achieve the proper granularity for your target market)

Then it is a matter of watching the price action at specific points in time

and matching what you see to the volume coming onto your screen.

Nothing works perfectly of course. But in my opinion it is a easier and

more accessible way to trade (for amateurs).

I will attach a chart, but without the proper background it will probably not

make much sense at first. Reading up on the subject of Cumulative Volume

Delta might be a good idea. As I have mentioned I will be LiveStreaming my

own trading in the coming days on Twitch and YouTube. I don't plan to do

that for very long, so it might be a good idea to visit and take a look. It might

help you

Postscript

The chart shows the S&P 500 Futures Market (NY session). CVD at the bottom

setup to provide max granularity. Price action shows a breakout (B/O above a key

reference) The CVD updates at intervals that align with the B/O so (eventually) the

trader learns to see whether the breakout has legs or is stalling on low volume.

Learning to identify the components (price action & volume) accurately is what

is required for success.

Good luck

------------------

I have pointed this out a couple of times previously

Reading order flow is fine IF you have the skills and can keep up

with fast market conditions. Few (if any) retail traders have the skills

or the talent. I have been doing this for many years and still find it

challenging to keep up and make good decisions. What makes it

easier to is to consolidate the data using CVD (once you learn how

to set it up to achieve the proper granularity for your target market)

Then it is a matter of watching the price action at specific points in time

and matching what you see to the volume coming onto your screen.

Nothing works perfectly of course. But in my opinion it is a easier and

more accessible way to trade (for amateurs).

I will attach a chart, but without the proper background it will probably not

make much sense at first. Reading up on the subject of Cumulative Volume

Delta might be a good idea. As I have mentioned I will be LiveStreaming my

own trading in the coming days on Twitch and YouTube. I don't plan to do

that for very long, so it might be a good idea to visit and take a look. It might

help you

Postscript

The chart shows the S&P 500 Futures Market (NY session). CVD at the bottom

setup to provide max granularity. Price action shows a breakout (B/O above a key

reference) The CVD updates at intervals that align with the B/O so (eventually) the

trader learns to see whether the breakout has legs or is stalling on low volume.

Learning to identify the components (price action & volume) accurately is what

is required for success.

Good luck

Attachments

Good Evening London & Euro Traders

Most of whom have long ago headed home or to the pub

It is about 8:30pm and the Power Hour trade happened

as it often does, with algos executing MOC orders (for a variety

of reasons), none of which are important at this moment

The bottom line is that this trade (for skilled operators) is very

lucrative because it is low (again depending on skill level)

risk/high return. Another +10. Here in the US, it is a little after

the Noon hour and I am done for the day.

Postscript

At the closeout of my day, I had a guest watching (in my home). They

trade as amateurs do, just as a hobby. They watched and observed

that (for them) it was fearful to enter because they worried about the possibility

of a quick reversal so close to the end of session. I remarked that while that

could happen, as could a natural disaster, or shut off of power, or any number

of things, one had to assume those risks, protect themselves as best they could

and take the trades. Here is a quote from a famous movie

"I must not fear.

Fear is the mind-killer.

Fear is the little-death that brings total obliteration.

I will face my fear.

I will permit it to pass over me and through me.

And when it has gone past, I will turn the inner eye to see its path.

Where the fear has gone there will be nothing.

Only I will remain."

Good luck

Most of whom have long ago headed home or to the pub

It is about 8:30pm and the Power Hour trade happened

as it often does, with algos executing MOC orders (for a variety

of reasons), none of which are important at this moment

The bottom line is that this trade (for skilled operators) is very

lucrative because it is low (again depending on skill level)

risk/high return. Another +10. Here in the US, it is a little after

the Noon hour and I am done for the day.

Postscript

At the closeout of my day, I had a guest watching (in my home). They

trade as amateurs do, just as a hobby. They watched and observed

that (for them) it was fearful to enter because they worried about the possibility

of a quick reversal so close to the end of session. I remarked that while that

could happen, as could a natural disaster, or shut off of power, or any number

of things, one had to assume those risks, protect themselves as best they could

and take the trades. Here is a quote from a famous movie

"I must not fear.

Fear is the mind-killer.

Fear is the little-death that brings total obliteration.

I will face my fear.

I will permit it to pass over me and through me.

And when it has gone past, I will turn the inner eye to see its path.

Where the fear has gone there will be nothing.

Only I will remain."

Good luck

Attachments

Last edited:

Hello London & Euro Traders

For those who may be interested in attending my "LiveStream" please come on time

and be ready to watch the preparation. We start by (briefly) reviewing the longer time frame

price action, proceeding to a specialty chart that uses (primarily) Volume Profile to determine

the location of High & Low Volume Nodes. On the chart attached below, we show the IB for

the previous week and project onto the next week.

Our objectives are to

1) Identify "trapped volume" and from that,

2) Predict, where the institutions will move the market in order to

3) Maximize the value of the pre-existing staged positions or

4) Add to or reduce risk ("Value at Risk Adjustment") or when absolutely necessary/as a last resort)

5) "Take Profits". Here I conclude by suggesting that as long as they (institutions) maintain a presence

they can increase profits for themselves and shareholders. If however circumstances force them to

"Take Profit" then they are back to square one, and they have to start the process all over again.

As a close examination of the chart will disclose, we try to outline the broad strokes so that a trader can

learn how to align themselves with the institutions intent.

So this is it in a nutshell, I evaluate the data and create a plan. For a limited time, observers can watch

as I do this, and execute. At some point I will close that down and folks will have to decide whether to

apply for a place in my class or move on to something else that makes more sense (to them).

While this is going on I would like to create a little buzz and drive more interested people towards "Trade2Win"

so that they can also benefit from the increase in traffic. I can only hope that is thought of as honorable.

Good Luck

For those who may be interested in attending my "LiveStream" please come on time

and be ready to watch the preparation. We start by (briefly) reviewing the longer time frame

price action, proceeding to a specialty chart that uses (primarily) Volume Profile to determine

the location of High & Low Volume Nodes. On the chart attached below, we show the IB for

the previous week and project onto the next week.

Our objectives are to

1) Identify "trapped volume" and from that,

2) Predict, where the institutions will move the market in order to

3) Maximize the value of the pre-existing staged positions or

4) Add to or reduce risk ("Value at Risk Adjustment") or when absolutely necessary/as a last resort)

5) "Take Profits". Here I conclude by suggesting that as long as they (institutions) maintain a presence

they can increase profits for themselves and shareholders. If however circumstances force them to

"Take Profit" then they are back to square one, and they have to start the process all over again.

As a close examination of the chart will disclose, we try to outline the broad strokes so that a trader can

learn how to align themselves with the institutions intent.

So this is it in a nutshell, I evaluate the data and create a plan. For a limited time, observers can watch

as I do this, and execute. At some point I will close that down and folks will have to decide whether to

apply for a place in my class or move on to something else that makes more sense (to them).

While this is going on I would like to create a little buzz and drive more interested people towards "Trade2Win"

so that they can also benefit from the increase in traffic. I can only hope that is thought of as honorable.

Good Luck

Attachments

Last edited:

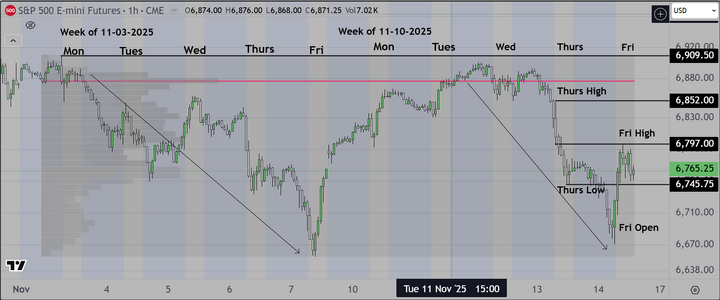

Posting this Weekly Pivot Chart

Wednesday is considered the Weekly Pivot by Trading Professionals

Price action from that point of reference is significant

We analyze price action based on that session high & low and in

comparison to the POC (point of control) created from the beginning

of the week. These are the key references that institutions use in order

to decide where to move markets

Based on what we see the markets are continuing higher however the lack

of data is causing institutions to hesitate here (at previous highs). Our initial

prediction for the NY session of the S&P500 is as follows

We expect a move higher early in the session followed by a reversal as institutions

look to protect (take) profit. This based on the additional data that will be provided

on a staggered basis by US government agencies that have previously been closed

Some of the data will be unavailable because those agencies (being shut down) have

not been able to collect it. That lack of data related to employment may cause

concern leading to a move lower.

The reaction to the US opening government agencies again will be seen in the London

Open first.

Wednesday is considered the Weekly Pivot by Trading Professionals

Price action from that point of reference is significant

We analyze price action based on that session high & low and in

comparison to the POC (point of control) created from the beginning

of the week. These are the key references that institutions use in order

to decide where to move markets

Based on what we see the markets are continuing higher however the lack

of data is causing institutions to hesitate here (at previous highs). Our initial

prediction for the NY session of the S&P500 is as follows

We expect a move higher early in the session followed by a reversal as institutions

look to protect (take) profit. This based on the additional data that will be provided

on a staggered basis by US government agencies that have previously been closed

Some of the data will be unavailable because those agencies (being shut down) have

not been able to collect it. That lack of data related to employment may cause

concern leading to a move lower.

The reaction to the US opening government agencies again will be seen in the London

Open first.

Attachments

Hello London

We have posted about this "Window of Opportunity" (one of several)

and it is interesting to us, because it provides skilled operators with a

a trade that is often very profitable. It does require experience and

the ability to manage the trade.

In the attached chart, we show one of our setups, an algo that we developed

We aren't going to detail it here. It requires dialogue between teacher and student

and the ability to show how it develops in real time. As mentioned that will

be happening soon.

We have posted about this "Window of Opportunity" (one of several)

and it is interesting to us, because it provides skilled operators with a

a trade that is often very profitable. It does require experience and

the ability to manage the trade.

In the attached chart, we show one of our setups, an algo that we developed

We aren't going to detail it here. It requires dialogue between teacher and student

and the ability to show how it develops in real time. As mentioned that will

be happening soon.

Attachments

Good Afternoon/Early Evening, London and Euro Based Traders

We want to provide an example of the Algo based entry setup we

employ. The Algo itself is simple (1-2-3). We look for specific behavior

to identify that initial setup. Our next requirement is to identify the "Risk

Bar". This bar is used by professionals to create a quick estimate of what

the initial risk is for the trade. With this information in hand, they can

look for a probable profit target and decide "is this trade worth that risk?"

(or "how likely is it that my profit target will be hit?") After that it is all about

entering using the correct order type to enter & exit, and managing the position

to its logical conclusion.

Interestingly, those who make this into a sustainable business, do so by

learning first how to manage risk, "thus the importance of the Risk Bar, THEN

they concentrate on maximizing profit (which is relatively easy to do).

Postscript

The attached chart shows one (1) trade. Actually there are two (2) on this chart

and the second is easy to see (in our opinion). We will be interested to see

if anyone takes the time to find it (it is in "plain sight").

Good Luck

We want to provide an example of the Algo based entry setup we

employ. The Algo itself is simple (1-2-3). We look for specific behavior

to identify that initial setup. Our next requirement is to identify the "Risk

Bar". This bar is used by professionals to create a quick estimate of what

the initial risk is for the trade. With this information in hand, they can

look for a probable profit target and decide "is this trade worth that risk?"

(or "how likely is it that my profit target will be hit?") After that it is all about

entering using the correct order type to enter & exit, and managing the position

to its logical conclusion.

Interestingly, those who make this into a sustainable business, do so by

learning first how to manage risk, "thus the importance of the Risk Bar, THEN

they concentrate on maximizing profit (which is relatively easy to do).

Postscript

The attached chart shows one (1) trade. Actually there are two (2) on this chart

and the second is easy to see (in our opinion). We will be interested to see

if anyone takes the time to find it (it is in "plain sight").

Good Luck

Attachments

Last edited:

Here is an example of the way that a "1-2-3" Algo can be adapted to fit

many situations. An observant person will notice that price creates a ledge

which is a price at which other algos are programmed to enter a value based

trade late in the (NY) session. Professionals know that most NY based traders

have already quit for the day (it is the weekend after all). So all of this is automated

and easy to monetize. You watch the price action, and you wait for the 1-2-3 to

occur relative to a key reference. When it happens, you take the trade, and you don't

have to hold for long WHY? Because 90% of the price action is automated. You get in

you take 10 pts and you get out.

What I am starting to enjoy about this is that there is a natural screening process at work.

Apparently only a few people see the possibilities, while the rest of you are content to continue to make

widgets, sell insurance or office supplies (honest work to be sure but is that what you want for a

career?)

Good luck

many situations. An observant person will notice that price creates a ledge

which is a price at which other algos are programmed to enter a value based

trade late in the (NY) session. Professionals know that most NY based traders

have already quit for the day (it is the weekend after all). So all of this is automated

and easy to monetize. You watch the price action, and you wait for the 1-2-3 to

occur relative to a key reference. When it happens, you take the trade, and you don't

have to hold for long WHY? Because 90% of the price action is automated. You get in

you take 10 pts and you get out.

What I am starting to enjoy about this is that there is a natural screening process at work.

Apparently only a few people see the possibilities, while the rest of you are content to continue to make

widgets, sell insurance or office supplies (honest work to be sure but is that what you want for a

career?)

Good luck

Attachments

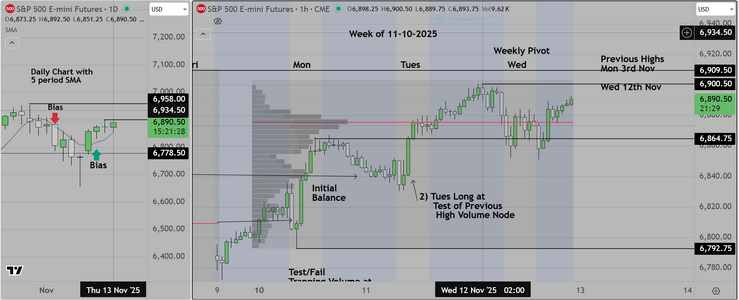

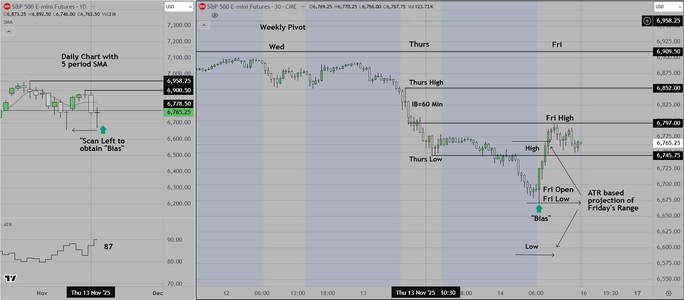

Still not feeling well enough to invite visitors to the

Weekend Prep

This Weekly Markup chart will provide a way to obtain a

short summary of what I do

1) The small chart on the left uses Daily Bars. We look for the obvious

price action clues. The annotation "Scan Left" reminds us that when price

Tests a level and reacts strongly, it suggests that the same thing is likely

upon retest. In this case the prior move is a pin bar (or "Buyer's Tail") and

the subsequent move up was significant. Naturally, we would expect the same

when price returns to retest that level. AND that is what happened.

2) on the right side, the Weekly Pivot Chart starts with either Monday or Wednesday (Weekly

Pivot), and again we start by looking for the obvious price action clues (range, highs & lows

tests and areas where buy or sell volume might be trapped). In this instance we have a ranging

market, waiting for news and on Thursday (London) reacted by trading lower, and so did the

NY session of the S&P 500 Futures.

3) Prior to the open on Friday, we use the 14 period ATR to forecast the probable range

at the NY open. Based on that reading of 87 pts, we can approximate the range. AND

what we know from "scanning left" on the smaller chart, is that a) if price trades down to

retest the previous low, institutions will probably come in to buy (see our next chart

And that is what happened.

That is why we monitor the weekly chart (each night after the close) watching price action

UNTIL we see a price behavior that creates an edge for us.

Look at the chart and ask yourself if you would be able to figure it out

Good Luck

Weekend Prep

This Weekly Markup chart will provide a way to obtain a

short summary of what I do

1) The small chart on the left uses Daily Bars. We look for the obvious

price action clues. The annotation "Scan Left" reminds us that when price

Tests a level and reacts strongly, it suggests that the same thing is likely

upon retest. In this case the prior move is a pin bar (or "Buyer's Tail") and

the subsequent move up was significant. Naturally, we would expect the same

when price returns to retest that level. AND that is what happened.

2) on the right side, the Weekly Pivot Chart starts with either Monday or Wednesday (Weekly

Pivot), and again we start by looking for the obvious price action clues (range, highs & lows

tests and areas where buy or sell volume might be trapped). In this instance we have a ranging

market, waiting for news and on Thursday (London) reacted by trading lower, and so did the

NY session of the S&P 500 Futures.

3) Prior to the open on Friday, we use the 14 period ATR to forecast the probable range

at the NY open. Based on that reading of 87 pts, we can approximate the range. AND

what we know from "scanning left" on the smaller chart, is that a) if price trades down to

retest the previous low, institutions will probably come in to buy (see our next chart

And that is what happened.

That is why we monitor the weekly chart (each night after the close) watching price action

UNTIL we see a price behavior that creates an edge for us.

Look at the chart and ask yourself if you would be able to figure it out

Good Luck

Attachments

Last edited:

Hello London & Euro Traders

We will not be LiveStreaming our Weekend Preparation so it only seems appropriate

that we provide a sample for those who may want to subscribe in future. Interested

readers can start with the previous post, where we review what happened during

the previous week. In that post we use a Weekly Pivot Chart (which uses Wednesday

as it's most recent "point of reference"). Here is our Higher Time Frame Narrative.

1) Primary Market Mover (Interest Rates)

For the sake of brevity, the bottom line is that the markets moved

lower based on several factors, the most important of which is the anticipation that

the US Fed may decide not to lower interest rates.

2) Daily/Weekly Time Frame/Opportunities for Swing Traders

Readers who follow along will see that we continue to monitor both the Daily and Weekly

time frames. On the Daily (posted below) we see an S&P 500 Futures Market that has created

what professionals call a potential "Major Trend Reversal" on the Daily Time Frame

That chart shows several trading opportunities for Swing Traders whose horizon is multiple days

to weeks. Readers can start on the right side at Oct 1st and continue to follow along to Nov 3rd

3) Market Structure & Analysis of Previous Trade

Along that path we see a 1) "Weak Low, followed by a higher high, and a "1-2-3" short setup

which is the first reasonable reversal entry that Swing Traders could take. That short entry would

have been filled at or near 6,866 and if held to its logical conclusion, would have exited at 6,665

approximately for a profit of 200 S&P pts (about $10,000 per contract before commissions).

4) Pattern Behavior (How Approach a Trading Range)

The "Retest of the Weak Low" was an area where Institutions are likely to come in to buy what they

see as discounted value. They wait for price to revisit that range of prices and then drive the market back

up, thus creating a "Trading Range". Its the same as the previous trade only in reverse

The next opportunity occurs when price (once again) revisits the upper part of the trading range

so its a "back & forth" kind of trading action that professionals call a "Round Trip" with price moving between

extremes.

5) Next Week (Our Prediction for either "Technical Rebound" or Continuation Lower

Will price rebound? (its called a "Technical Rebound" and move higher, or will the market continue the "Major

Trend Reversal" outlined previously, as institutions become concerned about the US Fed decision, and as

previous economic data is released to the public. Consensus is that the previous data, as well as the new

data will point to a steadily weakening US economy, which of course would lead to a move down as institutions

take profits. This is our prediction.

Postscript ("Using Scan Left to find Direction & Entry)

On our chart you may notice the text "Scan Left". This technique is useful because it provides advance warning

as to what is likely in terms of market direction. Simply put, when price tests an area where previously the market

reacted strongly (higher or lower), it will often do the same thing again.

We will not be LiveStreaming our Weekend Preparation so it only seems appropriate

that we provide a sample for those who may want to subscribe in future. Interested

readers can start with the previous post, where we review what happened during

the previous week. In that post we use a Weekly Pivot Chart (which uses Wednesday

as it's most recent "point of reference"). Here is our Higher Time Frame Narrative.

1) Primary Market Mover (Interest Rates)

For the sake of brevity, the bottom line is that the markets moved

lower based on several factors, the most important of which is the anticipation that

the US Fed may decide not to lower interest rates.

2) Daily/Weekly Time Frame/Opportunities for Swing Traders

Readers who follow along will see that we continue to monitor both the Daily and Weekly

time frames. On the Daily (posted below) we see an S&P 500 Futures Market that has created

what professionals call a potential "Major Trend Reversal" on the Daily Time Frame

That chart shows several trading opportunities for Swing Traders whose horizon is multiple days

to weeks. Readers can start on the right side at Oct 1st and continue to follow along to Nov 3rd

3) Market Structure & Analysis of Previous Trade

Along that path we see a 1) "Weak Low, followed by a higher high, and a "1-2-3" short setup

which is the first reasonable reversal entry that Swing Traders could take. That short entry would

have been filled at or near 6,866 and if held to its logical conclusion, would have exited at 6,665

approximately for a profit of 200 S&P pts (about $10,000 per contract before commissions).

4) Pattern Behavior (How Approach a Trading Range)

The "Retest of the Weak Low" was an area where Institutions are likely to come in to buy what they

see as discounted value. They wait for price to revisit that range of prices and then drive the market back

up, thus creating a "Trading Range". Its the same as the previous trade only in reverse

The next opportunity occurs when price (once again) revisits the upper part of the trading range

so its a "back & forth" kind of trading action that professionals call a "Round Trip" with price moving between

extremes.

5) Next Week (Our Prediction for either "Technical Rebound" or Continuation Lower

Will price rebound? (its called a "Technical Rebound" and move higher, or will the market continue the "Major

Trend Reversal" outlined previously, as institutions become concerned about the US Fed decision, and as

previous economic data is released to the public. Consensus is that the previous data, as well as the new

data will point to a steadily weakening US economy, which of course would lead to a move down as institutions

take profits. This is our prediction.

Postscript ("Using Scan Left to find Direction & Entry)

On our chart you may notice the text "Scan Left". This technique is useful because it provides advance warning

as to what is likely in terms of market direction. Simply put, when price tests an area where previously the market

reacted strongly (higher or lower), it will often do the same thing again.

Attachments

Last edited:

Same principles on a chart with 60 minute bars, over a period of two (2) weeks

As can be seen, price dropped significantly (far left) and we started our Volume Profile

at that point in time. The Red Line is the "Point of Control" and it shows the prices where

most of the trading occurred. As can be seen, it takes a while, but eventually price retests

and then moves lower (again). This repetitive behavior is common. It allows institutions to make

money in both directions. We simply follow along, entering and exiting at the extremes

Good luck

As can be seen, price dropped significantly (far left) and we started our Volume Profile

at that point in time. The Red Line is the "Point of Control" and it shows the prices where

most of the trading occurred. As can be seen, it takes a while, but eventually price retests

and then moves lower (again). This repetitive behavior is common. It allows institutions to make

money in both directions. We simply follow along, entering and exiting at the extremes

Good luck

Attachments

Hello Traders

As seen in the previous post, we begin with an analysis of Market Behavior on

a Higher Time Frame. We then transfer that knowledge to the shorter time frame.

Our business model allows us to create at least one (1) Swing Trade AND also

2) operate in the shorter intraday time frame, where (typically) we trade the NY Session

of the S&P 500 Futures.

Pre-Market Narrative

The information we obtained from our Higher Time Frame Analysis allows us to create

Intraday Trading plans as follows

Bullish Plan

As mentioned previously, a technical rebound may occur if institutions decide to buy at specific prices

that they see as representing "value". The short version is that they want to buy at "Wholesale" prices

then mark that inventory up and sell to the rest of us at "Retail" prices. There are two (2) ways to do this

the first is to buy if price tests a support zone (which would be around 5.950 down to 5,900). They would

also be willing to scale in, buying more as low as 5,800 (approximately). We outline a second way to "value"

trade" in our class, and it involves trapping "Sell Volume" at places where participants assume that the market

is moving lower, then "slamming the door", leaving them to decide whether or not to chase (which is why those

moves higher generally continue).

Bearish Plan

The Bearish plan involves, driving the market higher initially, above the highs shown on our Weekly Pivot Chart

then trapping buy volume by reversing abruptly. Skilled traders plan for this eventual occurrence by reviewing

a schedule of pending High Impact Economic reports. Any reputable economic calendar service should do the

trick. For the coming week, the high impact reports are as follows

1) Empire State Manufacturing on Monday

2) ADP Employment on Tues

3) FOMC, Housing Starts, Building Permits on Wednesday

4) Initial Jobless Claims, Philly Fed, Existing Home Sales on Thurs

5) S&P Global Flash PMI, University Of Michigan Final Survey on Friday

Monday & Tuesday are traditionally the most turbulent days, and one would want to capture those bigger

price moves by coordinating trades (aligning trade entry with specific time periods). Subscribers are able

to see how we do this from planning to execution on a daily basis.

Those who follow the logic can see, that this (or something similar) is what professionals do to prepare

and to obtain an edge over the "uninformed". Professionals go into the trading day with more (and better) information

than others. After a period of time, (if they can see a skilled person execute in front of them), they usually "Get It"

Then it is a matter of whether or not they can develop the skill & discipline required to do it themselves. In our opinion

it is similar to the preparation required to be a professional athlete.

Please understand that we will only be doing this once to give prospective students a look at what we provide.

At the end of each session we will provide a summary review here on this site. Basically that summary will outline

our results (successes and failures).

Good luck

As seen in the previous post, we begin with an analysis of Market Behavior on

a Higher Time Frame. We then transfer that knowledge to the shorter time frame.

Our business model allows us to create at least one (1) Swing Trade AND also

2) operate in the shorter intraday time frame, where (typically) we trade the NY Session

of the S&P 500 Futures.

Pre-Market Narrative

The information we obtained from our Higher Time Frame Analysis allows us to create

Intraday Trading plans as follows

Bullish Plan

As mentioned previously, a technical rebound may occur if institutions decide to buy at specific prices

that they see as representing "value". The short version is that they want to buy at "Wholesale" prices

then mark that inventory up and sell to the rest of us at "Retail" prices. There are two (2) ways to do this

the first is to buy if price tests a support zone (which would be around 5.950 down to 5,900). They would

also be willing to scale in, buying more as low as 5,800 (approximately). We outline a second way to "value"

trade" in our class, and it involves trapping "Sell Volume" at places where participants assume that the market

is moving lower, then "slamming the door", leaving them to decide whether or not to chase (which is why those

moves higher generally continue).

Bearish Plan

The Bearish plan involves, driving the market higher initially, above the highs shown on our Weekly Pivot Chart

then trapping buy volume by reversing abruptly. Skilled traders plan for this eventual occurrence by reviewing

a schedule of pending High Impact Economic reports. Any reputable economic calendar service should do the

trick. For the coming week, the high impact reports are as follows

1) Empire State Manufacturing on Monday

2) ADP Employment on Tues

3) FOMC, Housing Starts, Building Permits on Wednesday

4) Initial Jobless Claims, Philly Fed, Existing Home Sales on Thurs

5) S&P Global Flash PMI, University Of Michigan Final Survey on Friday

Monday & Tuesday are traditionally the most turbulent days, and one would want to capture those bigger

price moves by coordinating trades (aligning trade entry with specific time periods). Subscribers are able

to see how we do this from planning to execution on a daily basis.

Those who follow the logic can see, that this (or something similar) is what professionals do to prepare

and to obtain an edge over the "uninformed". Professionals go into the trading day with more (and better) information

than others. After a period of time, (if they can see a skilled person execute in front of them), they usually "Get It"

Then it is a matter of whether or not they can develop the skill & discipline required to do it themselves. In our opinion

it is similar to the preparation required to be a professional athlete.

Please understand that we will only be doing this once to give prospective students a look at what we provide.

At the end of each session we will provide a summary review here on this site. Basically that summary will outline

our results (successes and failures).

Good luck

Last edited:

Good Afternoon London

where the time is 1:45pm and we are at the tail end of the London Session of

the S&P 500 Futures. We begin our preparation using the attached chart, which

shows the previous NY session Markup (high/low) using 15 min bars on the right side

and daily bars on the left.

On the Daily Chart we see a trading range, framed by a VWAP envelope, and as mentioned in

previous posts, institutions created this because of the uncertainty as regards reporting of

economic news and concerns regarding the US Fed's willingness to cut interest rates. So basically

long/short trades as price tested the extremes

Shifting to the right side, we see the "London Session" which tested the previous high and then

swept lower, trapping buy volume at 6,800. It was a strong move.

For the coming NY Session open, we envision one of the following scenarios

1) After this strong move, a pullback, followed by continuation lower

2) Reversal after a test of Friday's Initial Balance Bar (3:30 London time on Friday) approximately 6,730

3) Impulse move to either the up or downside during the Initial balance (first 15 to 30 minutes) followed

by a range bound market, moving sideways, as participants wait for economic news (see previous posts above).

The Current 14 day ATR is 88 (approximately) so we know what the potential is for a strong move in

either direction.

Monday is an easy day to trade. If it goes as planned, we will monitor the first 15 minutes and get on board for 10 pts

then adjust our plan as necessary, waiting for possible trades at the end of the US/Euro Overlap at 4pm London

and again during the "Power Hour" at the close. Our plan consists of 1-3 possible trades.

Good luck

where the time is 1:45pm and we are at the tail end of the London Session of

the S&P 500 Futures. We begin our preparation using the attached chart, which

shows the previous NY session Markup (high/low) using 15 min bars on the right side

and daily bars on the left.

On the Daily Chart we see a trading range, framed by a VWAP envelope, and as mentioned in

previous posts, institutions created this because of the uncertainty as regards reporting of

economic news and concerns regarding the US Fed's willingness to cut interest rates. So basically

long/short trades as price tested the extremes

Shifting to the right side, we see the "London Session" which tested the previous high and then

swept lower, trapping buy volume at 6,800. It was a strong move.

For the coming NY Session open, we envision one of the following scenarios

1) After this strong move, a pullback, followed by continuation lower

2) Reversal after a test of Friday's Initial Balance Bar (3:30 London time on Friday) approximately 6,730

3) Impulse move to either the up or downside during the Initial balance (first 15 to 30 minutes) followed

by a range bound market, moving sideways, as participants wait for economic news (see previous posts above).

The Current 14 day ATR is 88 (approximately) so we know what the potential is for a strong move in

either direction.

Monday is an easy day to trade. If it goes as planned, we will monitor the first 15 minutes and get on board for 10 pts

then adjust our plan as necessary, waiting for possible trades at the end of the US/Euro Overlap at 4pm London

and again during the "Power Hour" at the close. Our plan consists of 1-3 possible trades.

Good luck

Attachments

Last edited:

and exit with +10 at 2:56pm

Entry based on a setup known as H2. Simply put the market tries twice

to reverse and is unsuccessful. We enter on the next bar at its open and hold to +10

or stoploss. In this case, we took +10

Now we wait for the US/Euro Overlap window to close

Entry based on a setup known as H2. Simply put the market tries twice

to reverse and is unsuccessful. We enter on the next bar at its open and hold to +10

or stoploss. In this case, we took +10

Now we wait for the US/Euro Overlap window to close

Attachments

Normally we would not bother with this, but for the retail crowd

we want to show, that this opportunity is known to many other professionals

who take the trade, then get out at approximately the same time (at +10)

Similar to the old saying "use it or lose it". This is "take it or lose it"

The chart shows other traders exiting at this profit point (approximately)

Postscript

If readers will review the previous posts, you will see that the scenario that played out

today (so far) is number three (Impulse move to the upside, then the market trades in a range)

we want to show, that this opportunity is known to many other professionals

who take the trade, then get out at approximately the same time (at +10)

Similar to the old saying "use it or lose it". This is "take it or lose it"

The chart shows other traders exiting at this profit point (approximately)

Postscript

If readers will review the previous posts, you will see that the scenario that played out

today (so far) is number three (Impulse move to the upside, then the market trades in a range)

Attachments

Last edited:

Similar threads

- Replies

- 5

- Views

- 4K

- Replies

- 3

- Views

- 4K