Here is a sample of our Weekly Discovery Process

We identify and evaluate high impact events as follows

1) Earning for Meta, Microsoft, Amazon & Apple are scheduled. Each one can have

significant effect on the markets. We look at the timing in terms of opportunity

and we have an algo that kicks in, allowing us to place trades after earnings are

released.

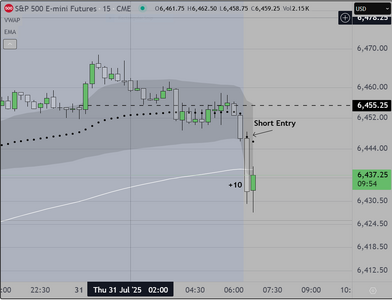

2) Federal Reserve will set rates. Again we use an algo process, that kicks in after the

decision is made

3) The "PCE" (Personal Consumption") considered by the FED to be critically important,

is scheduled to be released soon and that will have a potentially significant impact

on markets (as regards the decision to lower or maintain interest rates)

4) Jobs data will be released

5) Trumps tariffs deadline on Aug 1st

The general process is as follows

On a Saturday or Sunday, we start by planning each weekday starting with the 1) timing of

any significant earnings reports. This week Meta, Microsoft are reporting on Wednesday

and the others on Thursday (all after the close). We expect that Apple will beat estimates

because customers are buying product NOW to try to avoid having to pay a higher price

when tariffs kick in. The net effect could be a move higher for Apple (one example)

Interest Rate Decision is announced on Wednesday. We expect rates to stay the same

PCE is expected to show a rise of 2.3% to perhaps 2.6%. We expect those numbers to be exceeded

creating a possible opportunity on the short side.

Finally we expect the American president to announce trade deals and other items in an attempt

to distract from his problem with the Epstein files, and with the activation of tariffs. The net effect

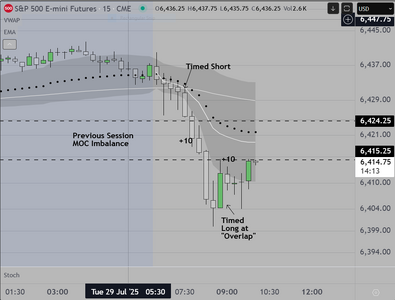

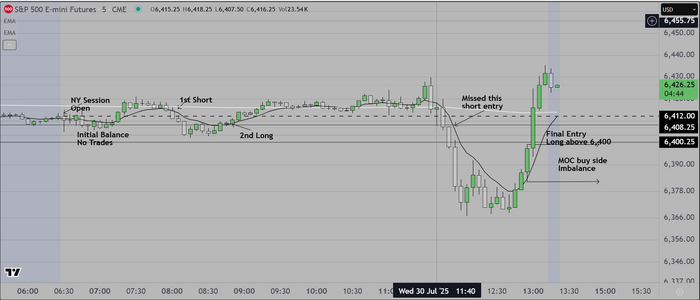

is likely to be negative for the markets. We are planning for a possible retracement lower on the 30th July

Good luck

We identify and evaluate high impact events as follows

1) Earning for Meta, Microsoft, Amazon & Apple are scheduled. Each one can have

significant effect on the markets. We look at the timing in terms of opportunity

and we have an algo that kicks in, allowing us to place trades after earnings are

released.

2) Federal Reserve will set rates. Again we use an algo process, that kicks in after the

decision is made

3) The "PCE" (Personal Consumption") considered by the FED to be critically important,

is scheduled to be released soon and that will have a potentially significant impact

on markets (as regards the decision to lower or maintain interest rates)

4) Jobs data will be released

5) Trumps tariffs deadline on Aug 1st

The general process is as follows

On a Saturday or Sunday, we start by planning each weekday starting with the 1) timing of

any significant earnings reports. This week Meta, Microsoft are reporting on Wednesday

and the others on Thursday (all after the close). We expect that Apple will beat estimates

because customers are buying product NOW to try to avoid having to pay a higher price

when tariffs kick in. The net effect could be a move higher for Apple (one example)

Interest Rate Decision is announced on Wednesday. We expect rates to stay the same

PCE is expected to show a rise of 2.3% to perhaps 2.6%. We expect those numbers to be exceeded

creating a possible opportunity on the short side.

Finally we expect the American president to announce trade deals and other items in an attempt

to distract from his problem with the Epstein files, and with the activation of tariffs. The net effect

is likely to be negative for the markets. We are planning for a possible retracement lower on the 30th July

Good luck